LI Auto: Vast Potential, But Risky Investment

June 12, 2023

🌧️Trending News

LI Auto (NASDAQ: LI) is a rapidly growing Chinese electric vehicle maker that has seen its stock price rise substantially in the last few years. This rapid growth has been fueled by the immense potential of the company’s electric vehicle technology, as well as its ability to rapidly expand its production capabilities.

However, investors should be aware that the risks associated with investing in Li Auto ($NASDAQ:LI) are very real and could potentially result in substantial losses. On the upside, Li Auto has the potential to revolutionize the electric vehicle industry with its innovative technology and unparalleled production scale. The company has already made substantial investments in developing their technology, and has a wide range of products in the pipeline.

Additionally, the company’s production capabilities are set to increase significantly over the next few years, with plans to expand into new markets. However, investors should be aware of the risks associated with investing in Li Auto. These include a volatile stock price and potential problems with the company’s production capabilities. Additionally, the Chinese government’s regulations on electric vehicles could have an unpredictable effect on the company’s operations, as well as its stock price. In conclusion, Li Auto holds great potential for investors, yet these potential rewards should be weighed against the associated risks. Those who are comfortable with these risks can reap the rewards of investing in Li Auto, while those who are more cautious may want to wait and see how the company performs before investing.

Share Price

LI AUTO has vast potential but investors should be weary of the associated risks. On Wednesday, the stock opened at $32.4 and closed at $31.8, down by 0.6% from its previous closing price of 32.0. This slight dip suggests that the market is concerned about the risks associated with investing in LI Auto.

The company is still relatively young and untested, and with a new product on the market, its success is uncertain. Investors should weigh both the positives and negatives carefully before deciding whether to invest in LI Auto. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Li Auto. More…

| Total Revenues | Net Income | Net Margin |

| 54.51k | -1.07k | -2.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Li Auto. More…

| Operations | Investing | Financing |

| 13.33k | -8.62k | 4.54k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Li Auto. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 94.01k | 47.38k | 47.25 |

Key Ratios Snapshot

Some of the financial key ratios for Li Auto are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 263.4% | – | -2.0% |

| FCF Margin | ROE | ROA |

| 15.5% | -1.5% | -0.7% |

Analysis

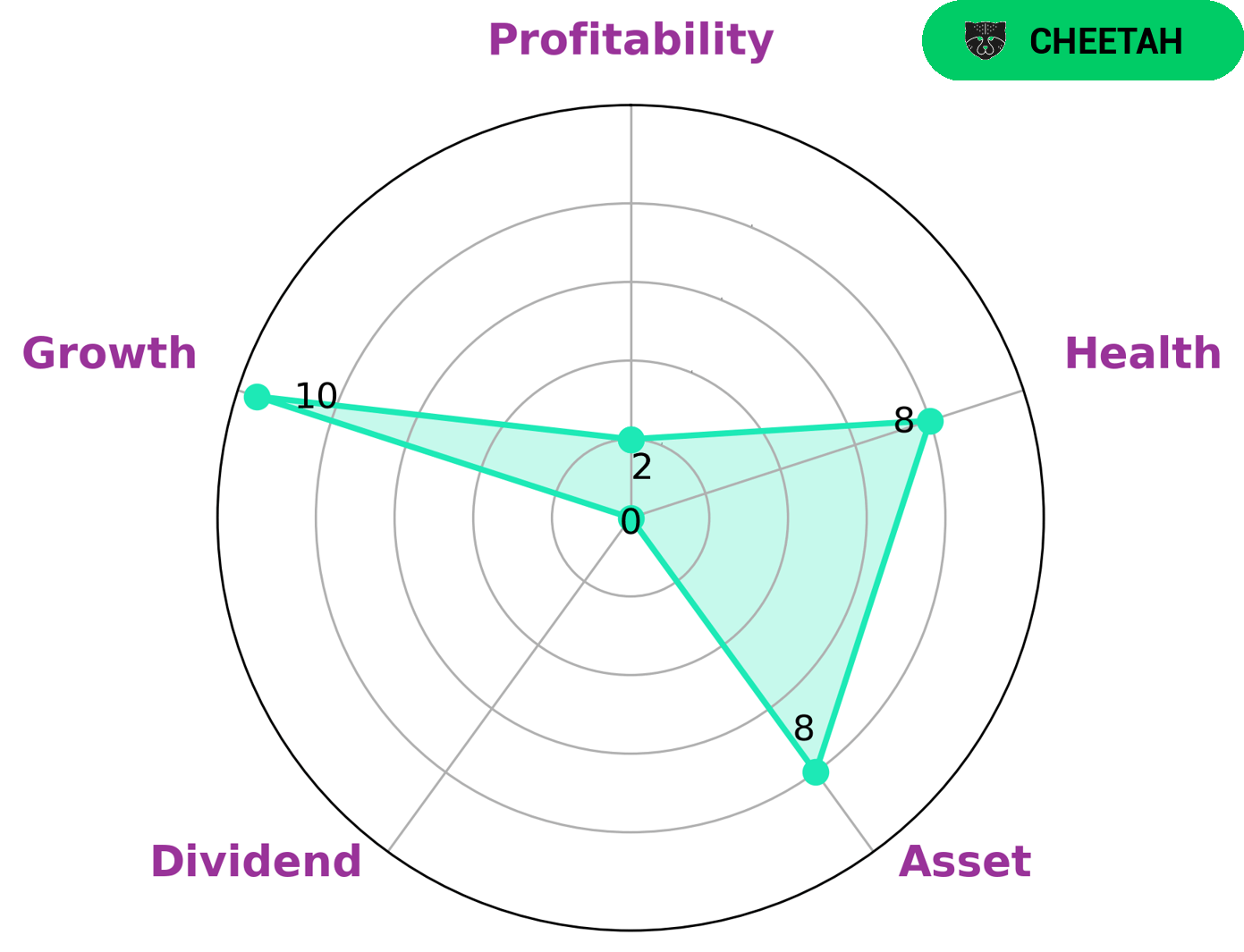

GoodWhale analysts have assessed LI AUTO’s fundamentals and classified it as a ‘cheetah’ on the Star Chart, meaning that the company has achieved high revenue or earnings growth but is considered to be less stable due to lower profitability. We believe that this type of company may be of interest to certain types of investors, such as those who are looking for higher returns over the short-term. In terms of overall financial health, LI AUTO scores highly with a rating of 8/10. This is because our analysis showed that the company has strong cashflows and is capable of paying off debt and funding future operations. In addition, LI AUTO also scores well in terms of assets and growth, but is relatively weaker in terms of dividend and profitability. More…

Summary

Investing in Li Auto presents a tremendous upside potential due to its innovative business model, leading market share, and strong product offerings. On the other hand, there are significant risks associated with investing in the company; competition in the industry is fierce, and there is a risk of technological changes disrupting the company’s strategy. Investors must carefully weigh the potential benefits and pitfalls of investing in Li Auto before making a decision.

Recent Posts