Man Group CEO Predicts More Bank Failures by 2023 Amidst Continuing Banking Crisis

March 29, 2023

Trending News 🌧️

The CEO of Man Group ($LSE:EMG), one of the world’s largest asset management companies, has predicted that more major banks will collapse within two years as the ongoing banking crisis continues to wreak havoc on the financial industry. In a recent interview, Man Group’s CEO stated that he expects to see more major bank collapses by 2023 as the economic environment continues to remain uncertain and volatile. He believes that banks will continue to struggle with bad loans, low interest rates, and a lack of investor confidence due to the ongoing banking crisis. He also noted that banks are facing stiff competition from fintech companies which could potentially cause more problems and insolvencies. The CEO’s remarks come at a time when many banks have already failed or been merged due to their inability to survive in the current economic climate. This prediction also adds to the already growing concerns about the future of banking, as financial institutions are increasingly facing risks from a variety of sources.

Many experts are warning that these potential collapses could further destabilize economies, leading to further recessions and financial crises. The CEO’s words should serve as a warning for governments, regulators and investors alike. In order to prevent further bank failures, all stakeholders must take measures to strengthen financial institutions and ensure the stability of their operations. Governments must also take action to ensure that the banking system is well-regulated and that all financial products are strictly monitored.

Stock Price

The Man Group CEO predicted more bank failures by 2023 as the banking crisis continues to take its toll on the global financial system. The media exposure surrounding the news has been largely negative, with the stock market reflecting this sentiment. On Monday, shares of the Man Group opened at £2.4 and closed at £2.4, representing a 1.9% rise from the previous day’s closing price.

Though this was a positive sign, it was not enough to convince investors that a recovery was imminent. The impact of the banking crisis is expected to continue for some time and investors remain uncertain about the future of the markets. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Man Group. More…

| Total Revenues | Net Income | Net Margin |

| 1.73k | 608 | 34.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Man Group. More…

| Operations | Investing | Financing |

| 737 | -40 | -623 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Man Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.3k | 1.6k | 1.34 |

Key Ratios Snapshot

Some of the financial key ratios for Man Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.9% | 37.5% | 43.6% |

