Mobileye Global Intrinsic Value Calculator – Daiwa Initiates Coverage of Mobileye with Positive Outlook

April 21, 2023

Trending News ☀️

Daiwa Securities has recently initiated coverage of Mobileye Global ($NASDAQ:MBLY), an Israeli provider of advanced driver assistance systems (ADAS), with an optimistic outlook. Despite a slip in their share price in the past few months, Daiwa remains confident in Mobileye’s potential and sees the potential for long-term growth. Through their sophisticated image-processing technology, Mobileye has developed a suite of ADAS products aimed at preventing accidents and providing safer driving experiences worldwide. Over the years, Mobileye has become a leader in the ADAS industry, forming partnerships with auto makers around the world to integrate their ADAS products into new cars.

This new product provides an affordable and easy way for drivers to upgrade their vehicles with advanced safety features. As the global automotive industry continues to move towards autonomous driving, it’s clear that Mobileye is well-positioned to benefit from this shift. Daiwa’s positive outlook on Mobileye is indicative of the company’s potential to capitalize on this growing trend and drive long-term growth.

Stock Price

On Wednesday, Daiwa released its initiation of coverage of the stock MOBILEYE GLOBAL with a positive outlook. The stock opened at $45.5 before closing at $44.9, down by 2.5% from its previous closing price of 46.0. The news of Daiwa’s positive outlook on the stock gave hope and optimism to investors, who have been on uncertain footing as the global pandemic continues to linger. Despite the slight decrease in price, Daiwa’s analysis has implied that there are still plenty of growth opportunities for MOBILEYE GLOBAL in the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mobileye Global. More…

| Total Revenues | Net Income | Net Margin |

| 1.87k | -82 | -4.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mobileye Global. More…

| Operations | Investing | Financing |

| 546 | 1.19k | -1.32k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mobileye Global. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 15.44k | 647 | 18.45 |

Key Ratios Snapshot

Some of the financial key ratios for Mobileye Global are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.6% | – | -0.4% |

