FOXF Intrinsic Value – Atria Investments Inc Sells Off Shares in Fox Factory Holding Corp by 11.8% in Q4

April 22, 2023

Trending News ☀️

This is the latest move by the investment firm in a period of time when the stock market has seen increased volatility. Fox Factory Holding ($NASDAQ:FOXF) Corp is a leading designer, manufacturer, and marketer of performance-defining ride dynamics products. The company primarily serves the bicycle, powersports, side-by-side vehicles, off-road vehicles, and all-terrain vehicles markets. They have grown rapidly in recent years, acquiring several well-known brands such as Race Face, Marzocchi, and Easton Cycling. Fox is also well-known for their innovative products and technologies, such as their patented FLOAT rear shock and FIT4 damping system.

Atria Investments Inc is a publicly traded investment firm that specializes in managing money for high net worth individuals and institutional investors. The firm has a strong track record of making successful investments and is known for taking calculated risks when investing in stocks.

Price History

On Wednesday, FOX stock opened at $112.0 and closed at $112.7, a decrease of 0.2% from its previous closing price of 112.9. This move is part of Atria’s restructuring efforts and reflects their intention to diversify their portfolio. This transaction is the latest in a series of activities that indicate the company’s commitment to enhancing shareholder wealth through strategic investments and decisions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for FOXF. More…

| Total Revenues | Net Income | Net Margin |

| 1.6k | 205.28 | 12.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for FOXF. More…

| Operations | Investing | Financing |

| 187.09 | -44.73 | -179.14 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for FOXF. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.62k | 496.95 | 26.53 |

Key Ratios Snapshot

Some of the financial key ratios for FOXF are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.7% | 29.8% | 15.1% |

