MOBILEYE GLOBAL Reports Strong Earnings for the 2nd Quarter of FY2023

August 10, 2023

☀️Earnings Overview

On July 27, 2023, MOBILEYE GLOBAL ($NASDAQ:MBLY) reported their financial results for the second quarter of FY2023, which ended on June 30, 2023. The total revenue for the quarter was USD 454.0 million, a 1.3% decrease from the same quarter the previous year. Their net income for the quarter was USD -28.0 million, a decrease from -7.0 million reported in the same quarter last year.

Market Price

On Thursday, MOBILEYE GLOBAL reported strong earnings for the 2nd quarter of FY2023. The company’s stock opened at $39.1 and closed at $38.0, which was 6.0% lower than its previous closing price of 40.4. Despite the drop in stock price, MOBILEYE GLOBAL still posted impressive results for its second quarter of the year.

Overall, MOBILEYE GLOBAL’s 2nd quarter results were strong, despite a decrease in stock price this week. The company’s strong performance demonstrates its resilience during the current difficult economic climate and is indicative of its future success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mobileye Global. More…

| Total Revenues | Net Income | Net Margin |

| 1.93k | -122 | -6.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mobileye Global. More…

| Operations | Investing | Financing |

| 510 | 785 | -914 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mobileye Global. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.43k | 630 | 18.35 |

Key Ratios Snapshot

Some of the financial key ratios for Mobileye Global are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.6% | – | -3.7% |

