DORMAN PRODUCTS Reports Fourth Quarter Earnings Results for FY2022 on February 28, 2023.

March 7, 2023

Earnings report

On February 28, 2023, DORMAN PRODUCTS ($NASDAQ:DORM) reported its earnings results for the fourth quarter of FY2022 ending on December 31, 2022. The total revenue for the quarter was USD 17.8 million, a decrease of 47.7% compared to the same quarter of the previous year. Despite the decreased revenue, net income was at USD 501.3 million, which is a 25.9% increase from the same period of the previous year. This increase in net income is attributed to improved cost controls and higher sales of certain products.

The results for this financial quarter are an indication of DORMAN PRODUCTS’ financial performance in the past year and mark positive news for its future prospects. With the healthy financial position and increased net income for the quarter, the company is well-positioned to continue its growth in the upcoming year.

Market Price

The stock opened at $90.6 and closed at $93.0, down 0.3% from the previous closing price of $93.3. Investors were largely expected to react positively to these financial results as the company has been consistently growing in the past few quarters and showing impressive performance.

However, the market responded in a lukewarm manner, with the stock price dropping slightly from the previous day’s closing price. In spite of this minor setback, DORMAN PRODUCTS has managed to remain largely unaffected by any major market movements, indicating that the company has been able to weather this uncertain period successfully. The company’s strong financial performance over the past few quarters is reflective of its financial stability and strong fundamentals. Overall, investors remain confidant in DORMAN PRODUCTS’ ability to report solid earnings results in the future, and sustained stock price growth is anticipated in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dorman Products. More…

| Total Revenues | Net Income | Net Margin |

| 1.73k | 121.55 | 7.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dorman Products. More…

| Operations | Investing | Financing |

| 41.69 | -365.32 | 168.24 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dorman Products. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.34k | 1.3k | 32.5 |

Key Ratios Snapshot

Some of the financial key ratios for Dorman Products are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 20.5% | 17.4% | 9.9% |

