Golub Capital BDC: Exploring Why This 10% Yield Is Ideal for Income Investors

June 12, 2023

☀️Trending News

Golub ($NASDAQ:GBDC) Capital BDC is an ideal choice for income investors due to its generous 10% yield. It provides financing solutions to middle-market companies in the form of senior secured loans, subordinated debt, and equity investments. Golub also provides investors with access to a wide variety of debt and equity investments that offer competitive yields with moderate risk. With its large portfolio of investments, Golub’s ability to generate consistent income makes it a reliable choice for income investors. The company has a strong track record of providing investors with attractive returns.

Moreover, Golub has maintained its excellent credit rating of BBB+ from Standard & Poor’s, which indicates its financial strength and stability. Investing in Golub Capital BDC provides investors with the opportunity to participate in the growth of middle-market companies while also enjoying the benefits of a 10% yield. This makes it an attractive option for income investors who are looking for a solid and reliable source of income. Furthermore, the company’s conservative approach to investing ensures that its portfolio is well diversified and protected from market risks.

Analysis

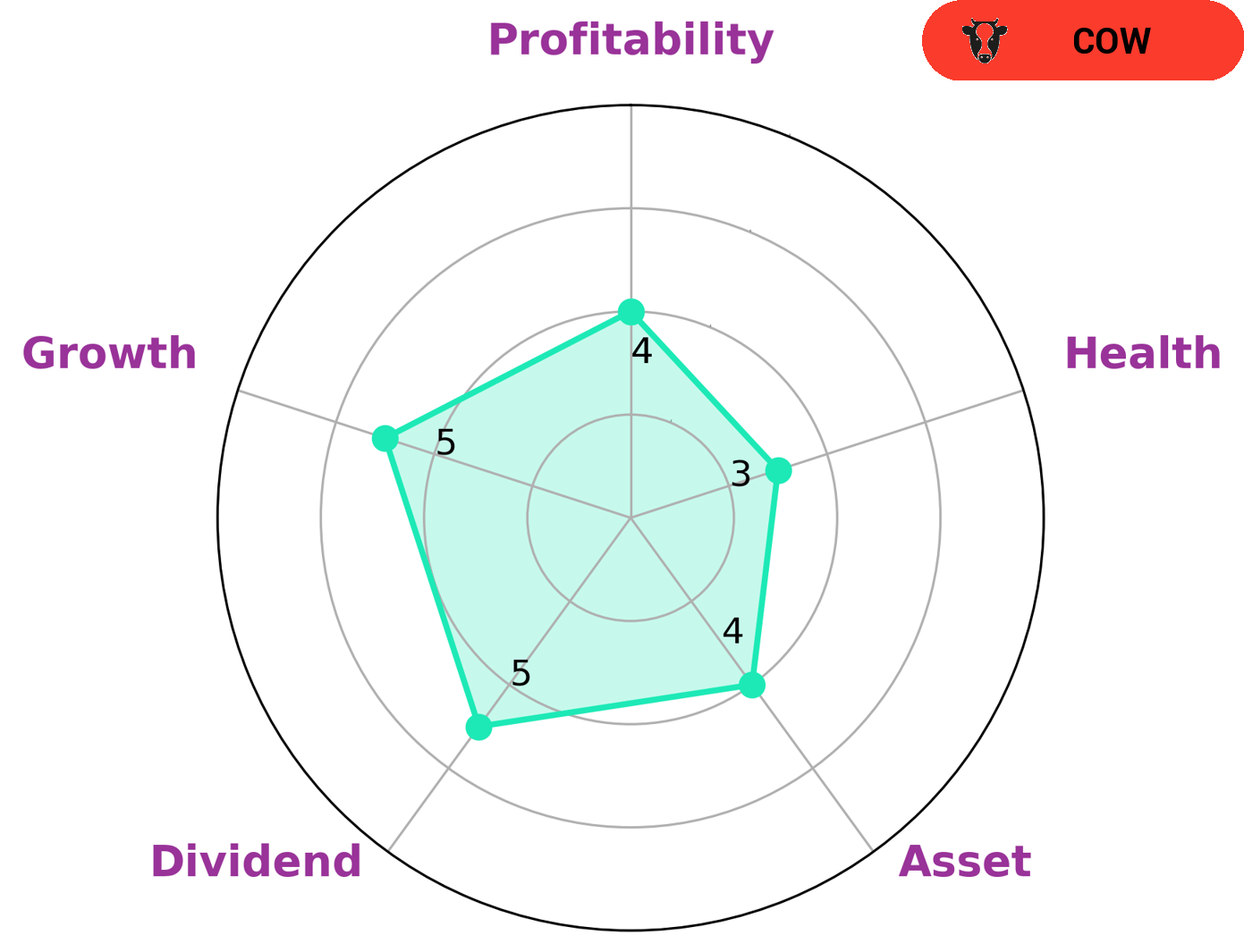

We recently conducted an analysis of GOLUB CAPITAL BDC’s wellbeing, and found their Star Chart health score to be 3/10, meaning the company is less likely to safely ride out any crisis without the risk of bankruptcy. GOLUB CAPITAL BDC is classified as a ‘cow’, meaning it has a track record of paying out consistent and sustainable dividends. It is also relatively strong in asset quality, dividends paid, growth, and profitability. All in all, GOLUB CAPITAL BDC looks like an interesting option for investors who are looking for a low-risk dividend play. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for GBDC. More…

| Total Revenues | Net Income | Net Margin |

| 131.67 | 107.57 | 81.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for GBDC. More…

| Operations | Investing | Financing |

| 55.26 | 13.42 | -91.51 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for GBDC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.67k | 3.17k | 14.73 |

Key Ratios Snapshot

Some of the financial key ratios for GBDC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 58.6% | – | – |

| FCF Margin | ROE | ROA |

| 42.0% | 2.7% | 1.2% |

Peers

