Deutsche Bank Cuts Polestar Automotive Holding UK’s Price Target Citing Product Delay, Macro Backdrop

May 16, 2023

Trending News 🌧️

Polestar Automotive Holding ($NASDAQ:PSNY) UK, a subsidiary of Volvo Car Group, is a leading automotive manufacturer and innovator in the electric vehicle market. The company focuses on producing premium electric cars and mobility services for global markets. Recently, Deutsche Bank has lowered Polestar Automotive’s price target citing the current product delay and macroeconomic backdrop. This has resulted in certain delays in the production of certain Polestar models.

Additionally, the current macroeconomic environment has had a negative impact on the company’s stock price. The slowdown in economic activity and the associated uncertainty have caused investors to become more wary of the stock. This has cast some doubts on the company’s ability to meet its projections and deliver on its growth targets amid a challenging environment. There is also an expectation that the company will need to reassess its production plans in light of the current situation. The company will need to reassess their plans in order to ensure that they meet their growth targets and deliver on their promise to revolutionize the electric vehicle industry.

Stock Price

The price target is still above the current market price of $3.3, despite the 0.9% decline from the prior closing price of $3.4. Additionally, a weak macroeconomic backdrop, caused by economic slowdowns around the world, has also been a factor in Polestar’s stock price decline. Ultimately, despite Deutsche Bank’s lower price target and the decline in stock price on Monday, Polestar is still a leader in the electric vehicle market and has seen success in recent months with a number of new product offerings. However, with stock markets around the world continuing to be volatile, it remains to be seen how Polestar will fare in the long-term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PSNY. More…

| Total Revenues | Net Income | Net Margin |

| 2.46k | -465.79 | -32.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PSNY. More…

| Operations | Investing | Financing |

| -1.09k | -715.97 | 2.09k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PSNY. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.94k | 4.08k | 0.06 |

Key Ratios Snapshot

Some of the financial key ratios for PSNY are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 198.7% | – | -13.8% |

