Yousif Capital Management LLC Reduces Investment in Dorman Products, (NASDAQ:DORM)

April 1, 2023

Trending News 🌥️

Dorman Products ($NASDAQ:DORM), Inc. (NASDAQ:DORM), a leading supplier of replacement parts and fasteners for the automotive aftermarket, has seen its stock holdings reduced by Yousif Capital Management LLC. This reduction in investment follows recent reports of a decrease in the company’s sales and profits due to the coronavirus pandemic. DORMAN PRODUCTS has been a long-time supplier of replacement parts to the automotive aftermarket industry, providing a wide range of products for both domestic and international markets. The company also manufactures and distributes fasteners and other related components for the automotive and industrial markets. DORMAN PRODUCTS has been a reliable supplier for many years, with a well-established distribution network and strong customer relationships. While the uncertainty of the pandemic has affected DORMAN PRODUCTS’ performance, the company remains committed to offering quality products and services. They continue to seek new opportunities and expand their product lines to better meet customer demand. The company is also focused on innovation and implementing cost-effective strategies to help maintain their competitive advantage. The news of Yousif Capital Management LLC reducing its investment in DORMAN PRODUCTS is certainly a cause for concern.

However, with their commitment to providing quality products, innovating, and expanding their product lines, the company should be able to weather this storm and come out on the other side stronger than ever.

Stock Price

Monday saw DORMAN PRODUCTS (NASDAQ: DORM) stock open at $83.0 and close at $83.1, an increase of 0.7% from the previous closing price of $82.5. Despite this, the stock still managed to make modest gains in the market. It is uncertain how much of an impact the reduced investment from Yousif Capital Management LLC will have on the company’s performance in the future. Investors will be monitoring the situation closely, as any further downturn in the stock price could be an indication of a larger financial problem for DORMAN PRODUCTS. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dorman Products. More…

| Total Revenues | Net Income | Net Margin |

| 1.73k | 121.55 | 7.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dorman Products. More…

| Operations | Investing | Financing |

| 41.69 | -526.84 | 472.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dorman Products. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.34k | 1.3k | 33.17 |

Key Ratios Snapshot

Some of the financial key ratios for Dorman Products are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.5% | 17.4% | 9.9% |

