Roth MKM Cites ‘Too Much Risk’ to Recommend Fox Factory Stock

April 9, 2023

Trending News ☀️

Roth MKM recently released a statement citing too much risk as the primary factor in its decision to not recommend investing in Fox Factory Holding ($NASDAQ:FOXF) stock. Fox Factory Holding is a worldwide leader in the design and manufacture of performance-defining ride dynamics products, including suspension systems, drivetrains, and other related products. The company’s products, many of which are designed and manufactured right here in the US, are used by mountain bike, snowmobile, all-terrain vehicle, side-by-side vehicle, and heavy truck manufacturers across the globe. Despite Fox Factory’s impressive track record and product portfolio, Roth MKM felt that the risk associated with investing in the company at its current Neutral rating is too high.

The risks include potential volatility in the stock markets, competitive pressures from new entrants and established players alike, political risk, and other macroeconomic issues. Although Roth MKM has not provided a buy or sell recommendation for the stock, it does believe that investors should evaluate their own risk tolerance before making any investment decision.

Price History

On Wednesday, FOX FACTORY HOLDING stock experienced a sharp decline, opening at $119.0 and closing at $107.0, representing a 12.7% drop from its previous closing price of 122.7. This downward trend caused Roth MKM to reconsider their stance on the company stock, leading them to withhold their recommendation due to the excessive risk that they perceived. As a result, the stock has been under pressure as investors remain uncertain of the company’s future prospects. Nonetheless, analysts remain optimistic that the company will be able to bounce back from this downturn, although it may take some time for this to happen. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for FOXF. More…

| Total Revenues | Net Income | Net Margin |

| 1.6k | 205.28 | 12.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for FOXF. More…

| Operations | Investing | Financing |

| 187.09 | -44.73 | -179.14 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for FOXF. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.62k | 496.95 | 26.53 |

Key Ratios Snapshot

Some of the financial key ratios for FOXF are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.7% | 29.8% | 15.1% |

