PAHA Stock Fair Value – PORSCHE AUTOMOBIL HOLDING SE Reports Positive Earnings Results for Q1 of FY2023.

May 24, 2023

Earnings Overview

PORSCHE AUTOMOBIL HOLDING SE ($BER:PAHA) announced their financial results for the first quarter of FY2023, which concluded on March 31, 2023. Total revenue decreased from the same period in the previous year, amounting to EUR 0.0 billion. Net income for the quarter was EUR 1.3 billion, representing a decrease of 40.8% in comparison to last year’s first-quarter results.

Share Price

On Monday, PORSCHE AUTOMOBIL HOLDING SE reported positive earnings results for the first quarter of their fiscal year 2023. The stock opened at €5.2 and closed unchanged at the same price. This positive earnings report was driven by strong global sales of Porsche’s vehicles in Europe, Asia, and the Americas.

This was largely due to higher sales of Porsche’s luxury and sports vehicles, and a surge in demand for its electric cars. The company’s stock has remained stable since the announcement, indicating that investors remain confident in its prospects in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PAHA. More…

| Total Revenues | Net Income | Net Margin |

| 177 | 3.92k | 2219.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PAHA. More…

| Operations | Investing | Financing |

| 770 | -7.32k | 6.16k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PAHA. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 60.37k | 7.25k | 16.79 |

Key Ratios Snapshot

Some of the financial key ratios for PAHA are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 14.8% | – | 2268.4% |

| FCF Margin | ROE | ROA |

| 435.0% | 4.8% | 4.2% |

Analysis – PAHA Stock Fair Value

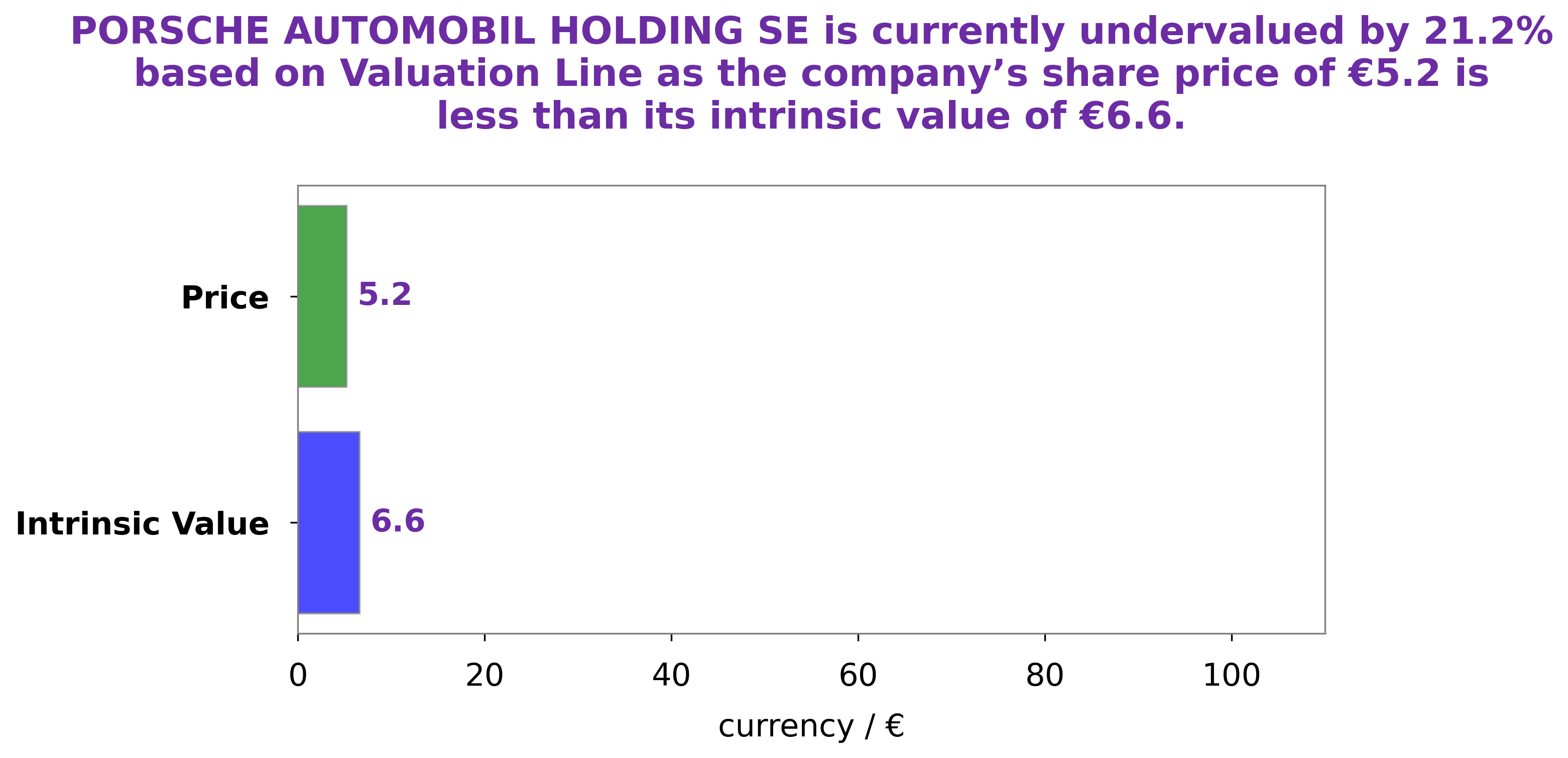

At GoodWhale, we have undertaken a financial analysis of PORSCHE AUTOMOBIL HOLDING SE, and utilized our proprietary Valuation Line to calculate the intrinsic value of its shares. Our analysis suggests that the intrinsic value of PORSCHE AUTOMOBIL HOLDING SE share is around €6.6. This is in comparison to the current share price of €5.2, suggesting that the share is currently undervalued by 21.3%. As such, investors may be able to capitalize on this undervaluation and benefit from the potential upside in PORSCHE AUTOMOBIL HOLDING SE stock price. More…

Summary

PORSCHE AUTOMOBIL HOLDING SE’s first quarter of FY2023 has reported total revenue of EUR 0.0 billion, representing a decrease from the same period the previous year. Net income for the quarter was EUR 1.3 billion, decreasing from the same period last year by 40.8%. This indicates a challenging investment climate for the company and may have a negative effect on the stock price. Investors should consider analyzing the strength of the company’s competitive position and long-term financial health before making any decisions regarding the stock.

Recent Posts