Ameriprise Financial Celebrates 135 Advisors Named to Forbes’ Top Women Wealth Advisors Best-In-State List.

March 5, 2023

Trending News ☀️

This honor highlights the exceptional achievements of women financial advisors affiliated with Ameriprise Financial ($NYSE:AMP). Each advisor has put in countless hours of hard work and dedication to serve their clients’ needs and pursue their passions. They have also been recognized for their commitment to helping clients make smart decisions about various investments and retirement planning. With this recognition, these advisors join the ranks of many other distinguished advisors that have been included on this list in the past.

Ameriprise Financial is thrilled to recognize and celebrate the achievements of its 135 top female financial advisors on the Forbes list. These advisors are true professionals whose hard work, dedication and commitment to excellence are helping more and more Americans secure their financial future.

Share Price

The news has been generally positive for the company, as admiration and recognition is being directed towards these financial professionals. On Thursday, AMERIPRISE FINANCIAL opened on the New York Stock Exchange at $340.8 and closed at $340.9, falling by 0.7% from its last closing price of 343.3. Despite this single-day fluctuation, the company remains in positive standing with investors and consumers. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ameriprise Financial. More…

| Total Revenues | Net Income | Net Margin |

| 14.27k | 2.56k | 17.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ameriprise Financial. More…

| Operations | Investing | Financing |

| 4.74k | -4.38k | 1.72k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ameriprise Financial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 158.47k | 154.85k | 34.31 |

Key Ratios Snapshot

Some of the financial key ratios for Ameriprise Financial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.8% | – | 23.7% |