| FCF Margin | ROE | ROA |

| 20.4% | -0.3% | -0.3% |

Analysis

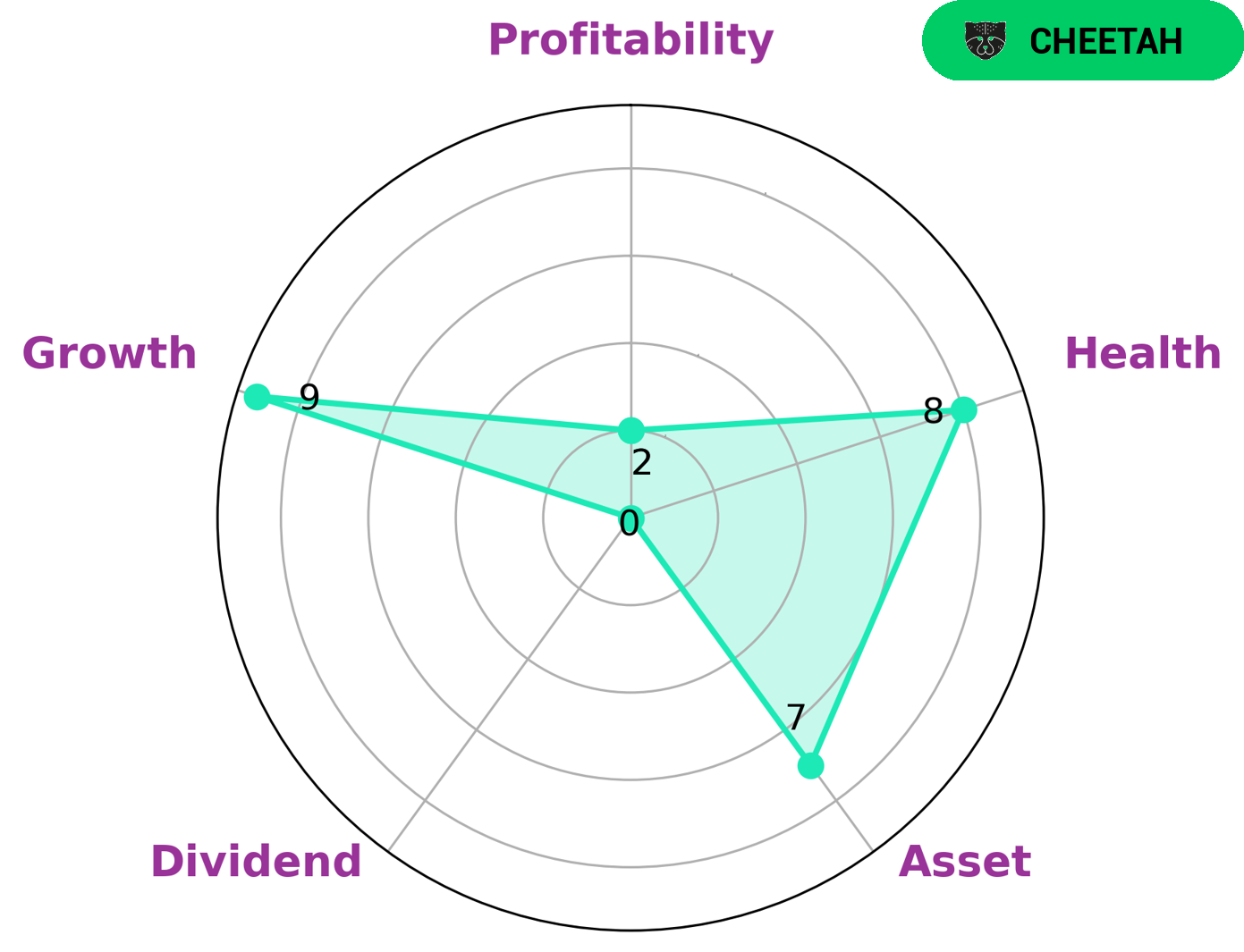

At GoodWhale, we’ve taken a look at MOBILEYE GLOBAL‘s financials and have come to some conclusions. Our Star Chart showed that MOBILEYE GLOBAL is strong in assets and growth, but weak in dividends and profitability. However, it has a very high health score of 8/10 with regard to its cashflows and debt, meaning that it is capable of paying off its debt and funding future operations. We have classified MOBILEYE GLOBAL as a ‘cheetah’, a type of company that has achieved high revenue and/or earnings growth but is considered less stable due to lower profitability. Investors who are looking for a company with high growth potential, but don’t mind taking on a bit more risk, may be interested in MOBILEYE GLOBAL. More…

Peers

It stands out among its competitors, OToBrite Electronic Inc, Garrett Motion Inc, and Innoviz Technologies Ltd, with its unique and cutting-edge products and services that are helping to shape the future of the automotive industry.

– OToBrite Electronic Inc ($TPEX:2256)

OToBrite Electronic Inc is a global leader in the development and production of electronic components and systems. The company designs, manufactures and distributes components and systems for a variety of applications, including automotive, industrial, medical and consumer markets. As of 2022, the company has a market cap of 1.46 billion dollars, indicating that it is a highly profitable and valuable company. Furthermore, the company’s Return on Equity (ROE) is 10.82%, which indicates that the company is able to effectively generate profits from its investments. This impressive market cap and ROE demonstrates that OToBrite Electronic Inc is a successful and well-managed business.

– Garrett Motion Inc ($NASDAQ:GTX)

Garrett Motion Inc is a leading provider of turbochargers and related technologies for the automotive industry. The company has a market cap of 492.62M as of 2022, which demonstrates its financial strength and market presence. The Return on Equity (ROE) of -200.83% indicates that the company is not generating a return on the investments it has made, suggesting that it may need to re-evaluate its strategies in order to improve its profitability. Despite this, Garrett Motion Inc continues to remain a leader in the automotive turbocharger market.

– Innoviz Technologies Ltd ($NASDAQ:INVZ)

Innoviz Technologies Ltd is a leading company in the autonomous vehicle industry, specializing in the development of lidar sensors and software solutions. The company has a market cap of 482.12M as of 2022 and a Return on Equity of -35.21%. This signifies that the company has been able to generate a negative return on its shareholders’ equity over the past year. Despite this, Innoviz Technologies Ltd remains well positioned in the autonomous vehicle industry, offering high-quality sensors and software solutions for many of the leading companies in the industry.

Summary

MOBILEYE GLOBAL recently reported their earnings for the second quarter of FY2023. Total revenue was USD454.0 million, a decrease of 1.3% year over year, and net income was negative USD 28 million, a decrease from a negative USD 7 million reported in the same period last year. This news caused the stock price to drop on July 27, 2023.

Investors may be concerned about the company’s performance and watch closely to see how the company responds to this decline in revenues. It is important to consider the company’s fundamentals and analyze their future prospects before investing in MOBILEYE GLOBAL.

Recent Posts