13M dividend yield calculator – Main Street Capital Corp Declares 0.225 Cash Dividend

February 9, 2023

Dividends Yield

13M dividend yield calculator – On February 2 2023, Main Street Capital ($BER:13M) Corp declared a 0.225 cash dividend to its shareholders. This news is a testament to Main Street Capital’s commitment to providing a steady stream of dividend income to its investors. MAIN STREET CAPITAL has an average dividend yield of 3.23%, as evidenced by the 1.51 USD annual dividend per share that was issued in 2021. It seeks to provide its investors with long-term capital appreciation and current income through debt and equity investments. MAIN STREET CAPITAL’s portfolio consists of investments in senior secured loans, second lien debt, subordinated debt and equity securities.

If you are looking for dividend stocks, this could be an ideal choice for you, with an ex-dividend date of February 7 2023. The company has a history of providing steady and reliable dividend income, making it a great option for long-term investors looking for capital preservation. Overall, MAIN STREET CAPITAL is a great choice for investors looking for a reliable dividend stock with a good yield. With its strong track record of providing steady returns and dividend income, MAIN STREET CAPITAL is an ideal choice for any investor looking for reliable income over the long-term.

Market Price

This was in line with the company’s commitment to maintain regular payments to its shareholders. The announcement was welcomed by investors, causing the stock to open at €36.1 and close at the same price, up by 0.3% from its previous closing price of €36.0. Dividends are paid out of the company’s earnings and are used to reward shareholders for their loyalty and faith in the company’s prospects. Main Street Capital Corp has established a track record of consistently paying dividends. This reflects the company’s commitment to rewarding its shareholders with a steady stream of income. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 13M. More…

| Total Revenues | Net Income | Net Margin |

| 322.91 | 229.64 | 71.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 13M. More…

| Operations | Investing | Financing |

| -613.99 | -184.53 | 615.58 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 13M. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.13k | 2.16k | 25.99 |

Key Ratios Snapshot

Some of the financial key ratios for 13M are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.3% | – | – |

| FCF Margin | ROE | ROA |

| -190.1% | 8.4% | 3.9% |

Analysis

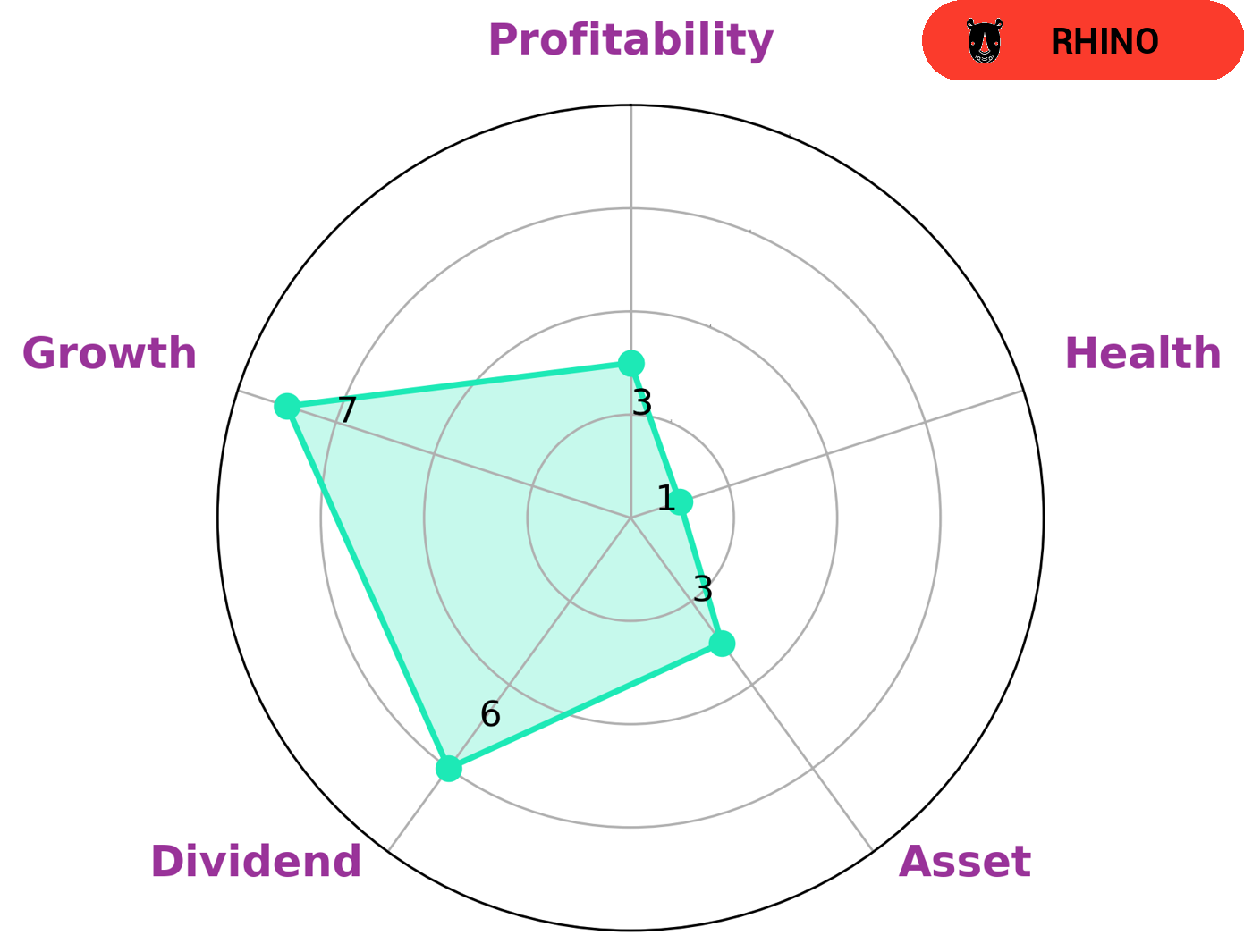

MAIN STREET CAPITAL is a company that has achieved moderate revenue or earnings growth and is classified as a ‘rhino’ in the Star Chart. According to GoodWhale’s analysis, MAIN STREET CAPITAL is strong in growth, medium in dividend and weak in asset, profitability. With a low health score of 1/10 with regard to cashflows and debt, MAIN STREET CAPITAL is less likely to pay off debt and fund future operations. Investors who are looking for moderate earnings growth and a dividend yield may be interested in MAIN STREET CAPITAL. However, they should consider the company’s weak asset and profitability, as well as its low health score. Investors should perform their own due diligence and analysis before investing, as the company’s fundamentals may not be suitable for their investment objectives. It is important for investors to keep in mind that companies classified as ‘rhino’ may have more volatile returns than those with stronger fundamentals. Therefore, investors should be aware of the risks associated with this type of company and ensure that their portfolio is diversified. Additionally, investors should assess the company’s management team, business strategy and competitive landscape before investing. More…

Summary

MAIN STREET CAPITAL is an attractive choice for dividend investors due to its high yield of 3.23%. The company has consistently paid out a dividend of 1.51 USD per share since 2021, with the next ex-dividend date coming up on February 7 2023. MAIN STREET CAPITAL has a strong balance sheet and a history of generating consistent cash flow, making it a reliable investment.

Analysts also note that its business model is well-suited to the current economic climate, giving it a competitive edge over its rivals. Investing in MAIN STREET CAPITAL would allow an investor to benefit from its steady dividend payments, as well as the potential for capital appreciation over time.

Recent Posts