FOXF Intrinsic Stock Value – Fox Factory Announces Hiring of Schemm from Trex as CFO

May 26, 2023

Trending News 🌥️

Fox Factory Holding ($NASDAQ:FOXF), a leading technology-driven manufacturer of high-performance off-road suspension products, recently announced the hiring of Schemm from Trex as their new Chief Financial Officer (CFO). This move is part of Fox Factory Holding’s mission to expand their leadership team and further strengthen their position in the suspension products industry. The company specializes in the design, engineering, and manufacturing of high-performance off-road suspension products for mountain bikes, side-by-sides, on-road vehicles, and trucks.

His extensive background in finance and accounting adds to the current leadership team’s strategic vision and contributes to the company’s ongoing success. By bringing aboard Schemm from Trex as Chief Financial Officer, Fox Factory Holding is continuing to strengthen their foothold in the suspension industry and further positioning themselves for growth and success.

Stock Price

On Thursday, FOX FACTORY HOLDING stock opened at $93.7 and closed at $92.0, down by 2.1% from last closing price of 94.1. Schemm brings a wealth of financial experience and expertise to the company and is expected to bring a high level of financial expertise to Fox Factory‘s management team that will be instrumental in helping to drive the company’s success and growth.

Additionally, he will be responsible for the oversight and management of all financial operations, including accounting, financial planning, analysis, and reporting. It is committed to delivering the highest quality products and services to its customers through its global network of manufacturing facilities and distribution partners. In his new role, Schemm will be a key leader in driving the company’s financial strategy and helping to ensure its continued success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for FOXF. More…

| Total Revenues | Net Income | Net Margin |

| 1.62k | 199 | 12.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for FOXF. More…

| Operations | Investing | Financing |

| 263.38 | -180.88 | -59.93 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for FOXF. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.82k | 660.18 | 27.52 |

Key Ratios Snapshot

Some of the financial key ratios for FOXF are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.0% | 34.1% | 15.1% |

