AXL Stock Fair Value Calculation – American Axle & Manufacturing Beats Expectations with Non-GAAP EPS of -$0.01 and Revenue of $1.49B

May 6, 2023

Trending News 🌥️

AMERICAN ($NYSE:AXL): This is great news for AAM, who are a global leader in the design and manufacturing of driveline and drivetrain systems for automobiles. AAM has managed to stay ahead of the game, however, as they have built a strong portfolio of products that have helped to drive growth despite the challenging market conditions. Going forward, AAM will likely continue to benefit from their strong product portfolio and their focus on innovative technology and design.

Earnings

American Axle & Manufacturing recently released their latest earning report for the fourth quarter of the fiscal year 2022, and the results are far better than expectations. Compared to the same quarter a year ago, total revenue was up by 12.8%, while net income saw a 130.0% decrease. This indicates a positive trend for the company’s future prospects.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AXL. More…

| Total Revenues | Net Income | Net Margin |

| 5.8k | 61.6 | 1.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AXL. More…

| Operations | Investing | Financing |

| 448.9 | -243 | -217.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AXL. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.47k | 4.84k | 5.47 |

Key Ratios Snapshot

Some of the financial key ratios for AXL are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.9% | -14.8% | 4.2% |

| FCF Margin | ROE | ROA |

| 4.7% | 27.0% | 2.8% |

Price History

On Friday, American Axle & Manufacturing (AAM) reported its third quarter earnings, beating analysts expectations. The market reacted positively to the news, with AAM’s stock opening at $7.3 and closing at $7.4, rising by 9.9% from the prior closing price of $6.7. This is a strong indicator of investors’ confidence in AAM’s future prospects and performance. By consistently outperforming expectations, AAM has established itself as an industry leader in axle and drivetrain manufacturing for both cars and commercial vehicles. Live Quote…

