Great West Life Assurance Co. Invests in Oxford Square Capital Corp.

February 17, 2023

Trending News ☀️

Great West Life Assurance Co. has recently announced that it has invested in the Oxford Square Capital ($NASDAQ:OXSQ) Corp., a financial services company. This acquisition gives Great West Life a new position in the company, allowing them to tap into a wealth of potential opportunities. It specializes in structuring and managing investments for clients across North America and Europe. The company’s services include portfolio management, investment strategy and research, and specialized trading strategies. This move will allow Great West Life to access a vast range of investment opportunities and to better serve its clients across the United States and around the world.

It will also enable the company to offer financial planning, asset management, and a variety of other products and services to its customers. This move marks a major milestone for Great West Life Assurance Co. and Oxford Square Capital Corp. Together, they will be able to combine their strengths and capabilities to provide a comprehensive range of services to their current and future customers. The acquisition will undoubtedly lead to new opportunities for both companies and will likely help them continue their growth and success in the future.

Market Price

Media coverage of the story has been overwhelmingly positive, and the stock market responded in kind. At opening, OXFORD SQUARE CAPITAL was priced at $3.5 per share, closing at $3.6 during the day’s trading. This is an increase of 1.1% from the previous closing price of 3.6. This is seen as a sign of confidence in the company, and investors are optimistic about the future prospects for OXFORD SQUARE CAPITAL. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for OXSQ. More…

| Total Revenues | Net Income | Net Margin |

| -58.66 | -62.75 | 107.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for OXSQ. More…

| Operations | Investing | Financing |

| 13.32 | 3.45 | -18.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for OXSQ. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 358.03 | 191.48 | 3.34 |

Key Ratios Snapshot

Some of the financial key ratios for OXSQ are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -51.8% | – | – |

