General Motors Stock Fair Value – General Motors Investing $1B in Next-Generation Internal Combustion Engines

June 7, 2023

🌥️Trending News

General Motors ($NYSE:GM) (GM) is a multinational company known for its production of cars, trucks, crossovers, and automobile parts. Now, GM has announced a $1 billion investment in developing the next generation of internal combustion engine vehicles. This investment will go towards creating more efficient and powerful engines that use the latest technologies. It will also help GM stay competitive in the ever-changing auto industry. GM aims to reduce emissions and increase fuel economy for its customers, while also creating jobs for their workforce. GM believes that this investment will help them remain a leader in the industry for years to come. The investment will also benefit GM’s suppliers, as they will be able to use new and more advanced technologies. This could help them create better parts and components for GM’s vehicles, which would help reduce costs and create a better product for customers.

Additionally, the investment could open up new opportunities for research and development, leading to even more advances in the internal combustion engine. GM’s $1 billion investment in internal combustion engine technology is a sure sign that the company is dedicated to staying ahead in the ever-changing auto industry. With this investment, GM is taking a step towards becoming an even larger leader in the market.

Price History

On Monday, General Motors (GM) announced that it is investing $1 billion into the development of next-generation internal combustion engines. GM stock opened at $34.4 and closed at $34.1, down by 0.4% from its previous closing price of 34.3. This investment is a step towards GM’s goal of creating eco-friendly vehicles that still offer the performance of a traditional internal combustion engine. The company is confident that its new engines will increase fuel efficiency while reducing emissions. GM is aiming to develop the engines with advanced technologies such as the ability to switch from traditional gasoline to alternative fuels, variable valve timing and direct fuel injection.

Additionally, GM plans to incorporate advanced materials, such as aluminum and composite plastic, to reduce weight and increase efficiency. GM’s plans to invest in the development of next-generation internal combustion engines signals the company’s commitment to sustainability and technological innovation in the automobile industry. The company aims to be a leader in the transition from traditional internal combustion engines to more eco-friendly alternatives. The success of this investment will ultimately determine GM’s success in achieving its goals for developing more efficient and sustainable vehicles. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for General Motors. More…

| Total Revenues | Net Income | Net Margin |

| 160.74k | 9.3k | 6.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for General Motors. More…

| Operations | Investing | Financing |

| 17.02k | -16.23k | 550 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for General Motors. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 267k | 192.77k | 48.61 |

Key Ratios Snapshot

Some of the financial key ratios for General Motors are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.0% | 29.8% | 7.8% |

