0IZ6 stock dividend – Golub Capital BDC Inc Announces 0.33 Cash Dividend

June 9, 2023

🌥️Dividends Yield

GOLUB CAPITAL BDC ($LTS:0IZ6) Inc. recently announced a cash dividend of 0.33 USD per share, to be paid out on June 1 2023. This additional dividend marks an increase compared to the dividends paid over the past three years, which were 1.26, 1.2, and 1.2 USD per share respectively. For investors seeking dividend stocks, GOLUB CAPITAL BDC is a solid option with an ex-dividend date of June 1 2023. The company’s dividend yield from 2022 to 2023 are 7.58%, 9.34%, and 8.93% respectively, with an average dividend yield of 8.62%.

This is slightly higher than the average dividend yield of the industrial sector, making GOLUB CAPITAL BDC an attractive option for investors looking for reliable dividends as part of their portfolio. For investors looking for a reliable source of cash dividends, GOLUB CAPITAL BDC is an attractive option.

Share Price

This follows the recent opening of the company’s stock at €11.8, which closed at the same amount, representing a decrease of 2.5% from its prior closing price of 12.1. Investors who hold the company’s stock on or before that date will be eligible to receive this payment. Golub Capital BDC Inc is dedicated to providing flexible debt and equity capital solutions to help middle-market companies grow. It is committed to delivering attractive returns to its shareholders through the payment of regular distributions, while also investing in growth and innovation. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for 0IZ6. More…

| Total Revenues | Net Income | Net Margin |

| 131.67 | 107.57 | 81.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for 0IZ6. More…

| Operations | Investing | Financing |

| 55.26 | 13.42 | -91.51 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for 0IZ6. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.67k | 3.17k | 14.73 |

Key Ratios Snapshot

Some of the financial key ratios for 0IZ6 are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 58.6% | – | – |

| FCF Margin | ROE | ROA |

| 42.0% | 2.7% | 1.2% |

Analysis

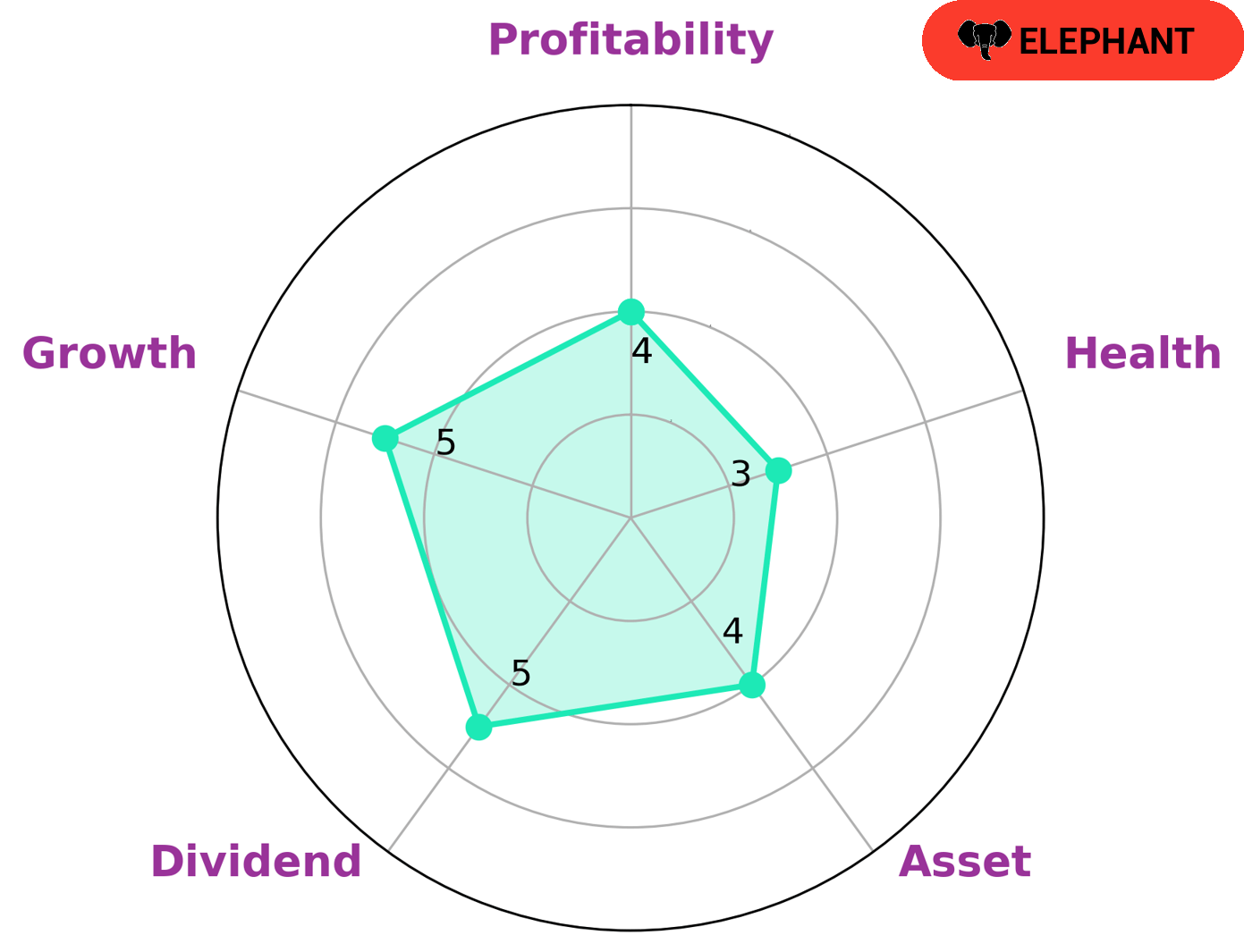

GoodWhale recently conducted an analysis of GOLUB CAPITAL BDC’s wellbeing. After evaluating the company through our proprietary Star Chart, we classified GOLUB CAPITAL BDC as an ‘elephant’, a type of company we conclude is rich in assets after deducting off liabilities. With a low health score of 3/10 with regard to its cashflows and debt, GOLUB CAPITAL BDC is less likely to safely ride out any crisis without the risk of bankruptcy. However, we also found that the company is strong in liquidity, and medium in asset, dividend, growth, and profitability. These results make it clear that GOLUB CAPITAL BDC is a viable investment option for investors who value stability and are looking for a company with a certain degree of predictability. Our analysis will help such investors make informed decisions, and understand the potential risks and rewards associated with investing in this particular company. More…

Summary

GOLUB CAPITAL BDC is an attractive investment opportunity for income-seeking investors, with a strong track record of steady and generous dividends over the last three years. Its dividend yields for the 2022 and 2023 fiscal years are 7.58%, 9.34%, and 8.93%, respectively, with an average dividend yield of 8.62%. This indicates that the company is likely to continue to pay out generous dividends in the near future, providing investors with a steady stream of passive income.

Furthermore, the stock’s dividend payment stability is further supported by its impressive financials. All in all, GOLUB CAPITAL BDC presents a compelling investment opportunity for those looking to maximize their returns.

Recent Posts