| FCF Margin | ROE | ROA |

| -22.7% | -22.5% | -11.0% |

Analysis

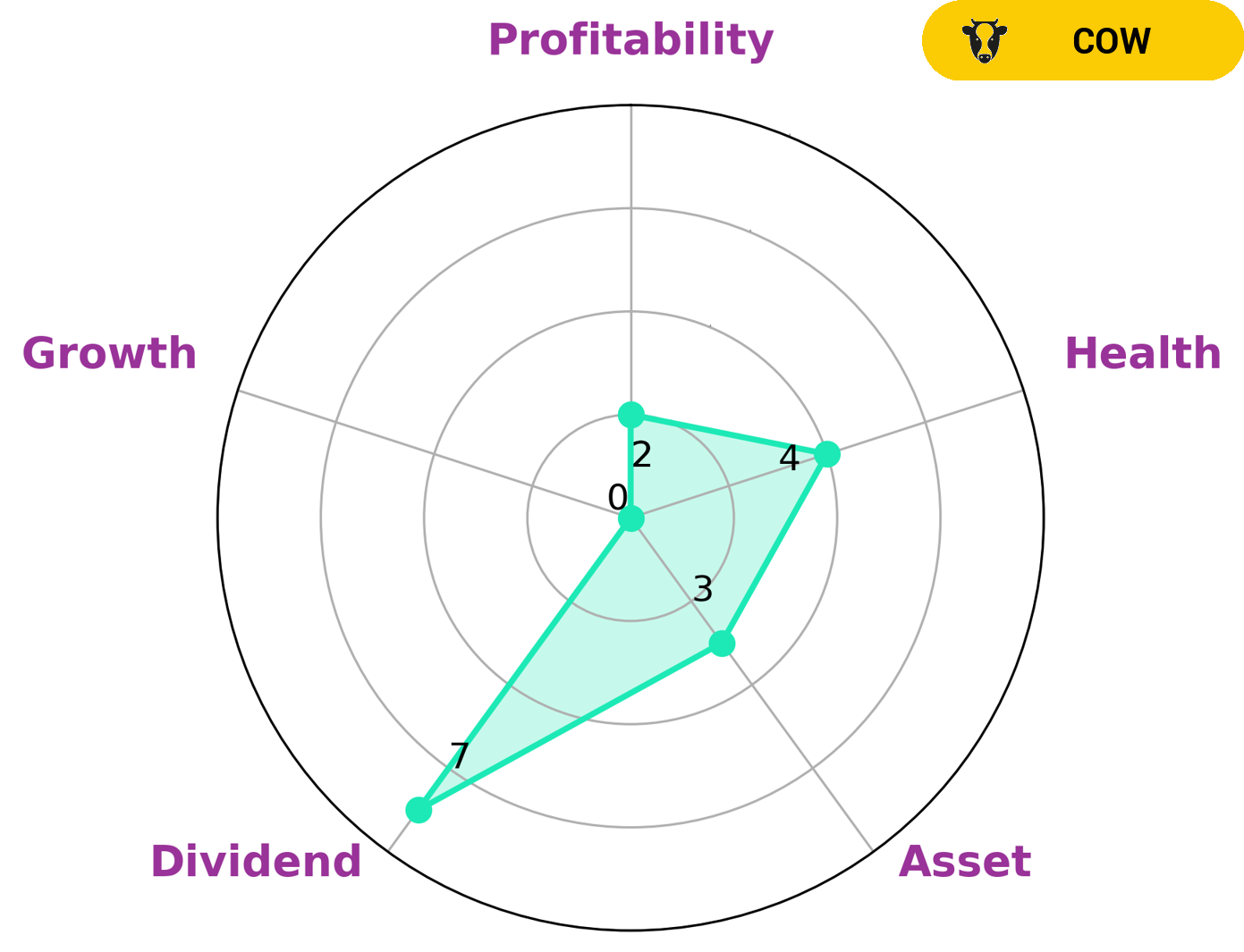

GoodWhale conducted an analysis of OXFORD SQUARE CAPITAL’s financials and found that OXFORD SQUARE CAPITAL is strong in dividend and weak in asset, growth, and profitability. Based on our Star Chart system, OXFORD SQUARE CAPITAL has an intermediate health score of 4/10, indicating it is likely to safely ride out any crisis without the risk of bankruptcy. OXFORD SQUARE CAPITAL is classified as a ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. We believe that investors looking for long-term, safe returns would be interested in this type of company, most likely conservative investors and those looking for high dividend yields. This company could also interest income-seeking investors as well as those looking for a steady and reliable return on their investment. More…

Peers

Oxford Square Capital Corp, Princeton Capital Corp, Ares Capital Corp, and OFS Capital Corp are all private equity firms. They compete for the same deals and usually invest in the same types of companies.

– Princeton Capital Corp ($OTCPK:PIAC)

Princeton Capital Corp is a publicly traded company with a market capitalization of $42.17 million as of 2022. The company has a negative return on equity of -2.24%. Princeton Capital Corp is a financial services company that provides a range of services including investment banking, asset management, and merchant banking.

– Ares Capital Corp ($NASDAQ:ARCC)

Ares Capital Corporation is a closed-end, non-diversified management investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940. Ares Capital makes investments primarily in middle-market companies in the U.S. and Europe through senior secured loans, mezzanine debt, and equity investments.

– OFS Capital Corp ($NASDAQ:OFS)

PFS Capital Corp’s market cap as of 2022 is 139.96M. The company’s ROE is 2.34%. PFS Capital Corp is a financial services company that provides investment banking and capital markets services to small and medium-sized enterprises.

Summary

Oxford Square Capital Corp. has been an attractive investment option for Great West Life Assurance Co. The majority of media coverage regarding the company’s performance have been positive, underlining the potential for immense returns. Analysts have pointed to their strong balance sheet, their diverse income sources, and their investment in conservative assets as strong indicators of continued success. Their portfolio also includes a variety of options, including stocks, bonds, real estate, and other investments.

With a focus on capital preservation and growth, they strive to generate consistent returns while mitigating risk. As such, Oxford Square Capital Corp. looks to be a great choice for investors who are looking for a secure return in the long-term.

Recent Posts