Xpeng Inc Stock Intrinsic Value – XPENG INC Reports Earnings for Q2 2023

August 24, 2023

🌥️Earnings Overview

On August 18 2023, XPENG INC ($NYSE:XPEV) reported their earnings results for the second quarter ending on June 30 2023. Total revenue of CNY 5062.7 million was reported, a decrease of 31.9% from the same period in the prior year. Net income of CNY -2804.6 million was reported, compared to -2700.9 million in the year prior.

Stock Price

On Friday, XPENG INC reported its earnings for Q2 2023. The stock opened at $14.6 and closed at $15.0, a decrease of 4.3% from the previous closing price of 15.6. Despite the lower sales and higher operating costs, XPENG INC CEO He Xiaopeng remained optimistic about the company’s prospects going forward. He said that XPENG INC is still on track to become a leader in autonomous vehicle technology, and that they are confident that their newest products will enable them to reach their financial goals for the full year. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Xpeng Inc. More…

| Total Revenues | Net Income | Net Margin |

| 21.06k | -9.88k | -45.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Xpeng Inc. More…

| Operations | Investing | Financing |

| -8.23k | 4.85k | 6k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Xpeng Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 66.68k | 34.01k | 37.92 |

Key Ratios Snapshot

Some of the financial key ratios for Xpeng Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 115.9% | – | -46.0% |

| FCF Margin | ROE | ROA |

| -61.3% | -18.0% | -9.1% |

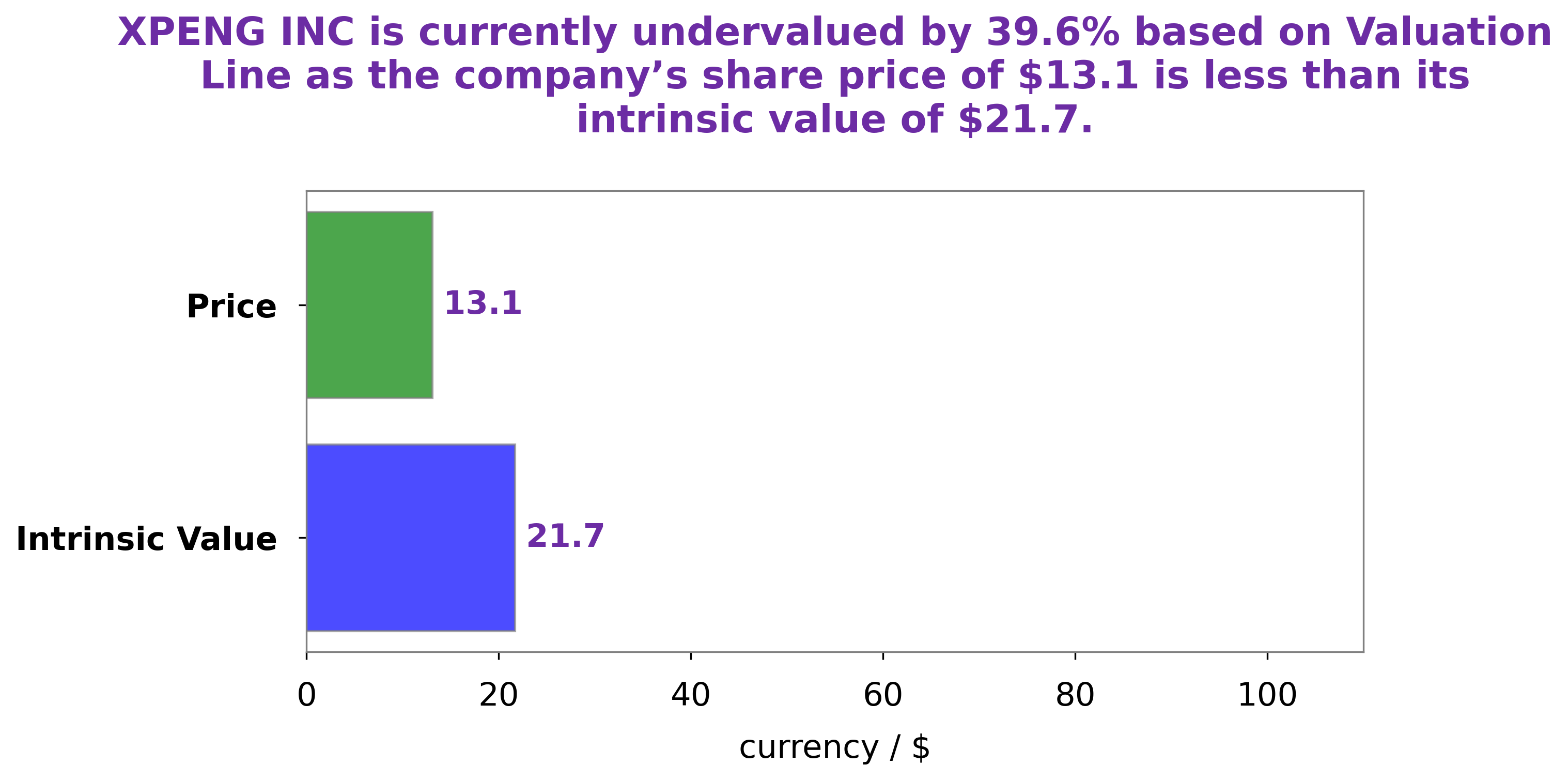

Analysis – Xpeng Inc Stock Intrinsic Value

At GoodWhale, we have conducted an analysis of XPENG INC‘s financials and have come to the conclusion that the fair value of XPENG INC shares is around $31.8. This was determined through our proprietary Valuation Line. Currently, XPENG INC stock is trading at $15.0, undervaluing the share price by 52.8%. This presents a great opportunity for investors to purchase shares in the company at a discounted rate. More…

Summary

Investors in XPENG INC were disappointed with the company’s second quarter results for the period ending June 30 2023, as total revenue dropped 31.9% year-on-year to CNY 5062.7 million and net income plummeted to a loss of CNY -2804.6 million, compared to the prior year’s -2700.9 million. The news caused the stock price to decrease on the same day, August 18 2023. Going forward, investors should thoroughly evaluate the company’s financials and operations before making any decisions on investing in XPENG INC. Analysts recommend taking a long-term view and assessing the company’s strategy and potential for growth.

Recent Posts