The Company’s investment activities are focused on leveraged buyouts, middle market lending, and mezzanine investments. Golub Capital BDC Inc is managed by Golub Capital LLC, an affiliate of Golub Capital Partners, LLC. OFS Capital Corp is a US-based closed-end investment company. The Company’s investment objective is to provide current income and capital gains. OFS Capital Corp invests primarily in middle-market companies in the form of mezzanine loans, first-lien, and second-lien loans, and equity securities. PhenixFIN Corp is a private equity firm specializing in growth capital, middle market, and mezzanine investments. PhenixFIN Corp was founded in 2006 and is based in Boston, Massachusetts. Princeton Capital Corp is a US-based investment company. The Company’s investment objective is to provide current income and capital gains. Princeton Capital Corp invests primarily in middle-market companies in the form of mezzanine loans, first-lien, and second-lien loans, and equity securities.

– OFS Capital Corp ($NASDAQ:OFS)

OFS Capital Corp is a publicly traded business development company that provides financing solutions to middle market companies. The company has a market cap of 114.02M as of 2022. OFS Capital Corp’s investment objective is to generate both current income and capital appreciation through debt and equity investments. The company invests primarily in senior secured and mezzanine loans of middle market companies.

– PhenixFIN Corp ($NASDAQ:PFX)

PhenixFIN Corp is a publicly traded company with a market capitalization of $79.3 million as of 2022. The company is engaged in the business of providing financial services and products to consumers and businesses. The company offers a wide range of services, including credit cards, loans, and investment products. PhenixFIN Corp is headquartered in San Francisco, California.

– Princeton Capital Corp ($OTCPK:PIAC)

Princeton Capital Corporation is a publicly traded company with a market capitalization of $33.13 million as of 2022. The company is engaged in the business of lending and investing in real estate and other businesses. Princeton Capital Corporation is headquartered in New York, New York.

Summary

Golub Capital BDC is a publicly traded business development company that provides financing solutions for middle-market companies. It offers investors a 10% dividend yield, making it attractive for income investing strategies. The company’s investments are diversified across a number of industries which helps to mitigate risk. Combined with its ability to access capital markets throughout different market cycles makes Golub Capital BDC an attractive income investment.

Investors can expect a good dividend yield with reduced risk. Further, the company’s financials show strong growth in book value, NAV, dividend and other measures of financial performance.

Recent Posts