COPART INC Reports Third Quarter Earnings Results for FY2023

May 26, 2023

Earnings Overview

Copart Inc ($BER:CO6). announced their financial results for Q3 of FY2023 ending April 30th, 2023. Total revenue for the period amounted to USD 1021.8 million, representing a 8.7% year-on-year increase. Net income for the quarter was USD 350.4 million, a 25.8% growth compared to the same period last year.

Market Price

COPART INC reported their third quarter earnings results for FY2023 on Wednesday. Despite a volatile stock market, the company’s stock opened at €74.3 and closed at €74.3, representing a modest 0.1% increase from the previous closing price of €74.3. The company reported strong financial performance for the quarter, with net income increasing by 17% year-over-year. This marks the company’s ninth consecutive dividend increase and further reflects its commitment to rewarding shareholders.

Overall, COPART INC’s third quarter earnings report was largely positive and could help to maintain investor confidence in the company’s long-term prospects. The stock’s slight increase on Wednesday is a sign of optimism among investors, and may indicate that COPART INC is well-positioned for future growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Copart Inc. More…

| Total Revenues | Net Income | Net Margin |

| 3.76k | 1.15k | 31.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Copart Inc. More…

| Operations | Investing | Financing |

| 1.32k | -313.5 | -350.25 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Copart Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.35k | 757.38 | 10.94 |

Key Ratios Snapshot

Some of the financial key ratios for Copart Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 19.1% | 20.9% | 37.3% |

| FCF Margin | ROE | ROA |

| 23.1% | 16.2% | 13.8% |

Analysis

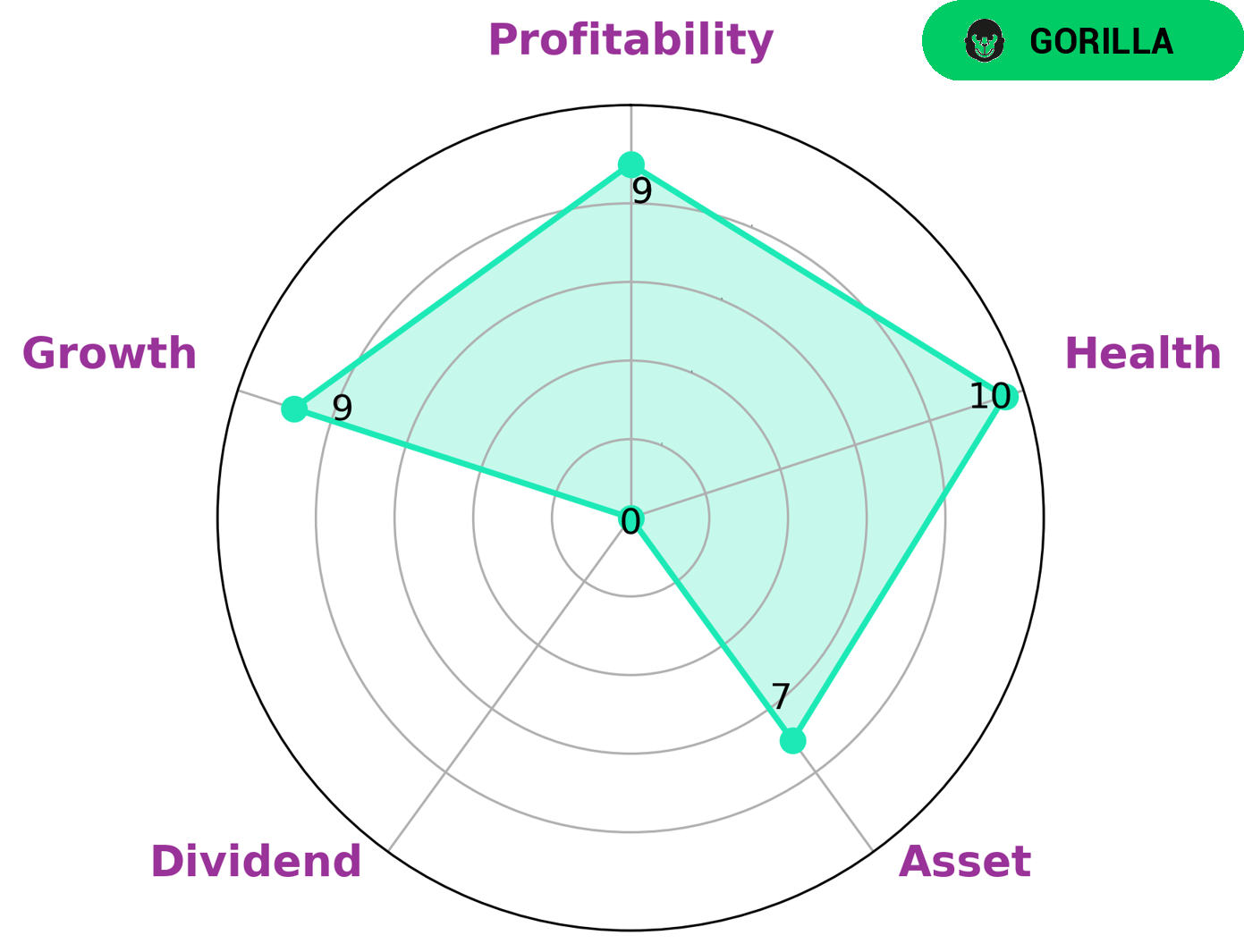

GoodWhale recently conducted an analysis of COPART INC‘s wellbeing and based on our Star Chart, COPART INC has a high health score of 10/10 with regard to its cashflows and debt. This is indicative of the company’s ability to pay off debt and fund future operations. COPART INC is classified as a ‘gorilla’, a type of company we conclude that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given the strong health score of COPART INC, we believe it could be an attractive investment opportunity for various types of investors. COPART INC is particularly strong in the areas of asset, growth, and profitability, and weak in dividend. Thus, investors that seek growth, capital appreciation, or value investing may find COPART INC appealing. On the other hand, dividend investors may want to look elsewhere for better returns. More…

Summary

COPART Inc reported strong financial results for the third quarter of FY2023. Total revenue grew by 8.7% year-on-year to USD 1021.8 million, while net income surged 25.8% to USD 350.4 million. This was driven by increased demand for used vehicles due to strong economic growth and low interest rates. Overall, the company is in a strong financial position and investors should consider investing in COPART as it seems to be a reliable and profitable investment opportunity.

Recent Posts