| FCF Margin | ROE | ROA |

| -3.2% | 11.4% | 2.9% |

Analysis – General Motors Stock Fair Value

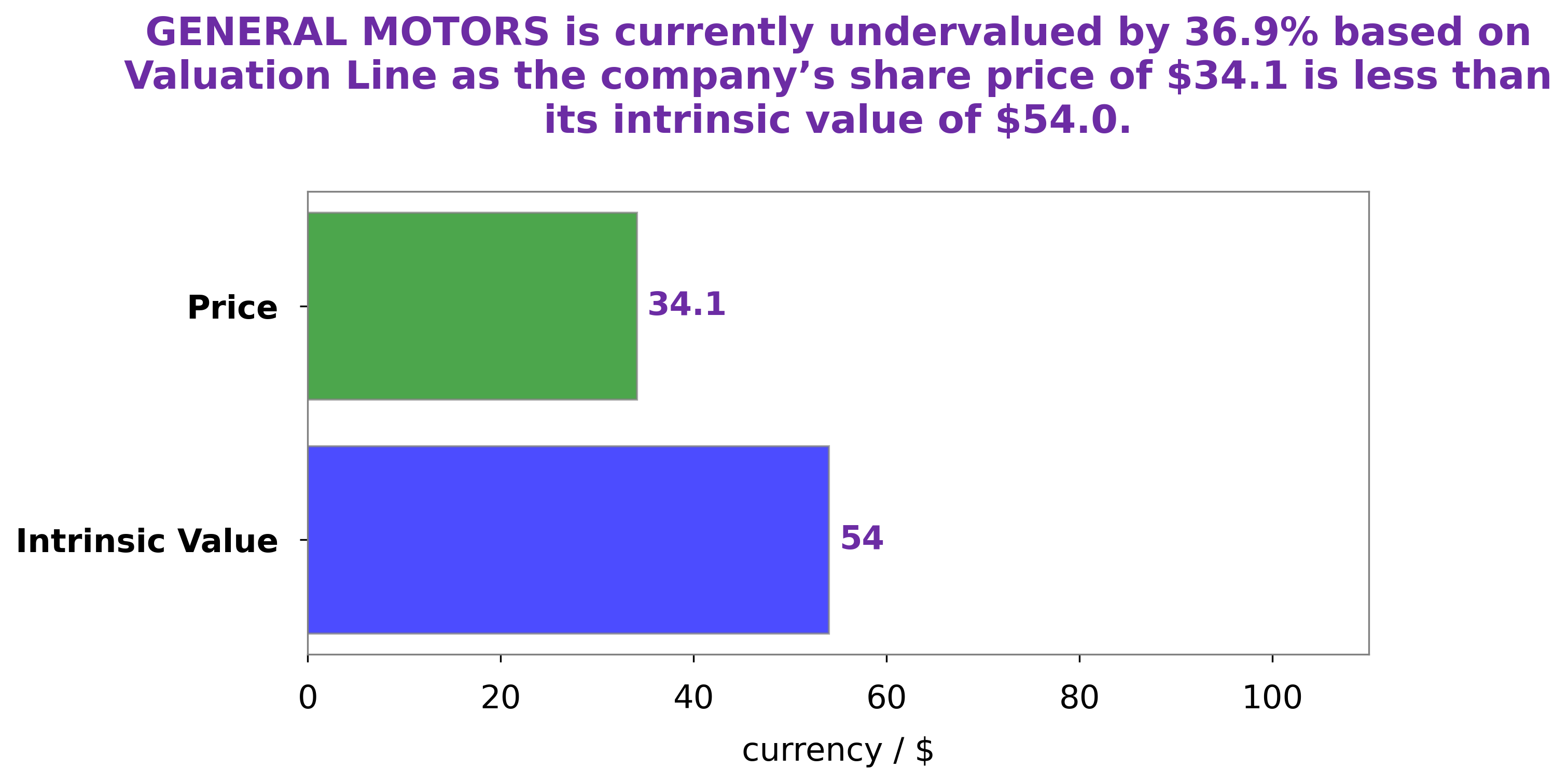

GoodWhale is proud to offer financial analysis of GENERAL MOTORS. Our proprietary Valuation Line technology evaluated the intrinsic value of the GENERAL MOTORS stock and found it to be around $54.0, suggesting that it is currently undervalued by 36.8%. At the current price of $34.1, investors can take advantage of this opportunity. With our powerful algorithms and analysis tools, you can trust GoodWhale to provide you with the insights you need to make informed decisions about your investments. More…

Peers

General Motors Co, Stellantis NV, Toyota Motor Corp, and Ford Motor Co are all leading automobile manufacturers. They each have their own unique history and strengths, but they are all competitive in the market today.

– Stellantis NV ($NYSE:STLA)

Stellantis NV is a holding company that was created in 2021 through the merger of Fiat Chrysler Automobiles and Groupe PSA. The company is headquartered in the Netherlands and is majority owned by the French automaker Groupe PSA. Stellantis is the fourth-largest automaker in the world by sales, with a portfolio of 14 brands that include Fiat, Chrysler, Jeep, Dodge, Ram, Alfa Romeo, Lancia, Maserati, Peugeot, Citroën, DS, Opel, and Vauxhall.

– Toyota Motor Corp ($TSE:7203)

Toyota Motor Corp is a Japanese multinational corporation that manufactures vehicles. It has a market cap of 27.43T as of 2022 and a Return on Equity of 11.32%. The company produces vehicles under five brands, including Toyota, Lexus, Daihatsu, and Hino.

– Ford Motor Co ($NYSE:F)

Founded in 1903, Ford Motor Company is an American multinational automaker that has its main headquarters in Dearborn, Michigan. The company sells automobiles and commercial vehicles under the Ford brand and most luxury cars under the Lincoln brand. Ford also owns Brazilian SUV manufacturer Troller, an 8% stake in Aston Martin of the United Kingdom, and a 49% stake in Jiangling Motors of China. It also has joint-ventures in China, Taiwan, Thailand, Turkey, and Russia. The company is listed on the New York Stock Exchange and is controlled by the Ford family; they have minority ownership but the majority of the voting power.

As of 2022, Ford Motor Company’s market capitalization is $47.32 billion, and it has a return on equity of 23.7%. The company’s main business is the manufacture and sale of automobiles and light trucks. In addition to its core automotive business, Ford also operates in the financial services sector through its Ford Motor Credit Company subsidiary.

Summary

General Motors has recently announced a $1 billion investment in the development and production of next-generation internal combustion engine (ICE) vehicles. This investment aims to make their ICE vehicles more efficient, lower emissions, and enhance performance. The investment could also help General Motors remain competitive in the changing automotive landscape, in which electric vehicles are becoming increasingly popular. GM is investing in research and development, production, and technology to advance their ICE vehicles, while also implementing more efficient production methods.

The company aims to provide customers with high-quality fuel-efficient vehicles that still offer the performance they expect. GM’s $1 billion commitment to next-gen ICE vehicles shows that they are dedicated to continuing to provide customers with reliable and efficient vehicles.

Recent Posts