Altisource Asset Management Poised for Major Expansion: Invest Now!

April 21, 2023

Trending News ☀️

Altisource Asset Management ($NYSEAM:AAMC) is positioned for major expansion and now is the time to invest. Their offerings are diverse and include investments in stocks, bonds, mutual funds, ETFs, and more. Altisource’s recent acquisitions of other asset management firms have enabled them to expand their presence around the world and become a major player in the industry. Their focus on customer service and secure investments has earned them widespread trust and respect from investors. With a commitment to providing quality products and services to their customers, Altisource is sure to continue to expand and attract more investors.

It is a great opportunity to invest in Altisource Asset Management now before they experience a potential surge in growth. With their strong track record and customer-oriented approach, the company is sure to continue to be a reliable source of investments and offers an exciting opportunity for investors. Now is the time to take advantage of the potential growth of Altisource Asset Management and invest for the future.

Price History

ALTISOURCE ASSET MANAGEMENT is set to make a major expansion, with their stock soaring 12.5% on Wednesday alone. This was a major jump from the previous closing price of 77.3, with the stock opening up at 78.0 and closing at 86.9. ALTISOURCE ASSET MANAGEMENT is sure to be a major player in the future, and investing now will ensure that you don’t miss out on the opportunity. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AAMC. More…

| Total Revenues | Net Income | Net Margin |

| 0.56 | -10.81 | -1865.8% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AAMC. More…

| Operations | Investing | Financing |

| -26.62 | 58.91 | -4.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AAMC. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 117.65 | 207.54 | -50.39 |

Key Ratios Snapshot

Some of the financial key ratios for AAMC are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -67.1% | – | – |