| FCF Margin | ROE | ROA |

| 32.1% | 61.5% | 1.3% |

Analysis

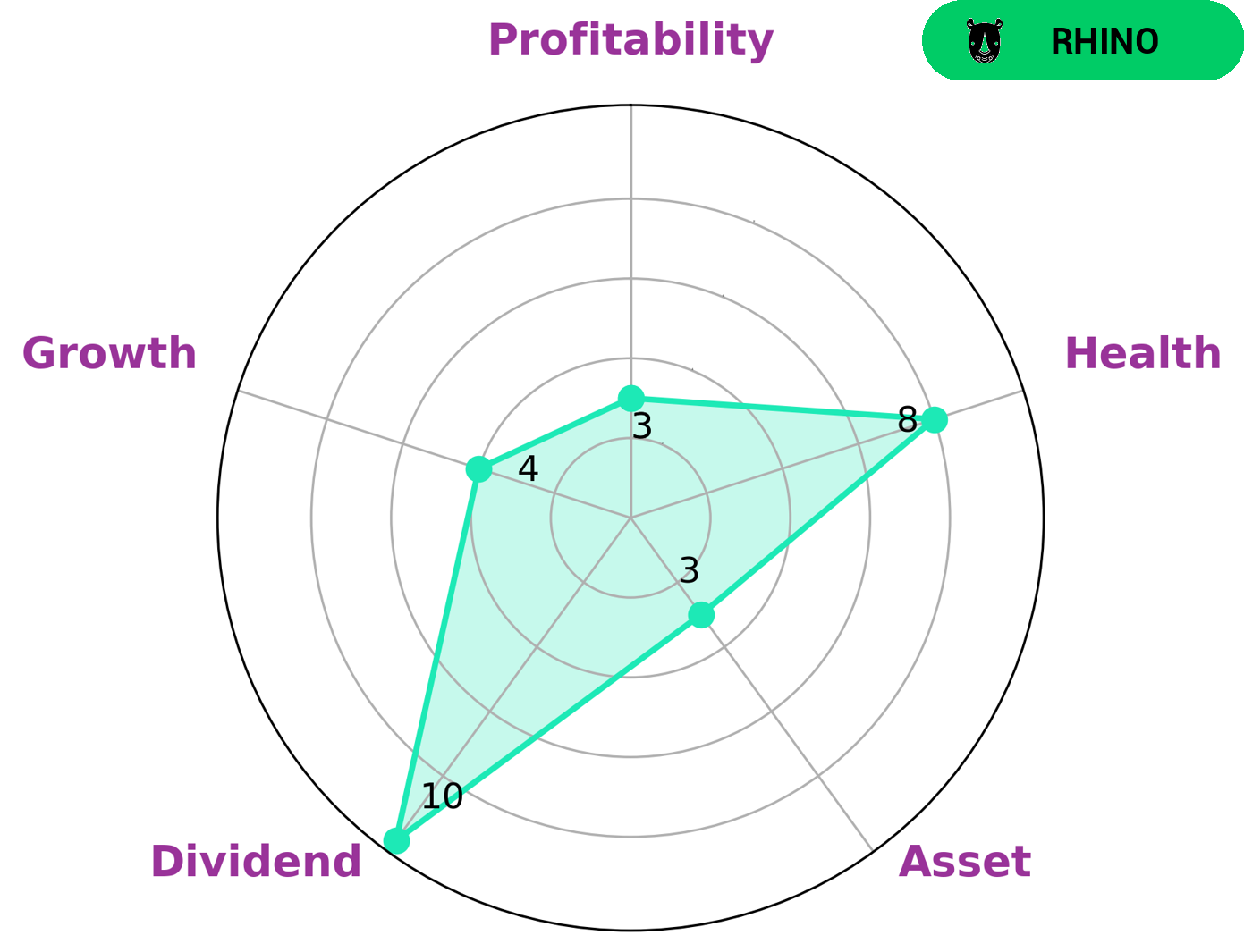

After conducting an in-depth analysis of AMERIPRISE FINANCIAL‘s fundamentals, GoodWhale has classified the company as a ‘rhino’ company type. This type of company is characterised by having achieved a moderate level of revenue or earnings growth over time. This makes AMERIPRISE FINANCIAL an attractive option for investors who are looking for a company with a steady level of income, rather than one that shows rapid growth. The company has a high health score of 8/10 with regards to its cash flows and debt, which indicates it is in a strong position to sustain operations and remain profitable in the face of financial uncertainty. In terms of its overall financial performance, AMERIPRISE FINANCIAL is strong in dividend, medium in growth, and weak in asset and profitability. These attributes make the company suitable for investors seeking a reliable income elevated by dividends, rather than those looking for higher capital appreciation. More…

Peers

Ameriprise Financial Inc. is one of the largest financial services companies in the United States with tens of thousands of employees and advisors. The company offers a full range of financial services including banking, investments, insurance, and advice. Ameriprise Financial Inc. has a large network of branches and ATMs across the United States. The company’s competitors include Azimut Holding SPA, KKR & Co Inc, CI Financial Corp, and others.

– Azimut Holding SPA ($OTCPK:AZIHY)

Azimut Holding SPA is a holding company for the Azimut Group, a financial services provider. The Group offers a wide range of services, including asset management, private banking, and insurance. As of 2022, the Group had a market capitalization of 2.89 billion euros and a return on equity of 40.25%. The Group’s products and services are available in more than 20 countries worldwide.

– KKR & Co Inc ($NYSE:KKR)

KKR & Co Inc is a New York City-based global investment firm that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate, credit, and hedge funds. The company had a market cap of $44.73B as of 2022 and a ROE of 4.34%. KKR’s portfolio includes some of the world’s leading companies, such as First Data, Dell Technologies, and Walgreens Boots Alliance. The company has a team of over 1,600 professionals operating in 28 countries.

– CI Financial Corp ($TSX:CIX)

CI Financial Corp is a diversified wealth management company that provides financial services to clients through its subsidiaries. The company has a market cap of 2.62B as of 2022 and a ROE of 28.09%. CI Financial’s subsidiaries include CI Investments, Assante Wealth Management, and CI Private Counsel. The company’s primary operations are in Canada, but it also has a presence in the United States, Europe, and Asia.

Summary

Ameriprise Financial, Inc. has recently celebrated the selection of 135 of their advisors to Forbes’ Top Women Wealth Advisors Best-In-State List. This demonstrates the organization’s commitment to investing excellence, offering quality advice to clients seeking to grow their wealth. Analysts have noted Ameriprise’s success in developing strategies that maximize returns and mitigate risk. The company is a leader in comprehensive asset management and financial planning services, providing clients with access to tools, resources and insights necessary to meet their financial goals.

Additionally, Ameriprise has built a reputation for its quality of customer service, providing a personal touch that puts clients at ease. With these accomplishments, investors can be confident that their assets are in capable hands when entrusting Ameriprise Financial with their investments.

Recent Posts