| FCF Margin | ROE | ROA |

| 8.9% | 13.9% | 9.4% |

Analysis

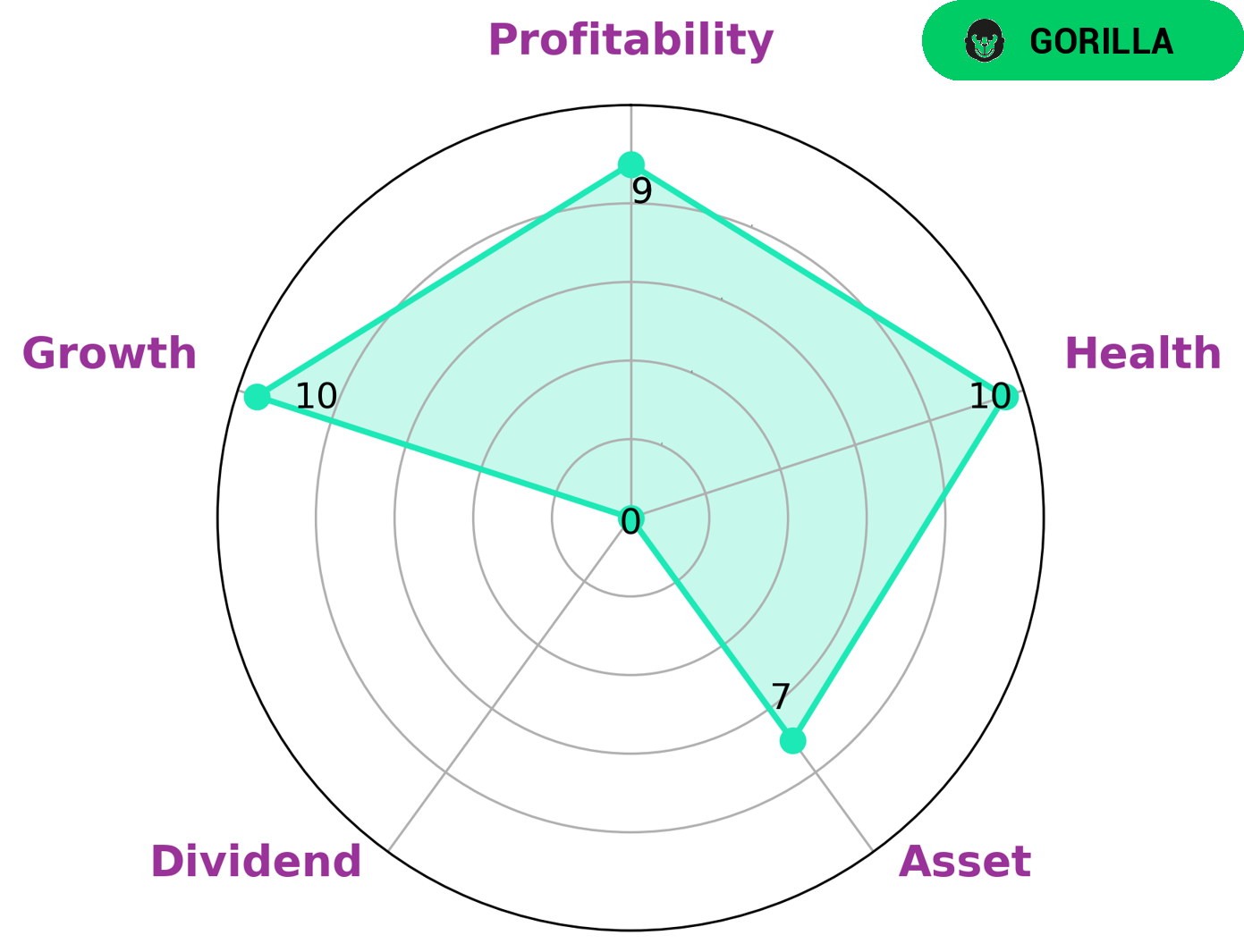

At GoodWhale, we have conducted an in-depth analysis of FOX FACTORY HOLDING’s fundamentals. Through our analysis, we have classified FOX FACTORY HOLDING as a ‘gorilla’, indicating that the company has achieved stable and high revenue or earning growth due to its strong competitive advantage. FOX FACTORY HOLDING can be an attractive investment for those who are seeking a well-positioned, financially sound company with strong growth potential. The company’s high health score of 10/10 indicate that it is in a strong position to sustain future operations in times of crisis. Furthermore, FOX FACTORY HOLDING is strong in terms of both asset and growth, as well as profitability. However, it is weak in terms of dividends. Therefore, investors who are looking for a company that can provide both capital growth and dividend income may not be attracted to FOX FACTORY HOLDING. More…

Peers

The Company’s products are sold to original equipment manufacturers and aftermarket customers. Fox Factory Holding Corp was founded in 1974 and is headquartered in Scotts Valley, California. Hankook & Co is a South Korean company that manufactures and sells tires. The company was founded in 1941 as the Chosun Tire Company and changed its name to Hankook Tire in 1968. Hankook Tire has manufacturing plants in South Korea, China, Hungary, and Indonesia. The company sells its tires under the Hankook, Kumho, and Nexen brands. Federal Corp is a Taiwanese company that manufactures and sells tires. Federal Corp was founded in 1954 and is headquartered in Taipei, Taiwan. The company has manufacturing plants in Taiwan, China, and Thailand. Federal Corp sells its tires under the Federal, Achilles, and Atturo brands. PT Multistrada Arah Sarana Tbk is an Indonesian company that manufactures and sells tires. PT Multistrada Arah Sarana Tbk was founded in 1976 and is headquartered in Jakarta, Indonesia. The company has manufacturing plants in Indonesia and Vietnam. PT Multistrada Arah Sarana Tbk sells its tires under the Multistrada, Tristar, and Maxxis brands.

– Hankook & Co ($KOSE:000240)

Hankook & Co is a South Korean conglomerate with a market cap of 1.17T as of 2022. The company has a Return on Equity of 5.05%. Hankook & Co is involved in a variety of businesses including tires, chemicals, and auto parts. The company has a strong presence in South Korea and is a major player in the global market.

– Federal Corp ($TWSE:2102)

Federal Corp is a publicly traded company with a market capitalization of 8.5 billion as of 2022. The company has a negative return on equity of 13.91%. Federal Corp is engaged in the business of manufacturing and selling automotive parts and systems.

– PT Multistrada Arah Sarana Tbk ($IDX:MASA)

PT Multistrada Arah Sarana Tbk has a market cap of 18.64T as of 2022, a Return on Equity of 19.35%. The company is engaged in the manufacturing of passenger car radial tyres and motorcycle tyres in Indonesia. It also exports its products to over 60 countries worldwide.

Summary

Fox Factory Holding (FOXF) is a company that manufactures and supplies suspension products and related accessories for mountain bikes, off-road vehicles, side-by-sides, all-terrain vehicles, and snowmobiles. Recently, investment analysis for FOXF has been mixed. Roth MKM released a note on the stock that viewed it as too risky to be constructive and the stock price dropped the same day. Analysts at other firms have remained neutral and have given the stock a hold rating.

Investors should approach FOXF with caution, as there is potential for further downside if market sentiment does not improve. As always, potential investors should conduct their own due diligence before investing in any stock.

Recent Posts