| FCF Margin | ROE | ROA |

| -4728.6% | 11.1% | -8.3% |

Analysis

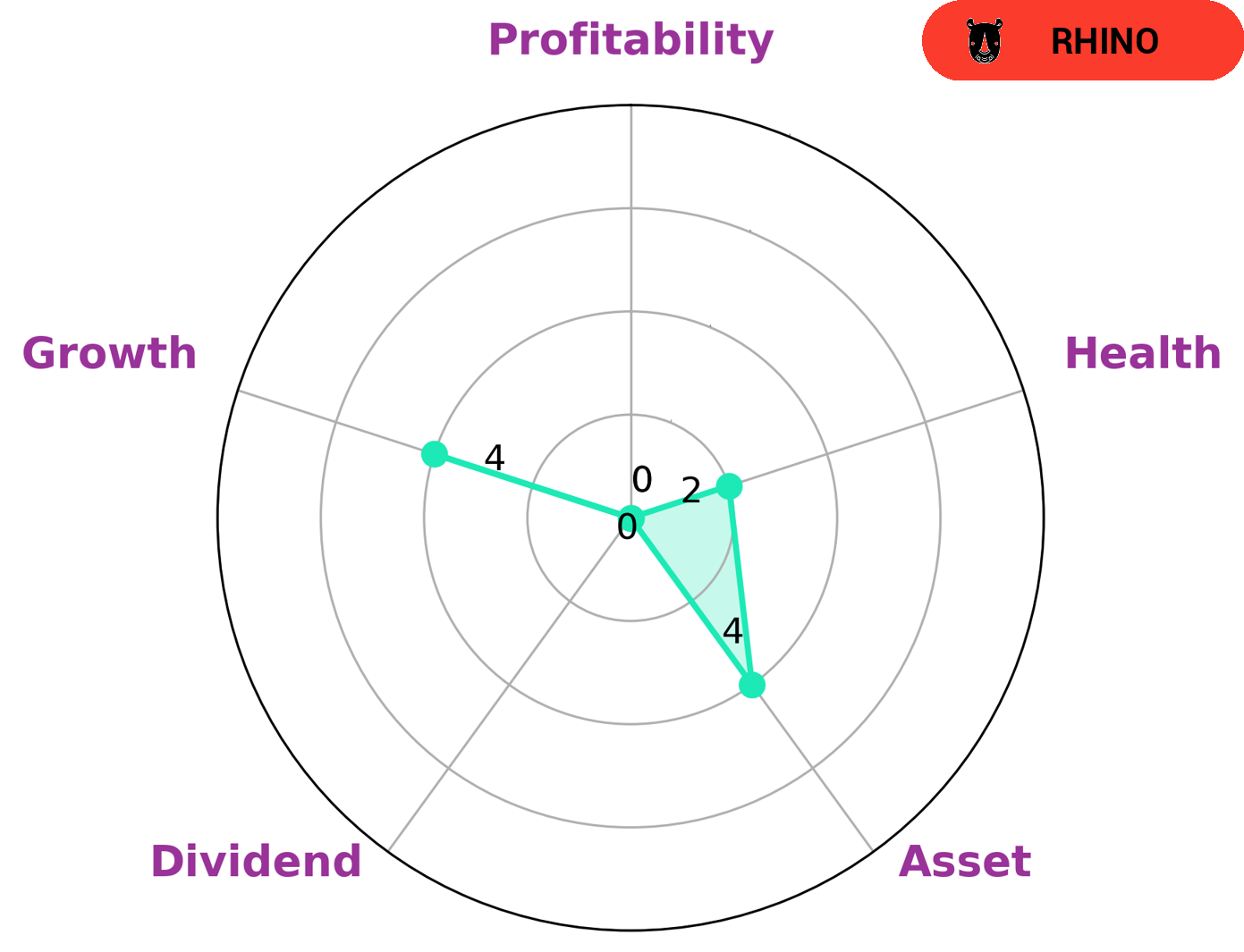

This indicates that ALTISOURCE ASSET MANAGEMENT may be an attractive investment opportunity for those looking for moderate, but stable returns. However, we should take caution when investing in ALTISOURCE ASSET MANAGEMENT as their health score is only 2/10. This indicates that they are less likely to pay off debt and fund future operations, compared to companies with higher ratings. We also see that ALTISOURCE ASSET MANAGEMENT is strong in asset management, medium in asset growth, and weak in dividends and profitability. Therefore, while they may be attractive to investors seeking moderate returns, they may not be suitable for those seeking long-term growth or high yield returns. More…

Peers

As a leader in its field, Altisource Asset Management Corp competes with other companies such as Ninety One PLC, Premier Miton Group PLC, and SEI Investments Co, providing innovative investment solutions to their clients.

– Ninety One PLC ($LSE:N91)

Ninety One PLC is a global asset manager, founded in South Africa in 1991. It provides a range of investment solutions to its clients, including actively managed funds, multi-management and exchange traded funds. As of 2023, the company has a market cap of 1.66 billion and a Return on Equity of 45.85%. Ninety One PLC’s market cap indicates the confidence of investors in the company and its ability to generate returns. Its high Return on Equity suggests that the company is generating returns from resources efficiently and is utilizing its resources effectively.

– Premier Miton Group PLC ($LSE:PMI)

Premier Miton Group PLC is an investment management company based in London, England. The company provides a wide range of asset management services to institutional and private clients across the UK and internationally. As of 2023, the company has a market cap of 149.23M, making it one of the most respected asset management companies in the sector. In terms of its Return on Equity, it stands at 7.35%, making it a sound investment for investors. The company has demonstrated strong financial performance in recent years and is well-positioned to capitalise on the opportunities presented by the current market climate.

– SEI Investments Co ($NASDAQ:SEIC)

SEI Investments Co is a global financial services firm that provides investment processing, investment management, and investment operations solutions. With a market cap of 7.98B as of 2023, the company has a strong presence in the financial services industry. Its Return on Equity (ROE) is 19.63%, indicating that the company is efficiently utilizing its shareholders’ equity to generate profits. SEI Investments offers a variety of financial products, such as private banking, wealth management, and investment management services, which help its clients achieve their financial goals.

Summary

Altisource Asset Management (AAM) is an attractive investment opportunity for investors seeking to capitalize on its impressive growth potential. AAM is a specialized asset management firm that focuses on creating customized solutions for clients in a wide range of areas, from real estate acquisitions to portfolio management. Furthermore, its strong track record of delivering strong returns makes it a particularly attractive option for long-term investors. With its large and diverse customer base, AAM has the potential to drive significant growth in the coming years.

Investors should take note of AAM’s impressive portfolio of investments and its strong balance sheet, both of which point to a bright future. Moreover, its commitment to providing top-notch service has helped to build a loyal customer base that will continue to drive growth and create value for shareholders. Altisource Asset Management is well-positioned for long-term success and should be considered by investors looking for a reliable and profitable long-term opportunity.

Recent Posts