AYRO Awarded U.S. Patent No. 10,670,527 by USPTO

January 30, 2023

Trending News ☀️

AYRO ($NASDAQ:AYRO), a revolutionary electric vehicle company, has been awarded U.S. Patent No. 10,670,527 by the United States Patent and Trademark Office (USPTO). This patent is for a unique and state-of-the-art modular platform that allows for the integration of advanced technologies such as electric drivetrains, advanced digital systems, and autonomous driving capabilities. The award of this patent further solidifies AYRO’s position as an innovator in the electric vehicle industry. AYRO is on a mission to create a world of clean air mobility, and this patent is another step towards this goal. The modular platform allows AYRO to develop integrated systems that can be used in a variety of vehicles, from light commercial vehicles to heavy-duty vehicles. It also enables AYRO to develop advanced digital systems that can be used to optimize the performance of their vehicles, in addition to making them safer and more efficient.

The award of this patent is a major milestone for AYRO, as it gives them a strong foundation on which to build their vehicle technology. With this platform, AYRO will be able to create innovative and efficient electric vehicles that will help to reduce emissions and improve air quality. This technology also provides a platform for the development of autonomous driving capabilities, allowing AYRO to develop vehicles with advanced safety features and capabilities. Overall, the award of USPTO’s U.S. Patent No. 10,670,527 to AYRO is an important step forward in their mission to create a world of clean air mobility. This patent gives AYRO the ability to develop revolutionary electric vehicles that are not only more efficient and safer but also create less emissions, helping to improve air quality and reduce climate change.

Share Price

On Tuesday, AYRO received a major accomplishment when the United States Patent and Trademark Office (USPTO) awarded them U.S. Patent No. 10,670,527. This patent is a significant milestone for the company and is expected to further bolster its competitive edge in the automotive and mobility industries. Despite this major accomplishment, AYRO’s stock opened and closed at $0.7 on Tuesday, down by 0.3% from the previous closing price of 0.7. While this may seem like a small decrease, it is still a sign that investors are not yet convinced of the long-term benefit of the patent to the company. The patent covers an improved cooling system for electric vehicles, which is designed to reduce the use of energy and increase the lifespan of battery components. This improved design is expected to help AYRO’s vehicles achieve more efficient performance while reducing their environmental impact.

Additionally, the patents cover a range of other improvements to the electric powertrain, such as increased reliability and improved safety. AYRO’s new patent is a testament to the company’s commitment to innovation and cutting-edge technology. With this new patent, they are positioned to become a leader in the automotive and mobility industries. The company plans to use the patent to further develop its products and services, which could lead to further growth in the future. Despite the slight decrease in stock price, investors should keep an eye on AYRO as they continue to innovate and develop new technologies that will shape the future of automotive and mobility. ayro“>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ayro. ayro“>More…

| Total Revenues | Net Income | Net Margin |

| 3.19 | -24.01 | -752.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ayro. ayro“>More…

| Operations | Investing | Financing |

| -20.87 | -16.8 | -0 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ayro. ayro“>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 62.13 | 3.68 | 1.57 |

Key Ratios Snapshot

Some of the financial key ratios for Ayro are shown below. ayro“>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -751.7% |