| FCF Margin | ROE | ROA |

| 23.3% | -0.0% | -0.0% |

Analysis – Mobileye Global Intrinsic Value Calculator

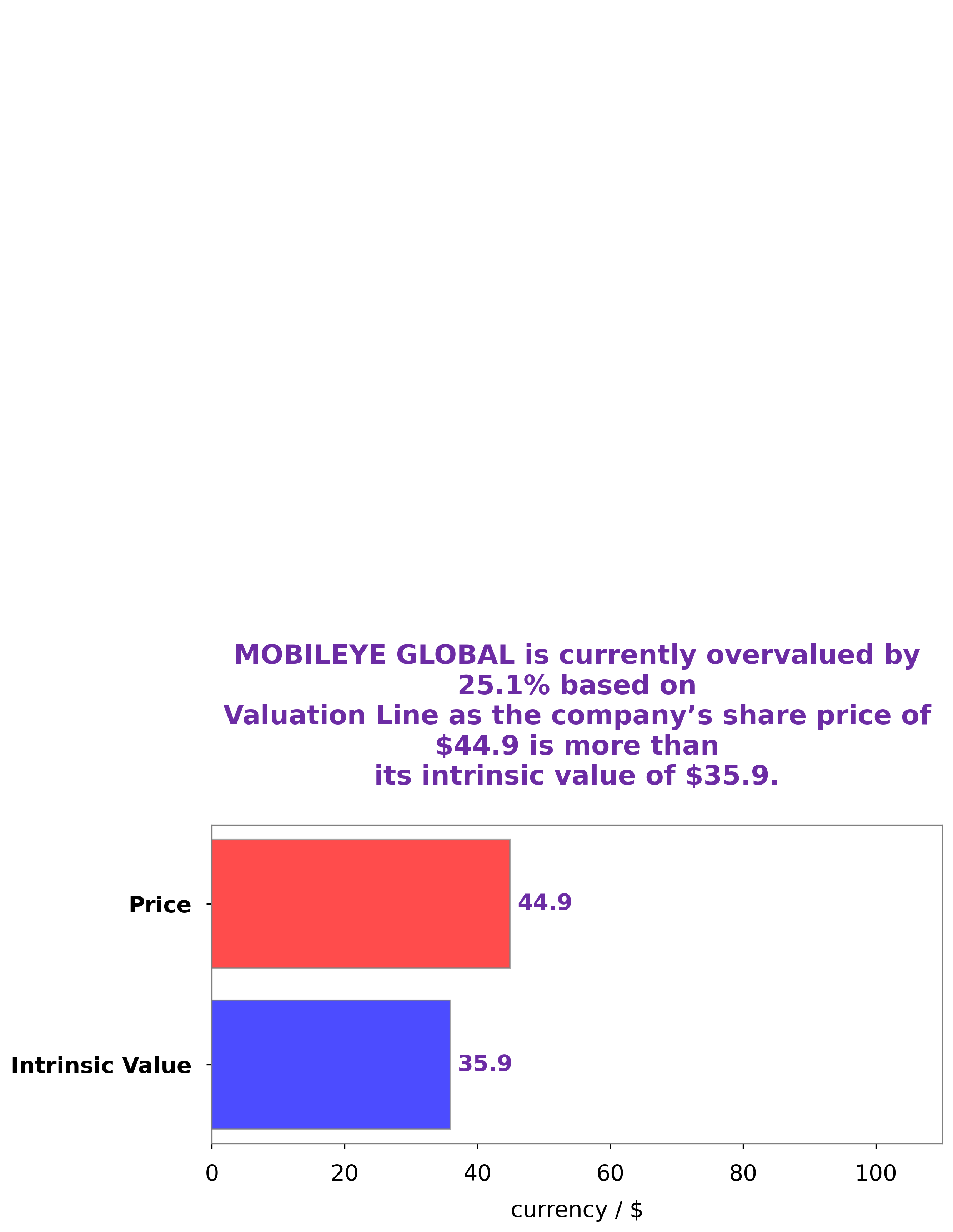

At GoodWhale, we have taken a deep look at the financials of MOBILEYE GLOBAL to deliver an accurate analysis. Our proprietary Valuation Line has determined that the fair value of its shares is around $35.9. However, the market is currently trading the stock at $44.9, indicating that it is overvalued by 25.2%. It is our recommendation that investors should take caution and keep a close eye on MOBILEYE GLOBAL’s performance before making any investment decisions. More…

Peers

It stands out among its competitors, OToBrite Electronic Inc, Garrett Motion Inc, and Innoviz Technologies Ltd, with its unique and cutting-edge products and services that are helping to shape the future of the automotive industry.

– OToBrite Electronic Inc ($TPEX:2256)

OToBrite Electronic Inc is a global leader in the development and production of electronic components and systems. The company designs, manufactures and distributes components and systems for a variety of applications, including automotive, industrial, medical and consumer markets. As of 2022, the company has a market cap of 1.46 billion dollars, indicating that it is a highly profitable and valuable company. Furthermore, the company’s Return on Equity (ROE) is 10.82%, which indicates that the company is able to effectively generate profits from its investments. This impressive market cap and ROE demonstrates that OToBrite Electronic Inc is a successful and well-managed business.

– Garrett Motion Inc ($NASDAQ:GTX)

Garrett Motion Inc is a leading provider of turbochargers and related technologies for the automotive industry. The company has a market cap of 492.62M as of 2022, which demonstrates its financial strength and market presence. The Return on Equity (ROE) of -200.83% indicates that the company is not generating a return on the investments it has made, suggesting that it may need to re-evaluate its strategies in order to improve its profitability. Despite this, Garrett Motion Inc continues to remain a leader in the automotive turbocharger market.

– Innoviz Technologies Ltd ($NASDAQ:INVZ)

Innoviz Technologies Ltd is a leading company in the autonomous vehicle industry, specializing in the development of lidar sensors and software solutions. The company has a market cap of 482.12M as of 2022 and a Return on Equity of -35.21%. This signifies that the company has been able to generate a negative return on its shareholders’ equity over the past year. Despite this, Innoviz Technologies Ltd remains well positioned in the autonomous vehicle industry, offering high-quality sensors and software solutions for many of the leading companies in the industry.

Summary

Investing analysis of Mobileye Global, a leading provider of advanced driving safety and autonomous driving solutions, has recently been updated. Analysts anticipate upside potential for the stock due to their broad array of products, strong customer relationships and unique technology. They also expect the continued adoption of their solutions for advanced driver assistance systems and autonomous vehicle technology to drive future growth.

Recent Posts