Lululemon Athletica Stock Fair Value – LULULEMON ATHLETICA Reports Strong Earnings for FY2023 Q4 Ending March 28, 2023

March 31, 2023

Earnings Overview

LULULEMON ATHLETICA ($NASDAQ:LULU) reported their FY2023 Q4 earnings results on January 31 2023, with the quarter ending on March 28 2023. Total revenue for the period was USD 119.8 million, a decrease of 72.4% from the same time last year. However, net income was USD 2771.8 million, a 30.2% increase year-over-year.

Transcripts Simplified

Earnings transcripts for Lululemon Athletica are available on various financial websites, such as SeekingAlpha.com, Nasdaq.com, MarketWatch.com and Yahoo! Finance. Transcripts can usually be found on the company’s Investor Relations webpage. To find the most up-to-date earnings transcripts for Lululemon, search the company name and “earnings transcript” on any of the sites listed above.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Lululemon Athletica. More…

| Total Revenues | Net Income | Net Margin |

| 8.11k | 854.8 | 13.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Lululemon Athletica. More…

| Operations | Investing | Financing |

| 966.46 | -569.94 | -467.49 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Lululemon Athletica. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.61k | 2.46k | 23.83 |

Key Ratios Snapshot

Some of the financial key ratios for Lululemon Athletica are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 26.8% | 24.7% | 21.3% |

| FCF Margin | ROE | ROA |

| 4.0% | 34.9% | 19.2% |

Market Price

On Tuesday, LULULEMON ATHLETICA reported strong earnings for FY2023 Q4 ending on March 28, 2023. The stock opened at $319.6 and closed at $320.3, which is a 1.0% increase from the previous closing price of $317.2. This is great news for investors, as the company has seen a steady increase in their stock prices over the past quarter, indicating their strong financial health. The company has reported a stellar quarter of sales, led by their digital and e-commerce channels, which experienced higher than ever demand for their products. The company is also seeing a growing demand for its athleisure apparel and accessories which has further boosted their sales and profits.

In addition, the company has implemented various strategies to drive customer engagement and loyalty, leading to increased customer satisfaction and loyalty. Overall, investors can be pleased with the strong performance of LULULEMON ATHLETICA during the past quarter. The company has shown resilience in the face of numerous challenges during the COVID pandemic, and their success reflects that. With their efficient operational processes, innovative strategies and high customer satisfaction, the company is well-positioned to continue to experience growth in the future. Live Quote…