| FCF Margin | ROE | ROA |

| 13.3% | 13.4% | 8.4% |

Analysis – FOXF Intrinsic Stock Value

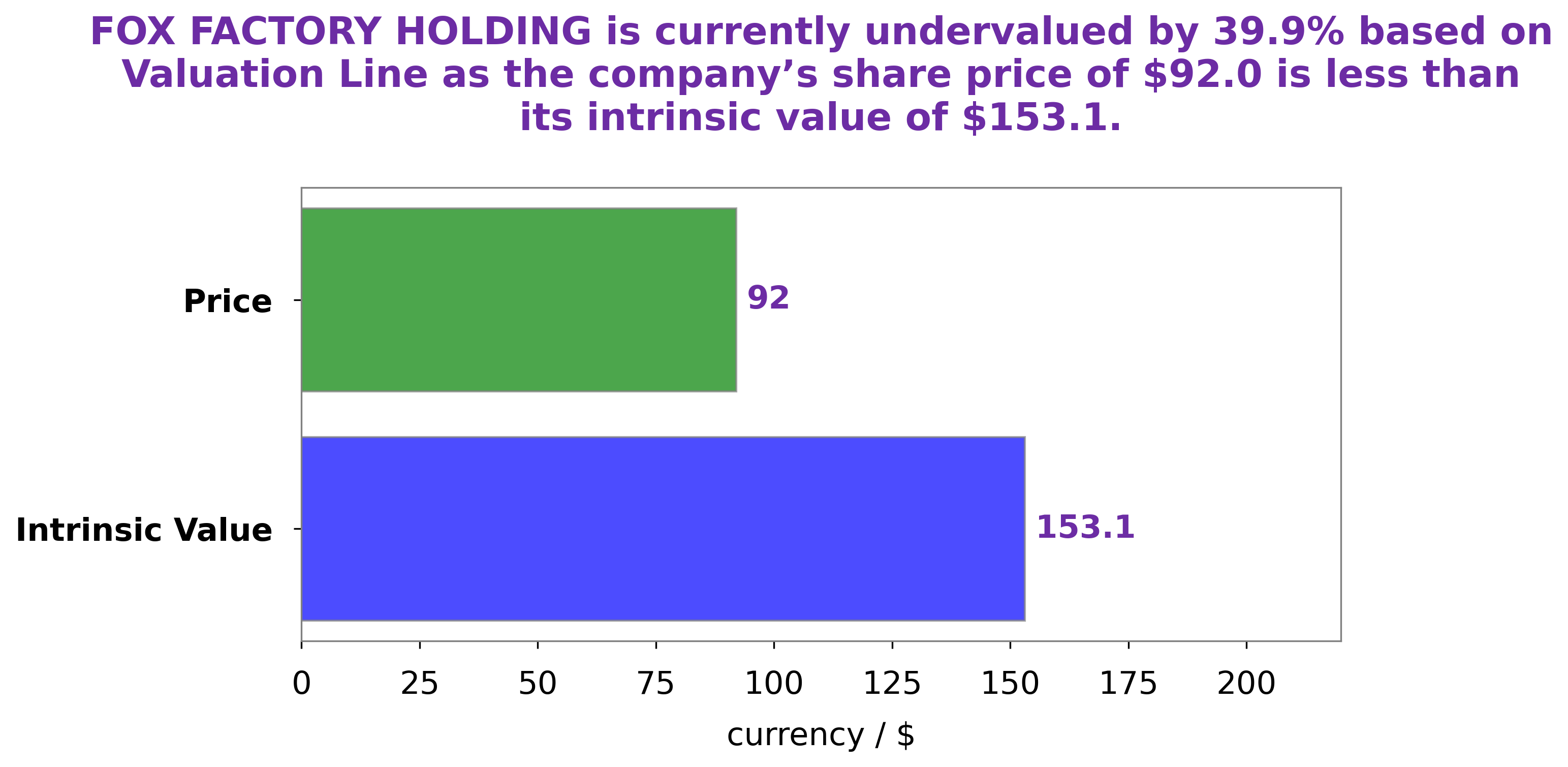

At GoodWhale, we have conducted a thorough analysis of FOX FACTORY HOLDING’s fundamentals. After careful consideration, we have arrived at a fair value of FOX FACTORY HOLDING’s share at around $153.1, which was calculated using our proprietary Valuation Line. Currently, the stock is being traded at $92.0, which is a remarkable 39.9% undervalued from its fair value estimate. This presents an attractive opportunity for investors as FOX FACTORY HOLDING’s stock is currently priced lower than its intrinsic value. More…

Peers

The Company’s products are sold to original equipment manufacturers and aftermarket customers. Fox Factory Holding Corp was founded in 1974 and is headquartered in Scotts Valley, California. Hankook & Co is a South Korean company that manufactures and sells tires. The company was founded in 1941 as the Chosun Tire Company and changed its name to Hankook Tire in 1968. Hankook Tire has manufacturing plants in South Korea, China, Hungary, and Indonesia. The company sells its tires under the Hankook, Kumho, and Nexen brands. Federal Corp is a Taiwanese company that manufactures and sells tires. Federal Corp was founded in 1954 and is headquartered in Taipei, Taiwan. The company has manufacturing plants in Taiwan, China, and Thailand. Federal Corp sells its tires under the Federal, Achilles, and Atturo brands. PT Multistrada Arah Sarana Tbk is an Indonesian company that manufactures and sells tires. PT Multistrada Arah Sarana Tbk was founded in 1976 and is headquartered in Jakarta, Indonesia. The company has manufacturing plants in Indonesia and Vietnam. PT Multistrada Arah Sarana Tbk sells its tires under the Multistrada, Tristar, and Maxxis brands.

– Hankook & Co ($KOSE:000240)

Hankook & Co is a South Korean conglomerate with a market cap of 1.17T as of 2022. The company has a Return on Equity of 5.05%. Hankook & Co is involved in a variety of businesses including tires, chemicals, and auto parts. The company has a strong presence in South Korea and is a major player in the global market.

– Federal Corp ($TWSE:2102)

Federal Corp is a publicly traded company with a market capitalization of 8.5 billion as of 2022. The company has a negative return on equity of 13.91%. Federal Corp is engaged in the business of manufacturing and selling automotive parts and systems.

– PT Multistrada Arah Sarana Tbk ($IDX:MASA)

PT Multistrada Arah Sarana Tbk has a market cap of 18.64T as of 2022, a Return on Equity of 19.35%. The company is engaged in the manufacturing of passenger car radial tyres and motorcycle tyres in Indonesia. It also exports its products to over 60 countries worldwide.

Summary

Fox Factory Holding Corporation, a leading manufacturer of high-performance suspension products and off-road vehicles, recently announced the appointment of Steve Schemm as its new Chief Financial Officer. With experience in public and private companies across multiple industries, Schemm has a proven track record in corporate finance, strategy, and operations. Investors in Fox Factory will be pleased to note that Schemm brings a wealth of knowledge to the role, having held CFO positions at several public and private companies. He also has strong financial acumen and a deep understanding of capital markets that should help Fox Factory continue to grow.

Additionally, his experience with mergers and acquisitions should provide insight into how the company can broaden its presence in the market. In short, Schemm is well-positioned to lead Fox Factory’s financial team and provide the necessary guidance to ensure profitable growth in the future.

Recent Posts