| FCF Margin | ROE | ROA |

| 8.9% | 13.9% | 9.4% |

Analysis – FOXF Intrinsic Value

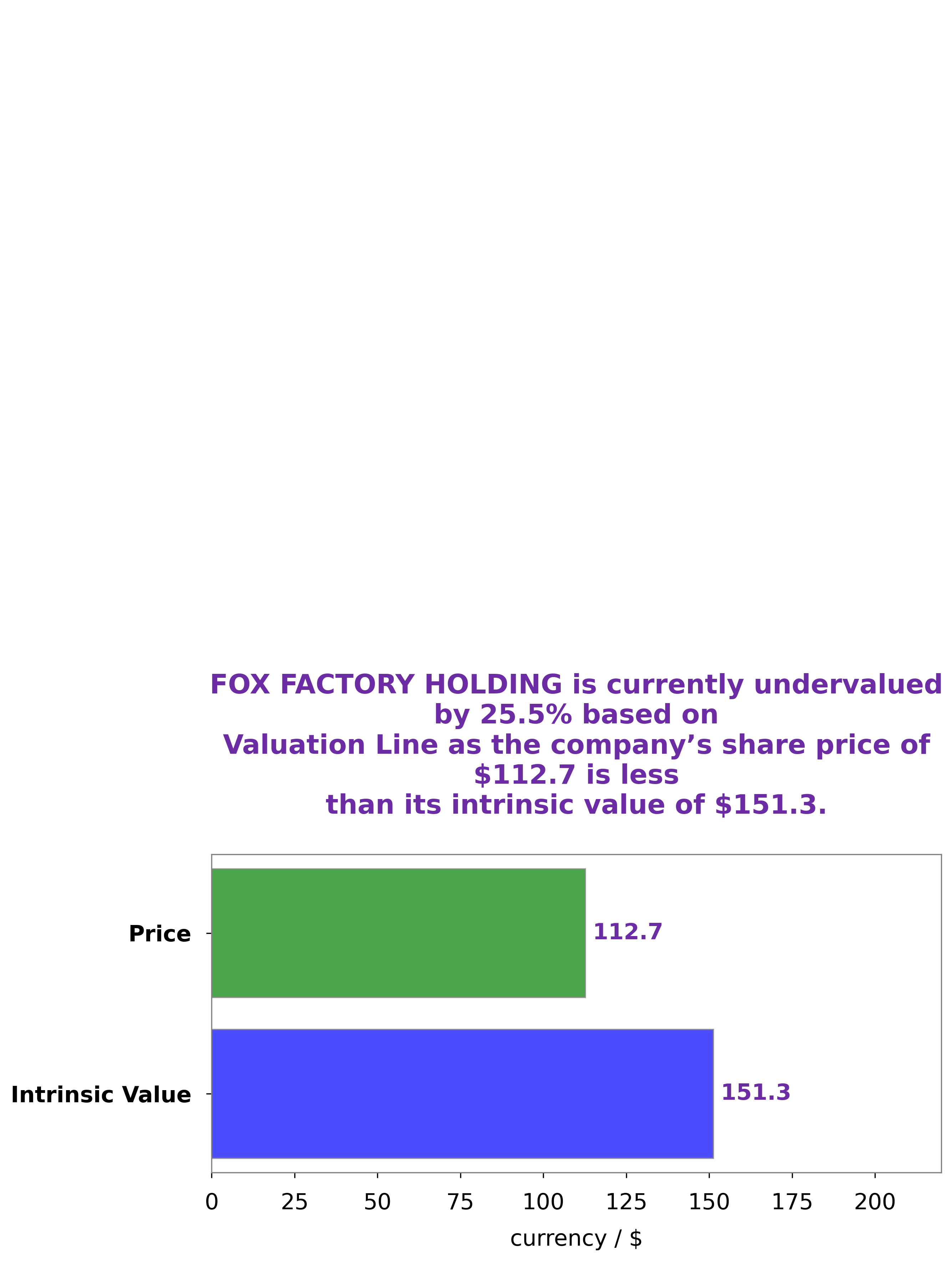

At GoodWhale, we conducted an analysis on the wellbeing of FOX FACTORY HOLDING. Through our proprietary Valuation Line, we determined that the fair value of FOX FACTORY HOLDING share is around $151.3. However, currently the stock is traded at $112.7, implying that it is undervalued by 25.5%. This observation provides a great opportunity for investors to buy the stock and enjoy the potential returns from market appreciation. More…

Peers

The Company’s products are sold to original equipment manufacturers and aftermarket customers. Fox Factory Holding Corp was founded in 1974 and is headquartered in Scotts Valley, California. Hankook & Co is a South Korean company that manufactures and sells tires. The company was founded in 1941 as the Chosun Tire Company and changed its name to Hankook Tire in 1968. Hankook Tire has manufacturing plants in South Korea, China, Hungary, and Indonesia. The company sells its tires under the Hankook, Kumho, and Nexen brands. Federal Corp is a Taiwanese company that manufactures and sells tires. Federal Corp was founded in 1954 and is headquartered in Taipei, Taiwan. The company has manufacturing plants in Taiwan, China, and Thailand. Federal Corp sells its tires under the Federal, Achilles, and Atturo brands. PT Multistrada Arah Sarana Tbk is an Indonesian company that manufactures and sells tires. PT Multistrada Arah Sarana Tbk was founded in 1976 and is headquartered in Jakarta, Indonesia. The company has manufacturing plants in Indonesia and Vietnam. PT Multistrada Arah Sarana Tbk sells its tires under the Multistrada, Tristar, and Maxxis brands.

– Hankook & Co ($KOSE:000240)

Hankook & Co is a South Korean conglomerate with a market cap of 1.17T as of 2022. The company has a Return on Equity of 5.05%. Hankook & Co is involved in a variety of businesses including tires, chemicals, and auto parts. The company has a strong presence in South Korea and is a major player in the global market.

– Federal Corp ($TWSE:2102)

Federal Corp is a publicly traded company with a market capitalization of 8.5 billion as of 2022. The company has a negative return on equity of 13.91%. Federal Corp is engaged in the business of manufacturing and selling automotive parts and systems.

– PT Multistrada Arah Sarana Tbk ($IDX:MASA)

PT Multistrada Arah Sarana Tbk has a market cap of 18.64T as of 2022, a Return on Equity of 19.35%. The company is engaged in the manufacturing of passenger car radial tyres and motorcycle tyres in Indonesia. It also exports its products to over 60 countries worldwide.

Summary

Fox Factory Holding Corp is a manufacturer and marketer of performance parts, primarily for off-road vehicles. This could be indicative of an overall bearish sentiment towards the company, suggesting that investors are selling off their shares due to a lack of faith in the company’s performance. It is important to analyse the company’s financials, customer feedback, and competition to better understand the rationale behind this move. Investors should also monitor news regarding upcoming product releases, changes in management, and strategic partnerships that could make Fox Factory Holding Corp an attractive option in the future.

Recent Posts