| FCF Margin | ROE | ROA |

| 0.2% | 10.4% | 4.6% |

Analysis

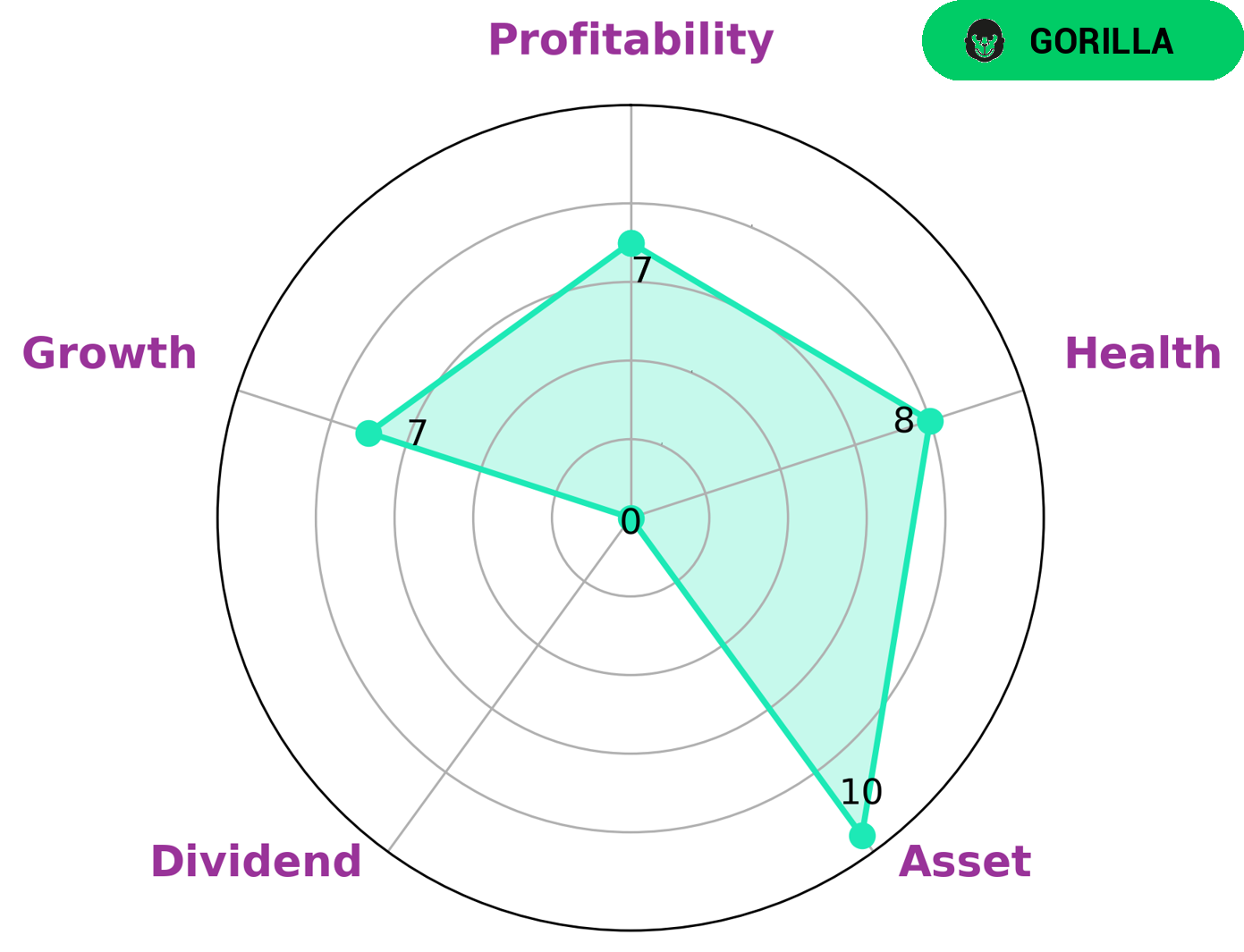

At GoodWhale, we have taken a deep dive into the financials of DORMAN PRODUCTS. Our analysis using the Star Chart methodology has yielded a high health score of 8/10 for the company, indicating that it is capable of weathering any potential storm and has very little risk of bankruptcy. We have determined that DORMAN PRODUCTS has strong assets and growth, as well as positive profitability, however its dividend rate is relatively weak. By classifying DORMAN PRODUCTS as a ‘gorilla’ company, we suggest that its high revenue and earning growth is due to its competitive advantage in its industry. This may be of interest to investors who are looking for companies that have potential for long-term growth. More…

Peers

The company competes with Hwaseung R&A Co Ltd, Shanghai Baolong Automotive Corp, Inter Cars SA. Dorman Products Inc offers a wide range of products including engine parts, suspension parts, electrical parts, and more. The company has a strong focus on quality and customer service.

– Hwaseung R&A Co Ltd ($KOSE:378850)

Hwaseung R&A Co Ltd is a South Korean conglomerate. It is the holding company of the Hwaseung Group, which consists of businesses in the auto parts, chemicals, and electronics industries. The company has a market cap of 71.31B as of 2022, and a return on equity of 8.21%. Hwaseung R&A Co Ltd is a publicly traded company on the Korea Exchange (KRX).

– Shanghai Baolong Automotive Corp ($SHSE:603197)

Shanghai Baolong Automotive Corp is a publicly traded company with a market capitalization of $9.01 billion as of 2022. The company has a return on equity of 10.38%. Shanghai Baolong Automotive Corp is engaged in the manufacture and sale of automotive parts and components. The company’s products include engine parts, transmission parts, suspension parts, and electrical parts. Shanghai Baolong Automotive Corp has a strong presence in the Chinese automotive market and is expanding its operations into other markets, such as the United States.

– Inter Cars SA ($LTS:0LUR)

Inter Cars SA is a Polish automotive parts and accessories retailer and distributor. The company operates through three segments: Retail, Wholesale, and E-commerce. It offers a range of products, including car parts, tools, equipment, and chemicals. As of 2022, Inter Cars SA had a market cap of 5.24 billion Polish zlotys and a return on equity of 18.9%.

Summary

Yousif Capital Management LLC recently reported a decrease in their holdings of Dorman Products, Inc. (NASDAQ:DORM). This represents a significant shift in sentiment towards the stock by the investment firm, as they had previously held over 1% of the company’s total shares. Analysts have largely been positive on the stock, citing its strong financial performance and potential for growth.

The company has posted consistent revenue and profit growth over the past several years, while its balance sheet remains healthy. While short term investors may be spooked by the latest news, those with a longer-term outlook may find an opportunity to acquire the stock at a discounted price.

Recent Posts