XPENG INC Reports Second Quarter FY2023 Earnings Results on June 30, 2023

August 27, 2023

🌥️Earnings Overview

XPENG INC ($NYSE:XPEV) revealed its earnings for the second quarter of FY2023 on June 30 2023, with total revenue of CNY 5062.7 million, a decrease of 31.9% from the previous year. Net income for the quarter was CNY -2804.6 million, an increase from the prior year’s loss of -2700.9 million.

Market Price

The company’s stock opened at $14.6 and closed at $15.0, a 4.3% decrease from the prior closing price of $15.6. The company’s stock performance on the day reflected investor sentiment towards the results, with shares trading lower than the prior closing price. Despite this, XPENG INC remains a strong player in the electric vehicle and autonomous driving sector and is well-positioned to continue its growth trajectory in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Xpeng Inc. More…

| Total Revenues | Net Income | Net Margin |

| 21.06k | -9.88k | -45.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Xpeng Inc. More…

| Operations | Investing | Financing |

| -8.23k | 4.85k | 6k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Xpeng Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 66.68k | 34.01k | 37.92 |

Key Ratios Snapshot

Some of the financial key ratios for Xpeng Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 115.9% | – | -46.0% |

| FCF Margin | ROE | ROA |

| -61.3% | -18.0% | -9.1% |

Analysis

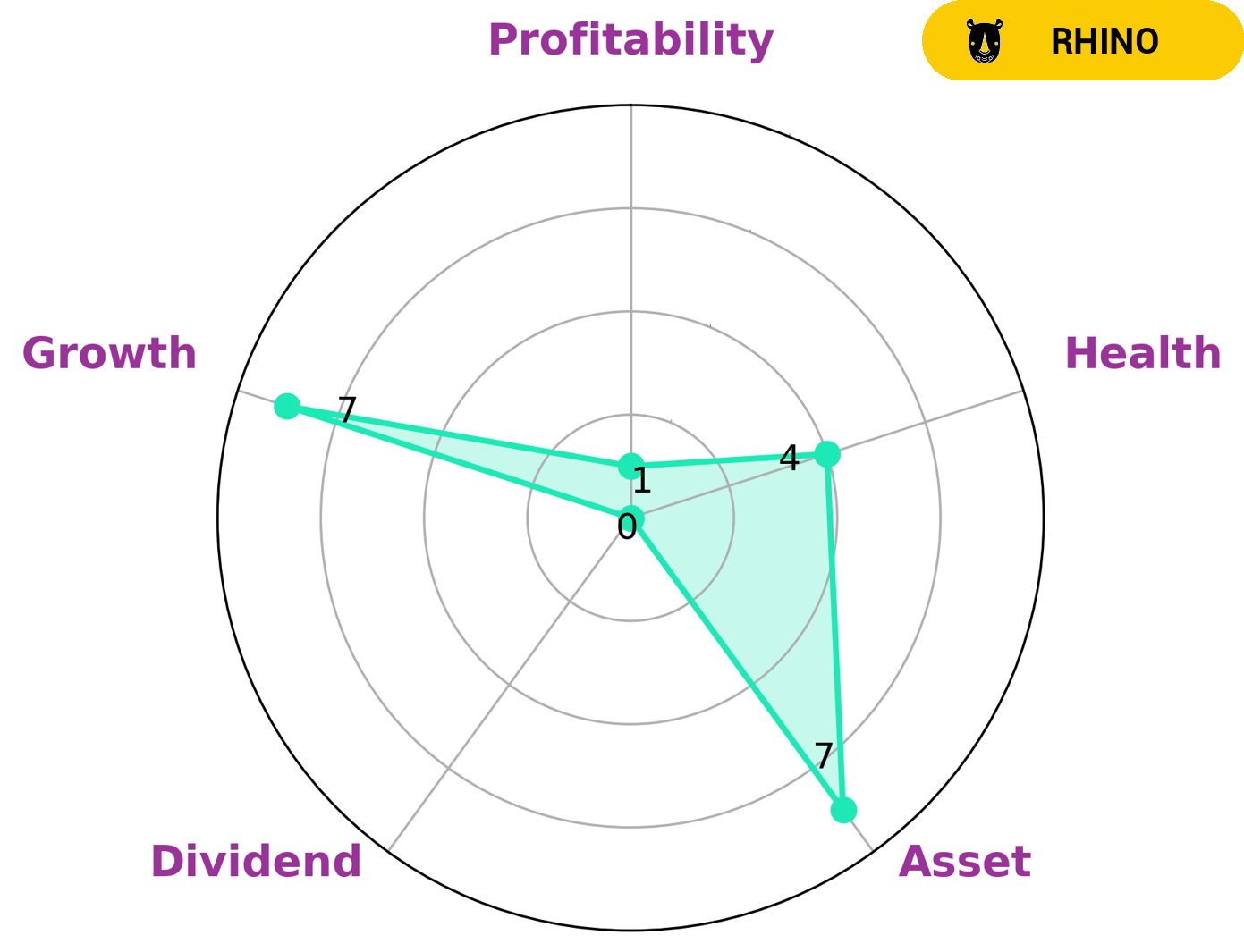

At GoodWhale, we have conducted an analysis of XPENG Inc‘s welfare. Our Star Chart has shown that XPENG Inc has an intermediate health score of 4 out of 10. Considering the cash flows and debt associated with the company, it is likely to be able to pay off its obligations and fund future operations. We have classified XPENG Inc as a ‘rhino’ – a type of company that has achieved moderate revenue or earnings growth. Investors interested in this type of company should be aware that XPENG Inc is strong in assets and growth, but weak in dividend and profitability. It is important to assess these metrics before making any investment decisions. More…

Summary

Investors were disappointed with XPENG INC‘s financial results for the second quarter of FY2023, as total revenue for the quarter decreased by 31.9%, while net income for Q2 was CNY -2804.6 million compared to a loss of -2700.9 million in the prior year. This led to a decline in XPENG INC’s stock price on June 30, 2023. While there are still risks associated with investing in the company, investors should look to see how XPENG INC will be able to improve their financial performance going forward to get a better understanding of the company’s potential.

Recent Posts