| FCF Margin | ROE | ROA |

| -685.9% | -24.6% | -24.2% |

VI Analysis

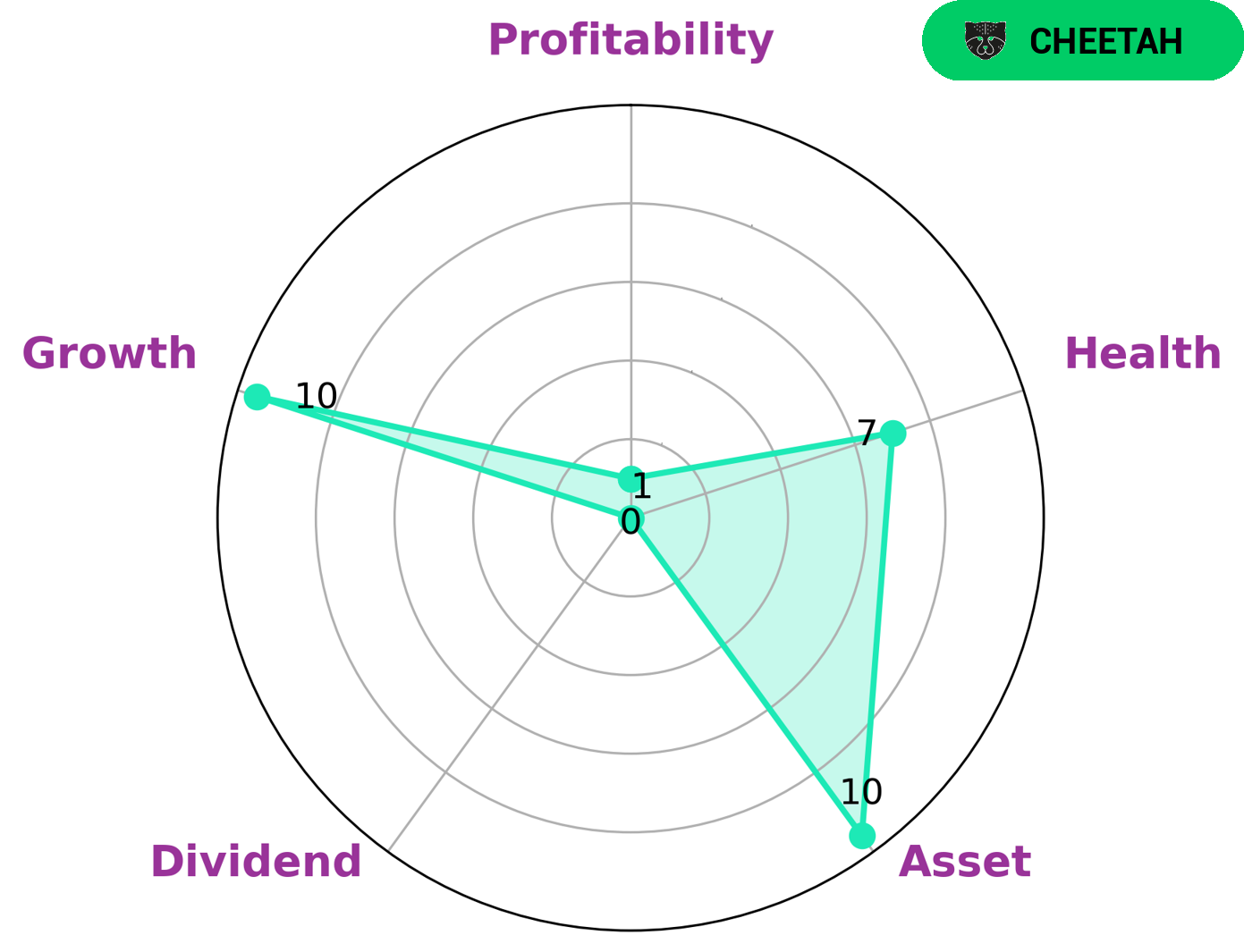

Investors interested in AYRO may be drawn to its strong fundamentals. The VI app provides a simple look into the company’s long-term potential, with a high health score of 7/10 based on cash flows and debt. This indicates AYRO is able to pay off its debts and fund future operations. In terms of financial strength, AYRO has a strong asset base, but its dividend and profitability ratings are lower. This classifies AYRO as a ‘cheetah’ – a type of company that achieves high revenue or earnings growth but is considered to be less stable due to its lower profitability. Given the company’s fundamentals, investors seeking higher growth rates with a higher risk profile may be attracted to AYRO. The company’s ability to pay off debt and fund future operations indicates it is well-positioned to capitalize on opportunities as they arise. Furthermore, investors who are comfortable with the associated risks may be encouraged by the potential for higher returns. In conclusion, AYRO’s strong fundamentals make it an attractive option for investors seeking higher growth with a higher risk profile. Its ability to pay off debt and fund future operations indicates it is well-positioned to capitalize on opportunities as they arise. Additionally, its ‘cheetah’ classification makes it an attractive option for investors who are comfortable with the associated risks and are seeking higher returns. ayro“>More…

VI Peers

The electric vehicle industry is becoming increasingly competitive as more and more companies enter the market. AYRO Inc, QuantumScape Corp, Lordstown Motors Corp, and XPeng Inc are all competing for a share of the market. Each company has its own unique technology and approach to electric vehicles, and it will be interesting to see how the competition plays out.

– QuantumScape Corp ($NYSE:QS)

QuantumScape is a company that specializes in the development of battery technology for electric vehicles. The company’s market cap as of 2022 is 3.54 billion, and its ROE is -16.07%. QuantumScape is a relatively young company, and it is still in the process of commercializing its battery technology. The company has faced some challenges in recent years, but it remains one of the leading developers of battery technology for electric vehicles.

– Lordstown Motors Corp ($NASDAQ:RIDE)

Founded in 1954, Lordstown Motors Corp is an American electric vehicle manufacturer. The company’s first product is the Endurance, an all-electric pickup truck. Lordstown Motors is headquartered in Ohio and has a manufacturing facility in Michigan.

As of 2022, Lordstown Motors Corp has a market cap of 397.88M and a Return on Equity of -39.42%. The company manufactures electric vehicles and its first product is the Endurance, an all-electric pickup truck.

– XPeng Inc ($SEHK:09868)

Peng Inc is a leading provider of online travel services. The company offers a wide range of travel-related products and services, including air tickets, hotel reservations, car rentals, and vacation packages. Peng Inc has a market cap of 44.6B as of 2022, a Return on Equity of -11.13%. The company has been growing rapidly, but has faced some challenges in recent years.

Summary

AYRO is a company in the emerging electric vehicle (EV) market that has been awarded a patent by the USPTO. The patent, number 10,670,527, covers the company’s innovative technology that is used in the design and production of its EVs. This patent provides AYRO with a competitive edge in the market, making it an attractive option for investors. AYRO’s technology enables it to produce EVs with higher efficiency and performance than the competition, allowing for lower operating costs and greater customer satisfaction.

Moreover, AYRO’s EV platform will enable the company to diversify its product offerings and expand into new markets. As such, investors should consider AYRO as a potential investment opportunity as it provides a unique competitive advantage and growth potential.

Recent Posts