Lithia Motors Intrinsic Value Calculator – LITHIA MOTORS Sees Prices of Used Vehicles Drop in Latest CPI Report

April 13, 2023

Trending News 🌧️

According to the latest Consumer Price Index report, the prices of pre-owned vehicles have continued to drop. They are also one of the leading franchised dealers of domestic and imported vehicles, including brands like Chrysler, Dodge, Jeep, and Honda. The declining prices of used vehicles have caused a significant decrease in sales at LITHIA ($NYSE:LAD) Motors, resulting in an overall loss in profits. The company has responded to the decreased demand by reducing their inventory of used vehicles, allowing them to more effectively manage their stock and improve their margins.

Despite this, the company’s stock is down from its peak earlier this year due to the continued uncertainty surrounding the used car market. LITHIA Motors is taking steps to adjust their strategy and make sure they are ready for whatever direction the industry takes. They are actively working with their suppliers to develop new strategies for buying and selling used vehicles, as well as developing innovative financial products that will help them maximize their profits. With a strong focus on customer service and a commitment to capitalizing on future opportunities, LITHIA Motors is well-positioned to weather this market downturn.

Share Price

Wednesday saw LITHIA MOTORS stock take a hit as the latest Consumer Price Index (CPI) showed a drop in prices of used cars and trucks. The company opened at $231.2 and closed at $219.6, a decrease of 3.5% from the previous closing price of $227.6. This news caused a drop in the company’s stock price, reflecting the sentiment in the market that the declining prices of used vehicles would have an adverse impact on the company’s bottom line and profitability. Nevertheless, investors should take solace in the fact that LITHIA MOTORS is still well-positioned to capitalize on any potential resurgence in the used vehicles market, given their wide network of dealerships and their focus on customer satisfaction. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lithia Motors. More…

| Total Revenues | Net Income | Net Margin |

| 28.19k | 1.25k | 4.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lithia Motors. More…

| Operations | Investing | Financing |

| -610.1 | -1.33k | 2.04k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lithia Motors. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.01k | 9.76k | 190.7 |

Key Ratios Snapshot

Some of the financial key ratios for Lithia Motors are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 30.5% | 56.7% | 6.7% |