| FCF Margin | ROE | ROA |

| -73.2% | -12761.2% | -5.4% |

Analysis

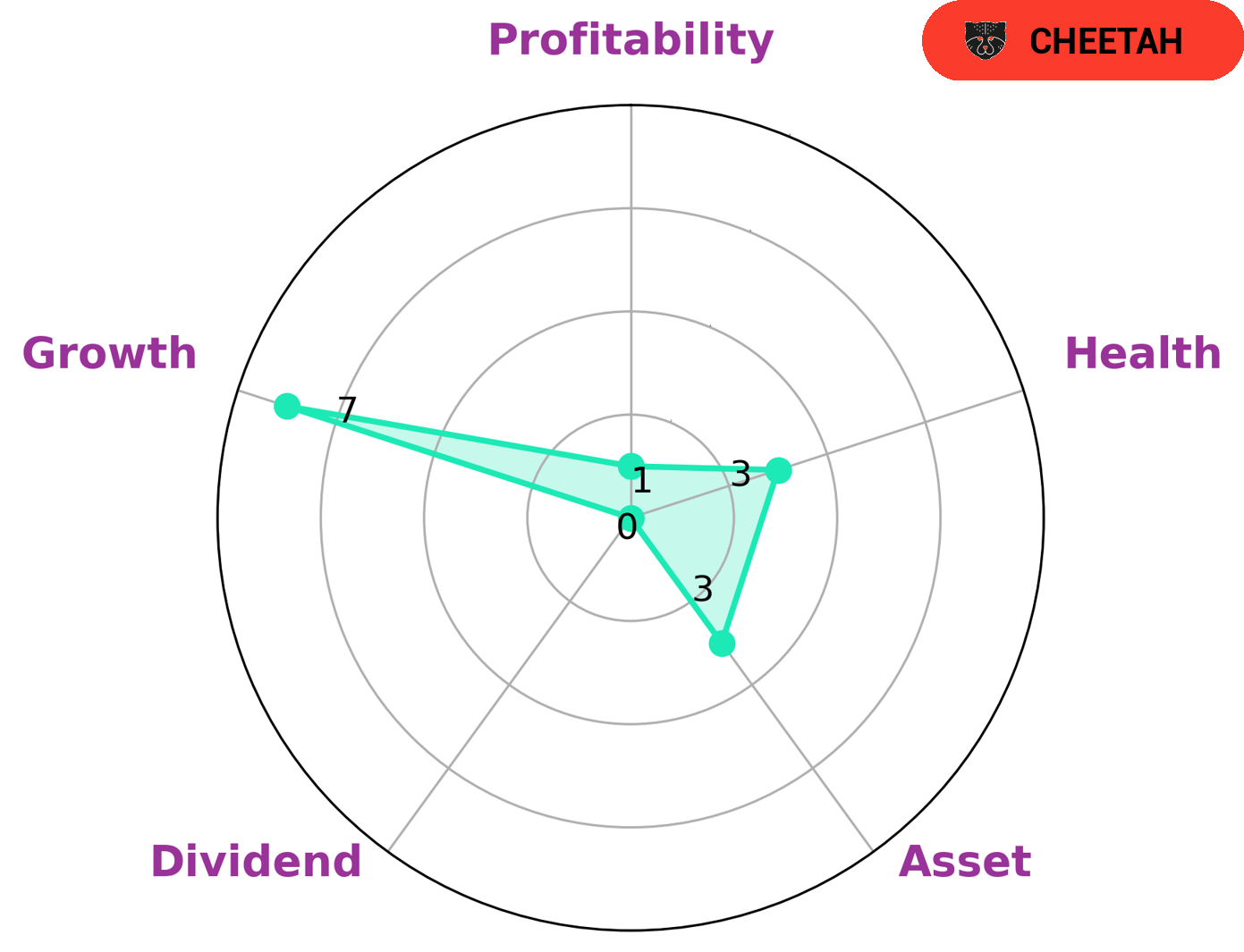

GoodWhale’s analysis of POLESTAR AUTOMOTIVE HOLDING UK has identified the company as a ‘cheetah’ on the Star Chart. This classification indicates that the company has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Our analysis further indicates that POLESTAR AUTOMOTIVE HOLDING UK is strong in growth, and weak in asset, dividend and profitability. The company’s low health score of 3 out of 10 based on its cashflows and debt means that it is less likely to safely ride out any crisis without the risk of bankruptcy. Given this assessment, potential investors interested in POLESTAR AUTOMOTIVE HOLDING UK should understand the risks associated with investing in a company that is considered less stable. Companies who are classified as ‘cheetahs’ are more likely to be volatile, and investors should be aware of this before investing. Those looking for more stable investment options may wish to consider other, more profitable companies. More…

Peers

The company has a strong presence in the UK market and is competing with Canoo Inc, RAC Electric Vehicles Inc, and Phoenix Motor Inc.

– Canoo Inc ($NASDAQ:GOEV)

Canoo Inc is a publicly traded company that designs and manufactures electric vehicles. The company has a market capitalization of 477.02 million as of 2022 and a return on equity of -169.72%. Canoo Inc is headquartered in Los Angeles, California and has manufacturing facilities in the United States, Canada, and Mexico. The company’s products include the Canoo LSEV, an electric vehicle that is designed for urban environments, and the Canoo MPD, an electric vehicle that is designed for off-road use.

– RAC Electric Vehicles Inc ($TPEX:2237)

RAC Electric Vehicles Inc is a leading manufacturer of electric vehicles. The company has a market cap of 3.65 billion as of 2022 and a return on equity of -10.56%. RAC electric vehicles are known for their quality, reliability, and performance. The company’s products are sold in over 50 countries around the world. RAC electric vehicles are used in a variety of applications including personal transportation, commercial fleet vehicles, and law enforcement.

– Phoenix Motor Inc ($NASDAQ:PEV)

Phoenix Motor Inc. is engaged in the business of designing, developing, manufacturing and selling light electric vehicles. The Company’s products include electric bicycles, electric scooters, electric motorcycles and electric tricycles. It also provides electric vehicle batteries, controllers, motors and related parts and components. The Company’s products are sold to original equipment manufacturers, distributors and retailers in China and internationally.

Summary

Deutsche Bank has lowered its price target for Polestar Automotive Holding UK, after delays to the company’s new product and a macroeconomic backdrop that has made automotive investments more challenging. The investment bank believes that Polestar has a solid business model, strong brand positioning, and a good track record of execution, which should benefit them long term. Despite the delay to their new product, the company is still expected to deliver positive returns in the near future if the macroeconomic environment remains stable. Investors should keep this in mind when making decisions about Polestar.

Recent Posts