| FCF Margin | ROE | ROA |

| 2.4% | 10.4% | 4.6% |

Analysis

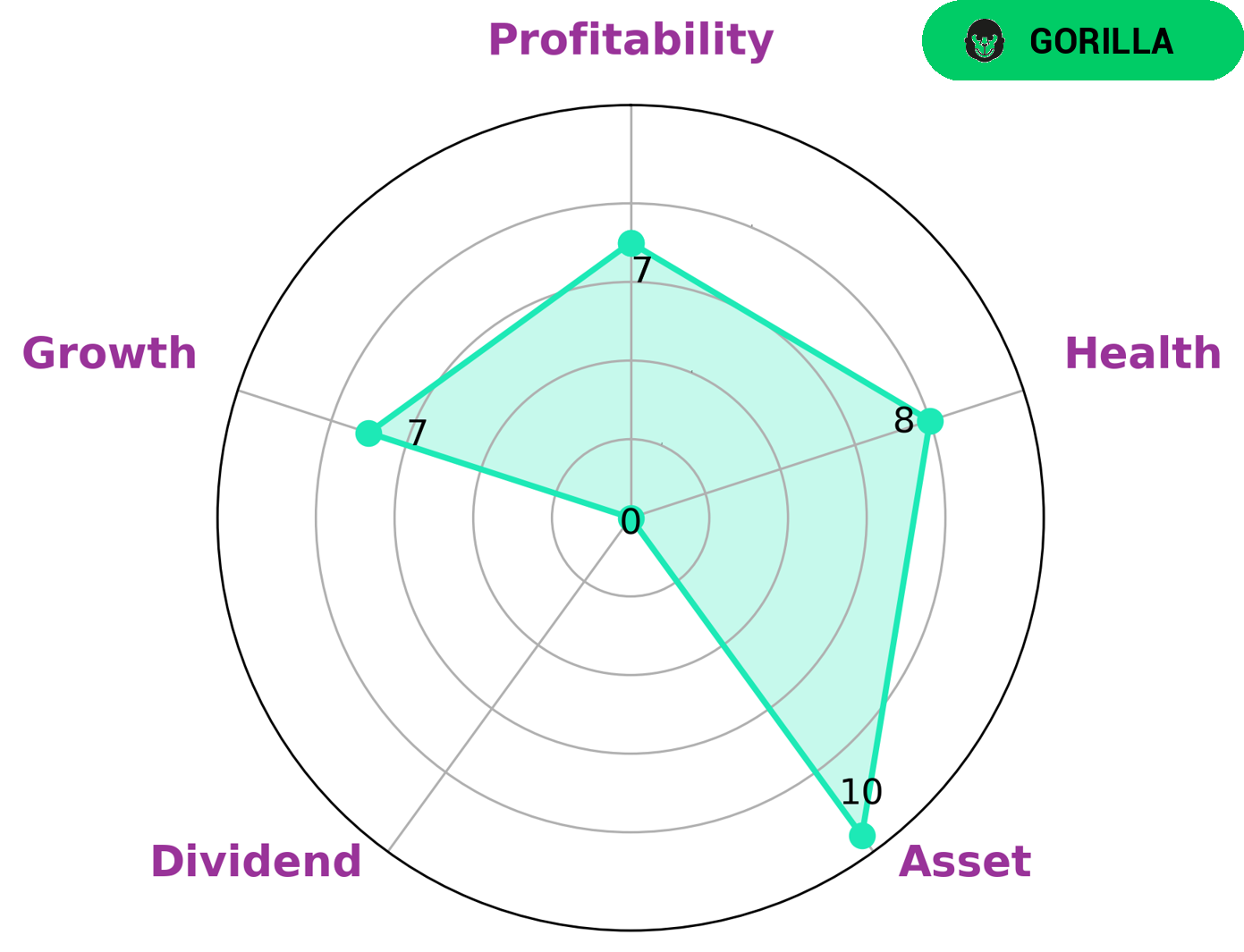

At GoodWhale, we conducted an analysis of DORMAN PRODUCTS‘ fundamentals to assess its investment potential as a company. According to our Star Chart metric, DORMAN PRODUCTS has a high health score of 8/10, which suggests that it can sustain future operations even in the midst of crises. Additionally, DORMAN PRODUCTS is classified as a ‘gorilla’, an apt name that reflects its strong competitive advantage. This means that it has achieved stable and high revenue or earning growth over time. Given DORMAN PRODUCTS’ impressive performance in terms of asset, growth, and profitability, it has potential to be attractive to a variety of investors. It is well-positioned among its peers, allowing it to withstand volatility in the market. However, it is considered weak in terms of dividend – a factor that some investors may find less appealing. Nevertheless, overall DORMAN PRODUCTS is an attractive stock that offers long-term stability and attractive returns. More…

Peers

The company competes with Hwaseung R&A Co Ltd, Shanghai Baolong Automotive Corp, Inter Cars SA. Dorman Products Inc offers a wide range of products including engine parts, suspension parts, electrical parts, and more. The company has a strong focus on quality and customer service.

– Hwaseung R&A Co Ltd ($KOSE:378850)

Hwaseung R&A Co Ltd is a South Korean conglomerate. It is the holding company of the Hwaseung Group, which consists of businesses in the auto parts, chemicals, and electronics industries. The company has a market cap of 71.31B as of 2022, and a return on equity of 8.21%. Hwaseung R&A Co Ltd is a publicly traded company on the Korea Exchange (KRX).

– Shanghai Baolong Automotive Corp ($SHSE:603197)

Shanghai Baolong Automotive Corp is a publicly traded company with a market capitalization of $9.01 billion as of 2022. The company has a return on equity of 10.38%. Shanghai Baolong Automotive Corp is engaged in the manufacture and sale of automotive parts and components. The company’s products include engine parts, transmission parts, suspension parts, and electrical parts. Shanghai Baolong Automotive Corp has a strong presence in the Chinese automotive market and is expanding its operations into other markets, such as the United States.

– Inter Cars SA ($LTS:0LUR)

Inter Cars SA is a Polish automotive parts and accessories retailer and distributor. The company operates through three segments: Retail, Wholesale, and E-commerce. It offers a range of products, including car parts, tools, equipment, and chemicals. As of 2022, Inter Cars SA had a market cap of 5.24 billion Polish zlotys and a return on equity of 18.9%.

Summary

The total revenue for the quarter was USD 17.8 million, a 47.7 percent decrease compared to the same quarter of last year. However, the company posted a net income of USD 501.3 million, a 25.9 percent increase from the same quarter of the previous year. Overall, Dorman Products remains a stable and reliable stock for investors to consider.

Recent Posts