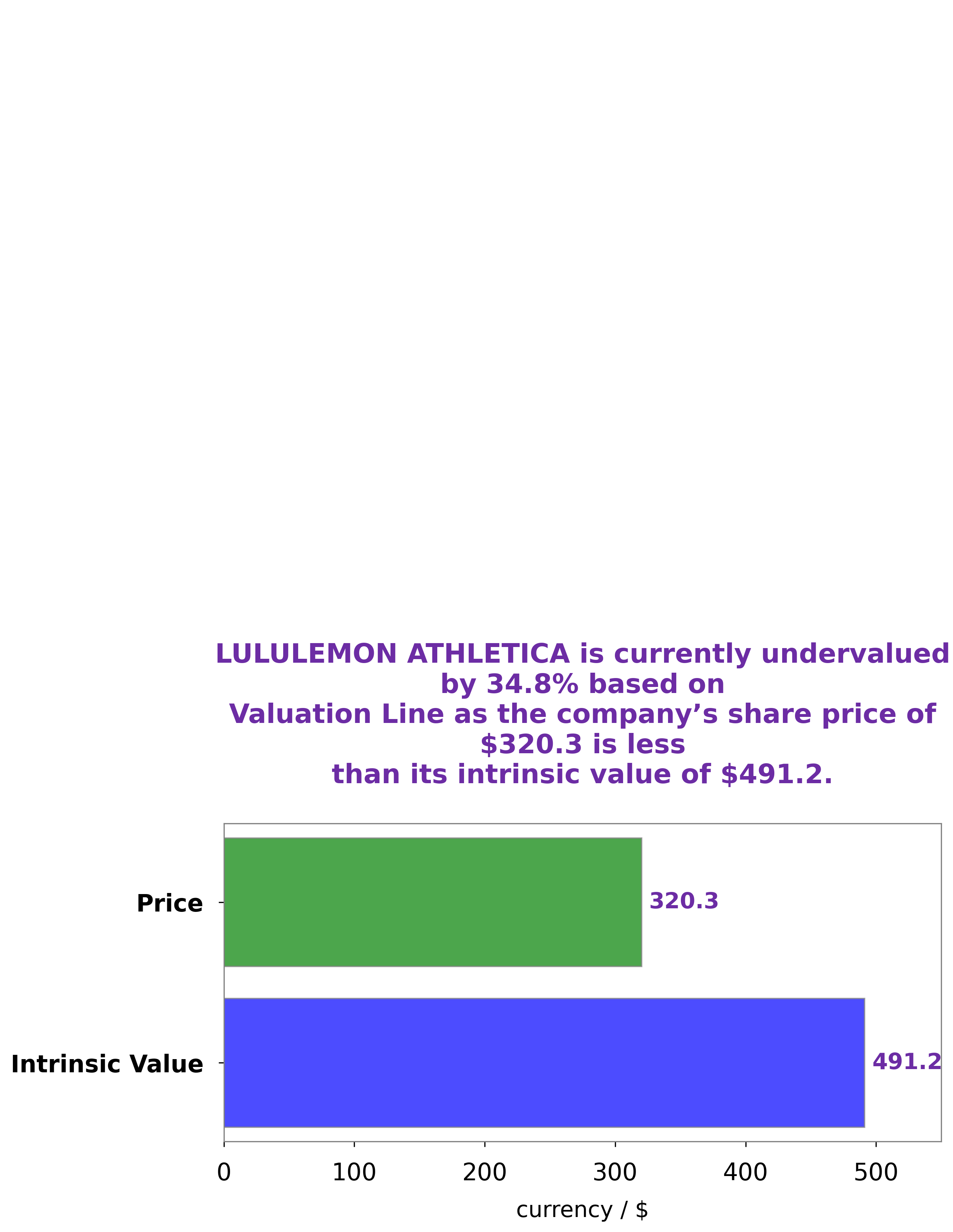

Analysis – Lululemon Athletica Stock Fair Value

At GoodWhale, we strive to provide our clients with the most up-to-date financial analysis and data to help them make informed investment decisions. We are proud to offer our clients an analysis of LULULEMON ATHLETICA, a leading athletic apparel company. Our proprietary Valuation Line indicates that the intrinsic value of a LULULEMON ATHLETICA share is around $491.2. This means that the stock is currently undervalued by 34.8%, as it is currently trading at $320.3. This presents a great opportunity for our clients to invest in this high-performing company at a discounted rate. By utilizing GoodWhale’s analysis of LULULEMON ATHLETICA, our clients can rest assured that they are making a sound and informed decision when investing in the company’s stock. More…

Peers

Lululemon Athletica Inc is a yoga-inspired, technical athletic apparel company for women. The company operates in the United States, Canada, and Australia. Lululemon Athletica Inc’s main competitors are Buckle Inc, Citi Trends Inc, and Tilly’s Inc.

– Buckle Inc ($NYSE:BKE)

Buckle Inc is a leading retailer of casual apparel, footwear, and accessories for young men and women in the United States. As of 2022, the company has a market capitalization of 1.77 billion dollars and a return on equity of 55.65%. Buckle Inc operates over 450 stores in 44 states across the country, and offers its products through its website and catalog. The company’s mission is to provide great fashion at a great value for its customers.

– Citi Trends Inc ($NASDAQ:CTRN)

Citi Trends Inc is a value-priced retailer of urban fashion apparel, accessories and home décor. The company operates over 600 stores in 31 states. Citi Trends’ mission is to be the largest and most convenient source of trend-right fashion at the right price for our target demographic of urban youth.

– Tilly’s Inc ($NYSE:TLYS)

Tilly’s Inc is a company that operates in the retail industry. The company has a market cap of 239.38M as of 2022 and a return on equity of 19.35%. The company operates through two segments: stores and e-commerce. The company offers a variety of products including apparel, footwear, and accessories for men, women, and children. The company operates stores in California, Arizona, Nevada, and Texas.

Summary

Investors looking to take advantage of the volatile market should take a closer look at Lululemon Athletica. In their most recent earnings report for Q4, the company reported a total revenue of USD119.8 million, a 72.4% drop year-over-year. Despite the significant decrease in total revenue, the company managed to remain profitable, suggesting that investors are likely to find value in the stock. With a strong brand presence and a potential rebound in the near future, Lululemon Athletica is a stock worth considering for those interested in investing.

Recent Posts