KAR Auction Services Closes at $14.44, How Will It Fare Amid Market Woes?

February 2, 2023

Trending News 🌧️

KAR ($NYSE:KAR) Auction Services Inc. is an American corporation that specializes in vehicle auctions, remarketing solutions, and related services. It operates through two primary segments: ADESA Auctions and Insurance Auto Auctions. The company’s stock closed at $14.44 in the previous trading day, and with the current market woes, it is expected to face downward pressure in the near future. The current market woes are the result of a combination of economic and political factors, such as high unemployment, weak consumer spending, and a volatile geopolitical environment. These factors have caused a decrease in demand for vehicles and other goods, resulting in a decrease in KAR Auction Services’ stock price.

In addition, the company’s debt burden, which has increased due to the acquisition of Insurance Auto Auctions, has also weighed on the stock. To address the current market woes, KAR Auction Services has implemented a number of strategic initiatives. The company has increased its focus on cost savings and operational efficiency to reduce the impact of lower revenues and higher costs. It has also developed new technology to improve its services and enhance customer experience. These initiatives have helped the company to remain competitive in the current market. The company has also shifted its focus to emerging markets such as Latin America, where there is significant growth potential. This shift has enabled KAR Auction Services to capitalize on the growth opportunities in these markets and offset some of the losses in other regions. Despite the current market woes, KAR Auction Services Inc. is well-positioned to capitalize on future opportunities. The company’s strong financial position and innovative strategies will help it navigate through these challenging times and emerge stronger as the market recovers.

Share Price

Media sentiment surrounding the company is mostly positive, given that its stock opened at $14.4 and closed at $14.9, representing a 2.5% increase from the previous closing price of $14.6. Investors are hopeful that KAR Auction Services Inc. can continue to withstand the market’s challenges and maintain its performance despite the volatility of the stock market.

However, the company has managed to sustain its profits despite the challenges of the market, which is a positive sign for investors. Furthermore, the company has diversified its services and operations, which allows them to remain profitable even in times of economic downturns. The company has a strong presence in online auctions, which is an area that could continue to grow even during market downturns.

Additionally, KAR Auction Services Inc. has been actively expanding its customer base, allowing it to capitalize on new opportunities and increase its profitability. Overall, KAR Auction Services Inc. appears to be well-positioned to weather the current market challenges and continue to perform well in the future. Investors are optimistic that the company can sustain its performance and generate returns over the long-term, despite the current market volatility and economic uncertainty. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for KAR. More…

| Total Revenues | Net Income | Net Margin |

| 2.31k | 161.2 | 4.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for KAR. More…

| Operations | Investing | Financing |

| -364.4 | 1.12k | -1.28k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for KAR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.3k | 3.77k | 13.6 |

Key Ratios Snapshot

Some of the financial key ratios for KAR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -17.0% | -30.7% | 7.6% |

