Oxford Square Capital Corp. Shares Dip 0.2% in Trading.

March 1, 2023

Trending News ☀️

Oxford Square Capital ($NASDAQ:OXSQ) Corp. has experienced a slight decrease in its stock price. This 0.2% dip in trading was seen in the early afternoon trading session on the Nasdaq Stock Market. The company, based out of New York City, is a publicly-traded financial services and investments company specializing in providing services to middle market companies. Oxford Square Capital Corp. has seen a steady growth over the past year, with a few minor dips here and there. Despite the recent drop, the stock is still trading at a slightly higher price than it was at the same time last year.

The company’s financial performance has remained strong, despite the dip in stock prices. This suggests that there continues to be faith in Oxford Square Capital Corp.’s future. Overall, the 0.2% drop in stock prices is not expected to have any long-term impact on the performance of Oxford Square Capital Corp. As the company continues to grow and expand its services, investors are sure to take notice and potentially lead to an increase in stock prices over time.

Share Price

Shares of Oxford Square Capital Corp. (OXSQ) dipped slightly on Thursday, with the stock opening at $3.6 and closing at $3.5, down 0.2% from the previous day’s closing price. This was the first day of trading since the company reported its fourth-quarter and full-year financial performance on Wednesday. The stock has not shown any significant volatility since the release.

Overall, investors seem to be cautiously optimistic about the company’s performance and future prospects, as the stock remains fairly flat in the wake of the earnings report. For now, it appears that traders are content to wait and watch the stock’s performance before deciding to make any big moves. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for OXSQ. More…

| Total Revenues | Net Income | Net Margin |

| -58.66 | -62.75 | 107.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for OXSQ. More…

| Operations | Investing | Financing |

| 13.32 | 3.45 | -18.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for OXSQ. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 358.03 | 191.48 | 3.34 |

Key Ratios Snapshot

Some of the financial key ratios for OXSQ are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -51.8% | – | – |

