China Yongda Automobiles Services Holdings Full Year 2022 Earnings: Lower than Expected

March 31, 2023

Trending News 🌧️

China Yongda Automobiles ($SEHK:03669) Services Holdings has delivered a lower-than-expected set of Full Year 2022 Earnings. This resulted in reduced sales of automotive services and a decline in demand for automotive related services.

In addition, the company faced a number of other headwinds such as rising costs of raw materials and increased competition in the automotive services sector. Despite these challenges, China Yongda Automobiles Services Holdings has made significant efforts to improve its profitability by implementing a cost-control strategy and improving its operating efficiency. The company has also invested heavily in the development of new products and services to attract more customers. Overall, investors should remain cautious moving forward due to the lower-than-expected earnings from China Yongda Automobiles Services Holdings. The company will need to continue working hard to improve its profitability and increase its market share in order to remain competitive in the industry.

Share Price

On Monday, CHINA YONGDA AUTOMOBILES SERVICES stock opened at HK$5.6 and closed at HK$5.0, a drop of 11.2% from the previous closing price of 5.6. The company had previously forecasted strong growth for FY 2022, but the results show that this was not achieved. The disappointing figures have caused investors to be concerned about the company’s ability to deliver on its future growth prospects.

The poor performance of CHINA YONGDA AUTOMOBILES SERVICES has cast a shadow over the automotive services industry as a whole, as investors are now viewing companies in this sector with caution. With such a weak performance, the company will need to reassess its strategies and take corrective actions to ensure that it can return to profitability and continue to deliver strong returns in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for China Yongda Automobiles. More…

| Total Revenues | Net Income | Net Margin |

| 68.81k | 1.98k | 2.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for China Yongda Automobiles. More…

| Operations | Investing | Financing |

| 4.34k | -985.5 | -3.68k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for China Yongda Automobiles. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 30.74k | 16.72k | 6.83 |

Key Ratios Snapshot

Some of the financial key ratios for China Yongda Automobiles are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.0% | 7.3% | 4.5% |