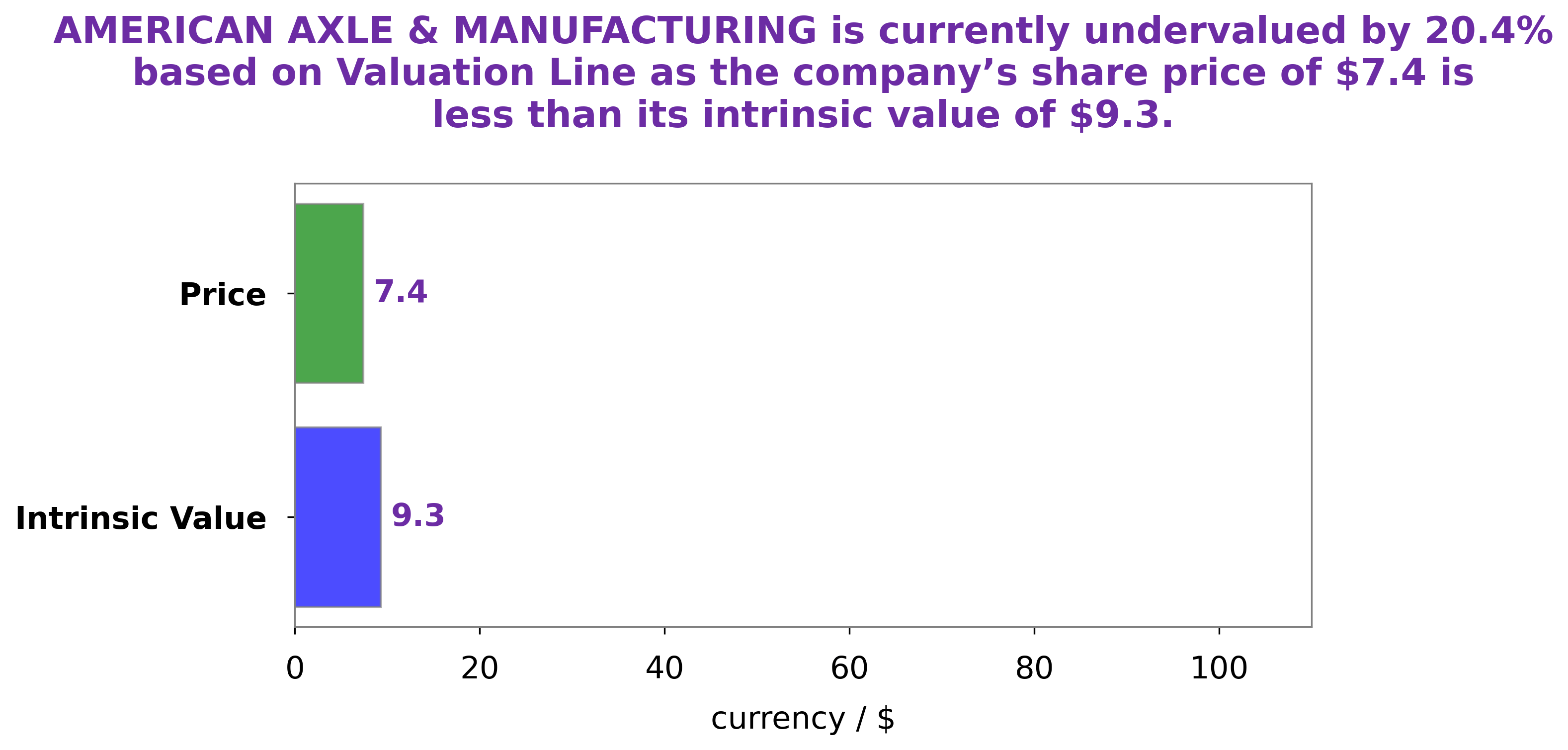

Analysis – AXL Stock Fair Value Calculation

At GoodWhale, we believe that the fair value of AMERICAN AXLE & MANUFACTURING (AAM) share is around $9.3. This was calculated by GoodWhale’s proprietary Valuation Line, which takes into account a wide range of fundamental parameters to assess the true value of a stock. However, right now AAM stock is traded at $7.4, which implies that it is undervalued by 20.0%. Our in-depth analysis of AAM’s fundamentals reveals that the company is well-positioned to create shareholder value in the long-term. AAM’s well-diversified product portfolio and integrated operations ensure a steady stream of revenue and profitability. Additionally, the company has been consistently optimizing its cost structure and investing in new technologies to boost efficiency and remain competitive. We believe that AAM is an attractive investment opportunity for investors looking for long-term growth and stability. Now that the stock is trading at a discount to its fair value, investors can benefit from the upside potential of AAM in the future. More…

Peers

It operates in four segments: Driveline, Metal Formed Products, Castings and Forgings, and Other. American Axle & Mfg Holdings Inc has several competitors, such as Rane Holdings Ltd, HGears AG, and UCAL Fuel Systems Ltd, all of which are engaged in similar areas of business.

– Rane Holdings Ltd ($BSE:505800)

Rane Holdings Ltd is a leading manufacturer and supplier of automotive components and systems, with a presence in the Indian, US, and European markets. The company has a market cap of 12.66B as of 2023, making it one of the largest players in the automotive industry. Its Return on Equity (ROE) is 10.29%, which indicates that the company is efficiently utilizing its equity to generate profits. The company has been able to maintain a steady growth rate over the years and is well poised to capitalize on the growing demand for automotive components.

– HGears AG ($BER:HGEA)

HGears AG is a global provider of high-quality gear drive components and systems for automotive, industrial, and agricultural applications. The company has a market cap of 83.2 million as of 2023, indicating that it is a relatively small and niche player in the industry. Its Return on Equity (ROE) of 2.74% indicates that the company is generating modest returns on its shareholders’ investments. HGears is committed to providing reliable, safe, and cost-effective solutions to its customers and has been able to maintain a steady growth rate over the years.

– UCAL Fuel Systems Ltd ($BSE:500464)

UCAL Fuel Systems Ltd is a leading manufacturer of automotive fuel systems, with a global presence across five continents. The company’s market cap is 2.77 billion as of 2023, reflecting its position as a major player in the automotive fuel systems industry. Additionally, UCAL Fuel Systems Ltd has achieved an impressive Return on Equity (ROE) of 7.9%, which is an indication of the firm’s strong performance and profitability. This high ROE shows that the company has been able to effectively utilize its equity base to generate high returns for its shareholders.

Summary

The company reported a Non-GAAP EPS of -$0.01, which beat market expectations by $0.06. Revenues for the quarter were reported at $1.49B and beat analyst expectations by $10M. Following the announcement of the results, the stock price for AAM went up on the same day. This indicates that investors are optimistic about the company’s future prospects.

AAM’s strong financial performance is likely attributed to its diversified product portfolio and focus on cost-cutting initiatives. Overall, AAM is poised to remain a leader in the automotive industry.

Recent Posts