| FCF Margin | ROE | ROA |

| -3.2% | 23.3% | 7.9% |

Analysis – Lithia Motors Intrinsic Value Calculator

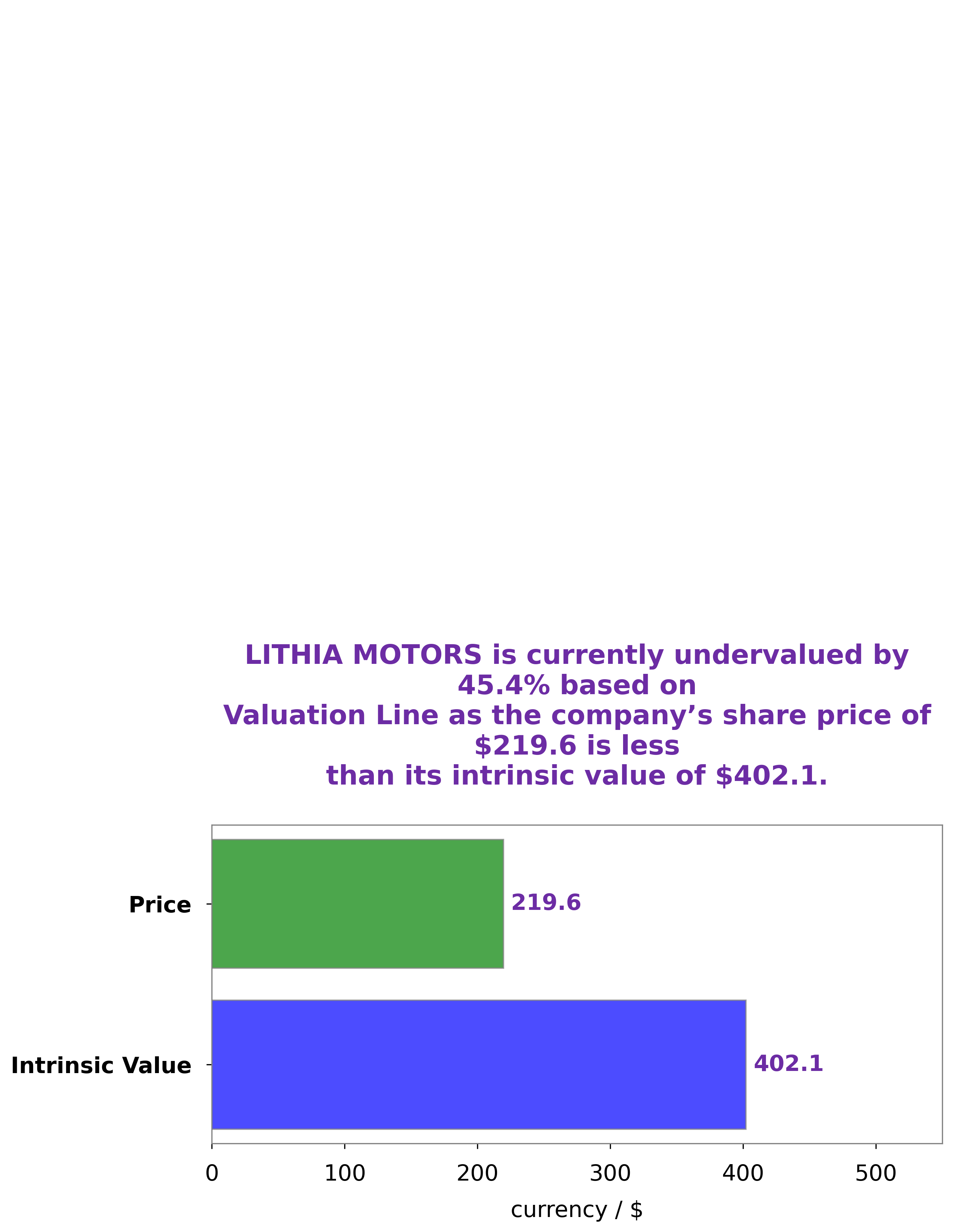

At GoodWhale, we conducted a detailed analysis of LITHIA MOTORS‘s financials. After considering the figures and projections, our proprietary Valuation Line estimated the fair value of a LITHIA MOTORS share to be around $402.1. However, the stock is currently being traded at $219.6 which is undervalued by 45.4%. This presents a great opportunity for investors who are looking for a good return on their investment. We believe that in the long-term, LITHIA MOTORS has the potential to deliver significant returns to investors. More…

Peers

Lithia Motors Inc, AutoNation Inc, Group 1 Automotive Inc, and Penske Automotive Group Inc are all leading automotive retailers. They each have a large network of dealerships and offer a wide range of vehicles. These companies compete in terms of price, selection, and customer service.

– AutoNation Inc ($NYSE:AN)

AutoNation is the largest automotive retailer in the United States. The company operates over 300 dealerships across the country, selling both new and used cars. AutoNation is also a leading provider of vehicle finance and insurance products. The company’s market cap is 5.47B as of 2022, and its ROE is 56.13%. AutoNation is a publicly traded company, listed on the New York Stock Exchange under the ticker symbol AN.

– Group 1 Automotive Inc ($NYSE:GPI)

Group 1 Automotive Inc is a publicly traded automotive retailer that offers a range of automotive products and services, including new and used vehicles, financing, insurance, and parts and service. As of 2022, the company had a market capitalization of 2.53 billion and a return on equity of 32.9%. Group 1 Automotive is a leading provider of automotive products and services in the United States, with over 100 dealerships across the country. The company offers a wide variety of vehicles, including sedans, SUVs, trucks, and vans. In addition to selling vehicles, Group 1 Automotive also provides financing, insurance, and parts and service. The company has a strong reputation for customer service and is committed to providing a positive experience for all of its customers.

– Penske Automotive Group Inc ($NYSE:PAG)

Penske Automotive Group Inc is an American automotive retailer with a market cap of 7.28B as of 2022 and a ROE of 29.75%. The company operates in the United States, United Kingdom, and Australia. It sells and services vehicles through its dealerships.

Summary

Lithia Motors is a leading automotive retailer that has seen its stock price drop recently in response to the latest Consumer Price Index (CPI) report. The report showed that used vehicle prices have continued to slide, creating a challenging market for investors interested in this stock. Analysts are closely watching the company’s reaction to the weak market conditions, as well as its ability to remain competitive in light of the current pricing environment.

With a strong portfolio of brands and a well-established network of dealerships, Lithia Motors may be able to withstand the current market pressures and make gains in the near future. Investors should continue to monitor the company’s performance and make decisions accordingly.

Recent Posts