| FCF Margin | ROE | ROA |

| 4.2% | 14.4% | 6.3% |

Analysis

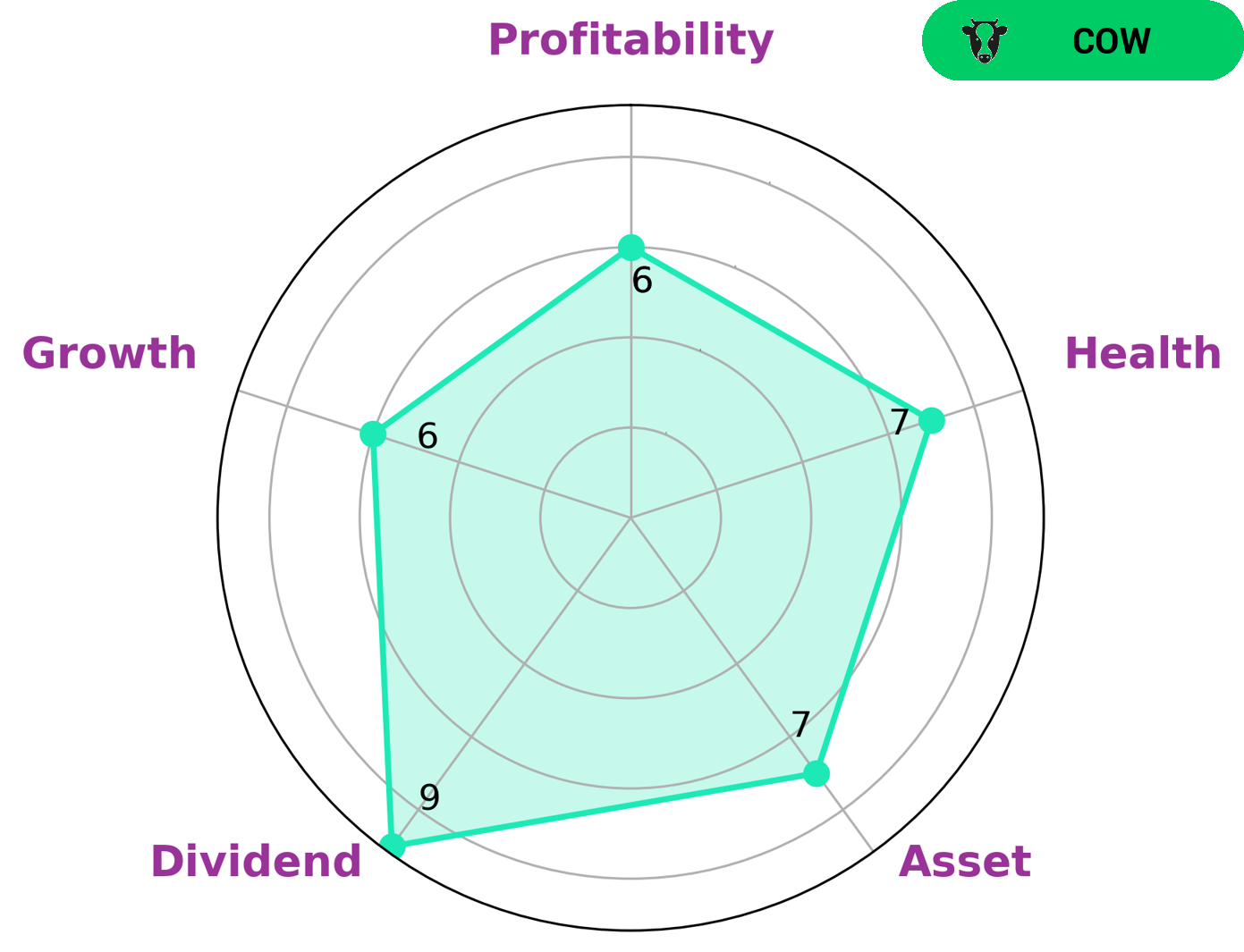

GoodWhale has conducted an analysis of CHINA YONGDA AUTOMOBILES SERVICES’ financials and rated it with a high health score of 7/10 with regard to its cashflows and debt. This indicates that the company is capable to sustain operations in times of crisis. We also found that CHINA YONGDA AUTOMOBILES SERVICES is strong in asset, dividend, and medium in growth, profitability. As such, we conclude that the company is classified as a ‘cow’, meaning it has the track record of paying out consistent and sustainable dividends. Given the analysis of CHINA YONGDA AUTOMOBILES SERVICES’ financials and the fact that it is a ‘cow’ company, we suggest this type of company may be of interest to investors looking for a stable dividend income and steady growth. The company’s strong cashflows and debt also make it an attractive option to investors looking for a safe and reliable option. More…

Peers

In recent years, the competition among China’s major auto service companies has intensified. Among them, China Yongda Automobiles Services Holdings Ltd has emerged as a leading player, followed by G A Holdings Ltd, Grand Baoxin Auto Group Ltd and Centenary United Holdings Ltd. These companies have been locked in fierce competition in terms of market share, service quality and price.

– G A Holdings Ltd ($SEHK:08126)

A holding company, HNA Group Co., Ltd. operates businesses in the aviation, hospitality, finance, and other sectors. The Company’s segments include Aviation, which engages in the operation of airlines; Hospitality, which owns and operates hotels; Finance, which provides banking and other financial services; and Corporate and Others, which includes other businesses. HNA Group Co., Ltd. is based in Haikou, China.

– Grand Baoxin Auto Group Ltd ($SEHK:01293)

Grand Baoxin Auto Group Ltd is a Chinese automotive manufacturer with a market cap of 1.05B as of 2022. The company has a Return on Equity of 11.81%. Grand Baoxin Auto Group Ltd manufactures and sells vehicles and vehicle parts. The company offers a range of vehicles, including sedans, SUVs, and commercial vehicles.

– Centenary United Holdings Ltd ($SEHK:01959)

Centenary United Holdings Ltd is a Hong Kong-based investment holding company principally engaged in the provision of banking and financial services. The Company operates its business through four segments. The Corporate Banking segment is engaged in the provision of banking services to corporate customers, including deposits, loans, trade financing, capital market services, cash management services, foreign exchange services and other related services. The Retail Banking segment is engaged in the provision of banking services to individual customers, including deposits, loans, trade financing, capital market services, cash management services, foreign exchange services and other related services. The Treasury segment is engaged in the provision of treasury products and services, including foreign exchange trading, money market trading, fixed income trading, derivatives trading and other related services. The Others segment is engaged in the provision of personal accident insurance, general insurance and other related services.

Summary

China Yongda Automobiles Services Holdings reported their full year 2022 earnings, and unfortunately missed expectations. Investors reacted negatively with the stock price moving down the same day. When analyzing the investment potential of China Yongda Automobiles Services, investors should assess the company’s revenue and profitability, as well as its competitive position in the industry. Further, investors should look at the company’s cash flow and assess whether it is able to meet its short-term obligations.

Investors should also consider the company’s valuation, in comparison to other stocks in the industry, to determine whether the stock is overvalued or undervalued. Furthermore, investors should evaluate any risks associated with the investment, such as macroeconomic conditions and industry changes that could impact the company’s performance. Ultimately, investors must determine if the potential rewards outweigh the risks to decide if they should invest in China Yongda Automobiles Services.

Recent Posts