| FCF Margin | ROE | ROA |

| 40.0% | 28.9% | 14.3% |

Analysis

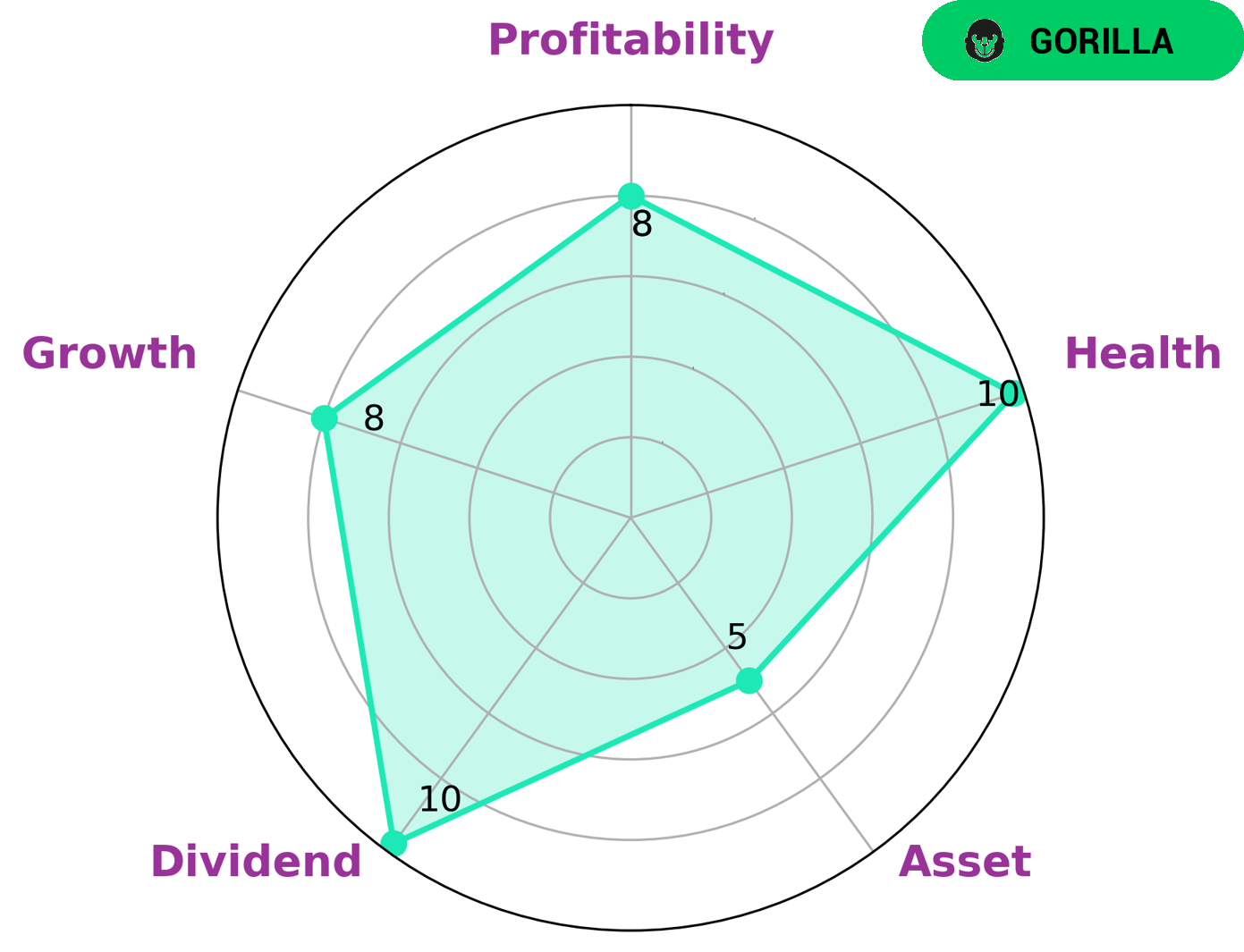

We at GoodWhale recently conducted an analysis of MAN GROUP‘s wellbeing. Our Star Chart showed that MAN GROUP is strong in dividend, growth, and profitability, and medium in asset. Furthermore, our health score for MAN GROUP is 10/10, indicating that the company has a healthy cashflow and debt ratio, and is capable of riding out any crisis without the risk of bankruptcy. Due to its strong competitive advantage, MAN GROUP is classified as a ‘gorilla’ type of company, meaning it achieved stable and high revenue or earning growth. This makes MAN GROUP an attractive option for investors looking for a stable and strong investment with high return potential. Investors seeking long-term capital appreciation and steady growth would be particularly interested in this company. Additionally, investors looking for dividend payments and security may also find MAN GROUP to be an ideal option. More…

Peers

The global asset management industry is highly competitive. There are a number of large firms that compete for market share, including Man Group PLC, The Carlyle Group Inc, Franklin Resources Inc, and Microequities Asset Management Group Ltd. Each company has a different strategy for winning market share, but all are focused on providing the best possible experience for their clients.

– The Carlyle Group Inc ($NASDAQ:CG)

The Carlyle Group is one of the world’s largest private equity firms with $212 billion of assets under management across 128 funds and 170 fund of funds vehicles. Carlyle’s purpose is to invest wisely and generate superior long-term returns for our investors while adhering to the highest standards of corporate governance and social responsibility. Carlyle has invested $81 billion in 1,796 companies worldwide since 1987. These companies have employed millions of people and generated billions of dollars of revenues annually.

– Franklin Resources Inc ($NYSE:BEN)

Franklin Resources Inc is a holding company that provides investment management and related services to clients in the United States and internationally. It has a market cap of 11.66B as of 2022 and a ROE of 9.9%. The company’s investment services include mutual funds, closed-end funds, institutional separate accounts, and managed accounts. Franklin Resources Inc was founded in 1947 and is headquartered in San Mateo, California.

– Microequities Asset Management Group Ltd ($ASX:MAM)

Microequities Asset Management Group Ltd is an Australian-based provider of specialist funds management and stockbroking services. The company has a market capitalisation of $93.46 million as of 2022 and a return on equity of 49.58%. Microequities specialises in small-cap and micro-cap stocks and offers a range of services including portfolio management, research, and broking.

Summary

The Man Group, a leading investment company, has predicted that there will be more bank failures in the next four years due to the continuing banking crisis. This has led to increased caution among investors in the industry, as they are concerned about their investments in the sector. To better understand the current situation and potential risks involved in investing in Man Group, investors must analyze the company’s financials, including its revenue, expenses, and cash flow. They must also analyze Man Group’s product portfolio, customer base, and competitive landscape.

Additionally, they should assess the company’s risk management strategies and its ability to withstand financial shocks. Overall, understanding the risks involved in investing in Man Group is key to successful portfolio management.

Recent Posts