| FCF Margin | ROE | ROA |

| -20.4% | 6.9% | 2.1% |

Analysis

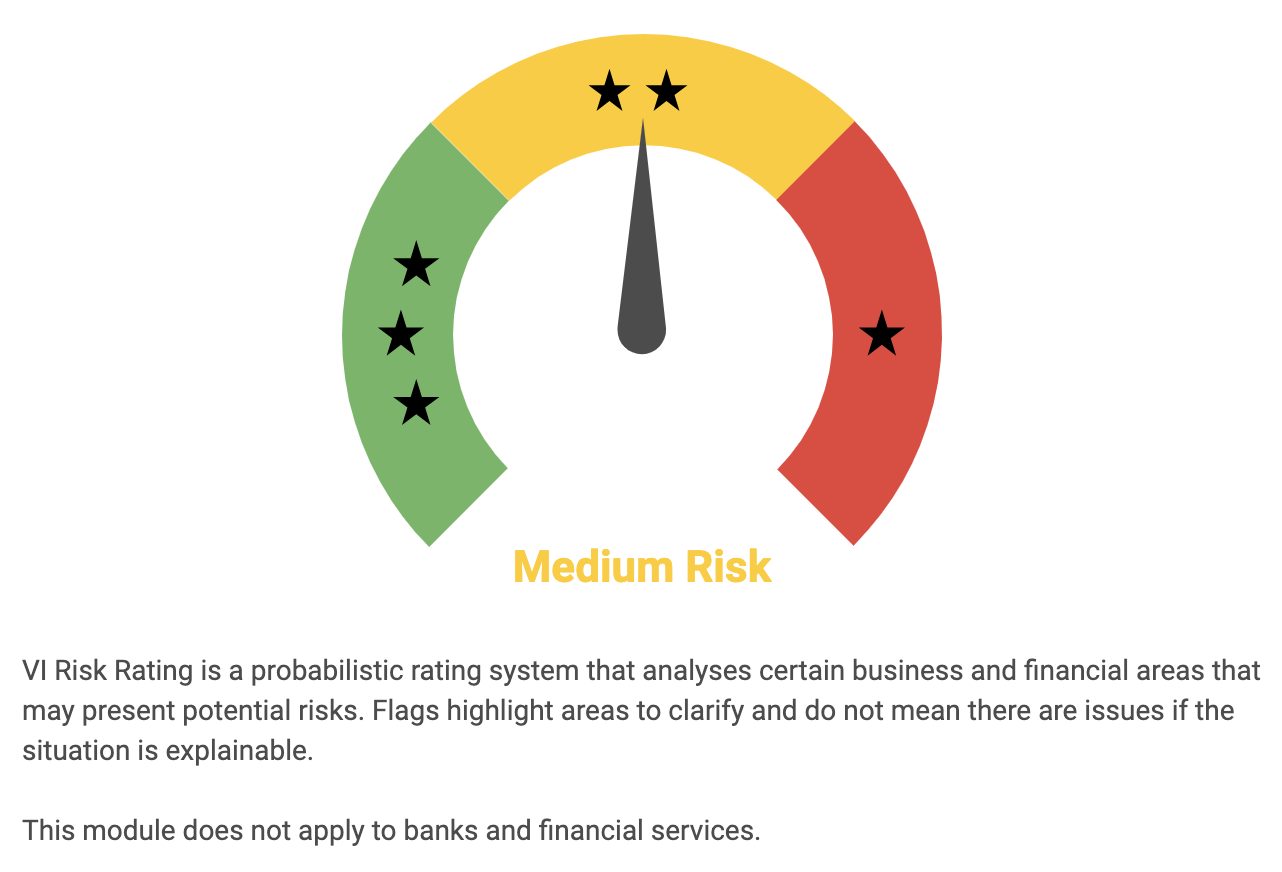

KAR AUCTION SERVICES is a medium-risk investment according to GoodWhale’s Risk Rating analysis. This indicates that the company has a few financial and business risks that are worth considering before investing. GoodWhale has identified 1 risk warning in the balance sheet of KAR AUCTION SERVICES. Investors should register with GoodWhale to find out what these risks are. More generally, investors should consider all aspects of a company before investing. It is important to look at the company’s financials, including its balance sheet, income statement, and cash flow statement. Investors should also consider the company’s competitive landscape, management team, and industry trends. It is also important to consider a company’s long-term prospects, as well as any potential areas of risk. In addition to financial and business analysis, investors should also consider other factors such as political and economic climate. Global events can have a significant impact on a company’s performance, and investors should be aware of any potential risks in this regard. Finally, investors should also consider their own risk tolerance when making investment decisions. Overall, KAR AUCTION SERVICES is considered a medium-risk investment according to GoodWhale’s Risk Rating analysis. Investors should take the time to consider all aspects of the company before investing, and register with GoodWhale to find out more about the 1 risk warning identified in the balance sheet. More…

Peers

The company operates through three segments: ADESA, Inc, Insurance Auto Auctions, Inc, and Capital One Auto Finance. KAR Auction Services was founded in 2002 and is headquartered in Carmel, Indiana. Some of KAR Auction Services’ competitors include NowAuto Inc, America’s Car-Mart Inc, and Peter Warren Automotive Holdings Ltd.

– NowAuto Inc ($OTCPK:NWAU)

America’s Car-Mart, Inc. is engaged in the operation of used automobile dealerships in the United States. The company operates through two segments, Automotive Sales and Automotive Finance. It offers financing for the purchase of vehicles to customers who are unable to obtain traditional financing from banks or other lending institutions. The company also sells vehicles on consignment for customers. As of April 30, 2018, it operated 138 dealerships in 11 states. America’s Car-Mart, Inc. was founded in 1981 and is headquartered in Bentonville, Arkansas.

– America’s Car-Mart Inc ($NASDAQ:CRMT)

Warren Automotive Holdings Ltd is a car dealership company. It is headquartered in Sydney, Australia. The company has a market capitalization of 481.38 million as of 2022 and a return on equity of 11.46%. The company operates a chain of car dealerships across Australia. It offers a range of new and used cars, finance, insurance, and after-sales services.

Summary

Investors interested in KAR Auction Services Inc. (KAR) should consider the stock’s recent performance amid market volatility. As of this writing, KAR has closed at $14.44, a slight increase over the last few days. The stock has held steady throughout the market downturn, indicating that it may be a good option for investors looking for a safe bet. Media sentiment surrounding KAR is mostly positive, suggesting that the company is well-positioned to weather market downturns.

KAR’s long-term prospects remain strong, with a history of steady growth, healthy dividends, and a diversified portfolio of services. Investors should consider their own risk tolerance when choosing whether or not to invest in KAR stock.

Recent Posts