| FCF Margin | ROE | ROA |

| -22.7% | -22.5% | -11.0% |

Analysis

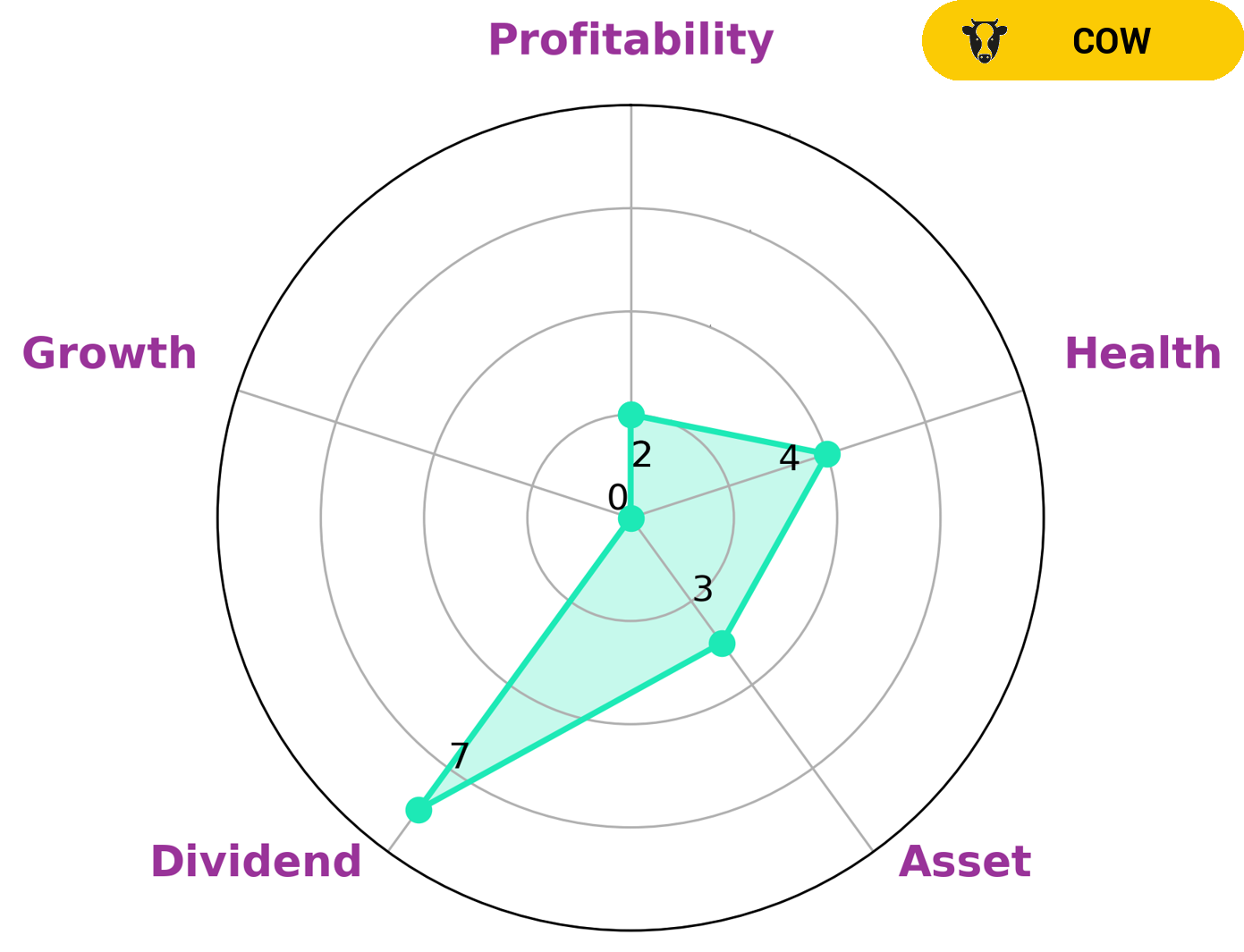

At GoodWhale, we recently conducted an analysis of Oxford Square Capital’s wellbeing. We applied the Star Chart system and determined that Oxford Square Capital is categorized as a ‘cow’. As a cow, Oxford Square Capital has the track record of regularly paying out stable and sustainable dividends. These types of companies tend to attract investors who are looking for steady and reliable income from their investments. Oxford Square Capital also has an intermediate health score of 4/10 with regards to its cashflows and debt. This suggests that the company is likely to be able to ride out any crisis without the risk of bankruptcy. In terms of asset, growth, profitability, and dividend, Oxford Square Capital was assessed to be relatively weak. Notably, the company’s dividend strength seems to be the largest contributor to its overall wellbeing rating. More…

Peers

Oxford Square Capital Corp, Princeton Capital Corp, Ares Capital Corp, and OFS Capital Corp are all private equity firms. They compete for the same deals and usually invest in the same types of companies.

– Princeton Capital Corp ($OTCPK:PIAC)

Princeton Capital Corp is a publicly traded company with a market capitalization of $42.17 million as of 2022. The company has a negative return on equity of -2.24%. Princeton Capital Corp is a financial services company that provides a range of services including investment banking, asset management, and merchant banking.

– Ares Capital Corp ($NASDAQ:ARCC)

Ares Capital Corporation is a closed-end, non-diversified management investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940. Ares Capital makes investments primarily in middle-market companies in the U.S. and Europe through senior secured loans, mezzanine debt, and equity investments.

– OFS Capital Corp ($NASDAQ:OFS)

PFS Capital Corp’s market cap as of 2022 is 139.96M. The company’s ROE is 2.34%. PFS Capital Corp is a financial services company that provides investment banking and capital markets services to small and medium-sized enterprises.

Summary

OXFORD SQUARE CAPITAL is a publicly traded company on the Nasdaq Global Select Market. This mid-cap investment firm specializes in providing financial and advisory services to companies of all sizes, with a focus on firms in the technology, medical, and consumer sectors. Recently, their shares dropped 0.2%, indicating a slight market downturn. To analyze this change, investors should consider the company’s recent performance and any other factors that could be influencing the stock price, such as the current macroeconomic environment.

Additionally, evaluation of the underlying fundamentals of the company and its competitors can provide insight into the underlying value of the stock. Ultimately, investors should make sure to research and understand what factors influence the stock price before investing in OXFORD SQUARE CAPITAL.

Recent Posts