Hibbett Stock Intrinsic Value – HIBBETT Reports Positive Earnings for Q2 FY2024

August 28, 2023

☀️Earnings Overview

HIBBETT ($NASDAQ:HIBB) released its second quarter FY2024 earnings results on July 31 2023, reporting total revenue of USD 374.9 million, a decrease of 4.6% from the same period in the prior year. Net income for the quarter ending August 25 2023 was USD 10.9 million, a decrease of 55.9% compared to the same period in the previous year.

Market Price

On Friday, sports apparel retailer HIBBETT announced their financial results for the second quarter of their fiscal year 2024. The news was positive, with their stock opening at $43.6 and closing at $45.0, soaring by 22.2% from its previous closing price of 36.9. The increase in stock price was driven largely by HIBBETT’s increased profit margins year over year. In addition to the impressive financial results, HIBBETT also reported positive comp sales growth of 4% when compared to the same period last year.

This growth has been attributed to the company’s successful marketing and promotional campaigns which have helped drive traffic into their stores. Overall, HIBBETT’s positive financial results for the second quarter of FY2024 have been a cause for celebration for investors and stakeholders alike, who are now reaping the rewards of their investment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hibbett. More…

| Total Revenues | Net Income | Net Margin |

| 1.72k | 110.77 | 6.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hibbett. More…

| Operations | Investing | Financing |

| 21.42 | -63.17 | -14.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hibbett. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 976.87 | 579.56 | 31.3 |

Key Ratios Snapshot

Some of the financial key ratios for Hibbett are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.8% | 31.7% | 8.5% |

| FCF Margin | ROE | ROA |

| -2.3% | 23.0% | 9.4% |

Analysis – Hibbett Stock Intrinsic Value

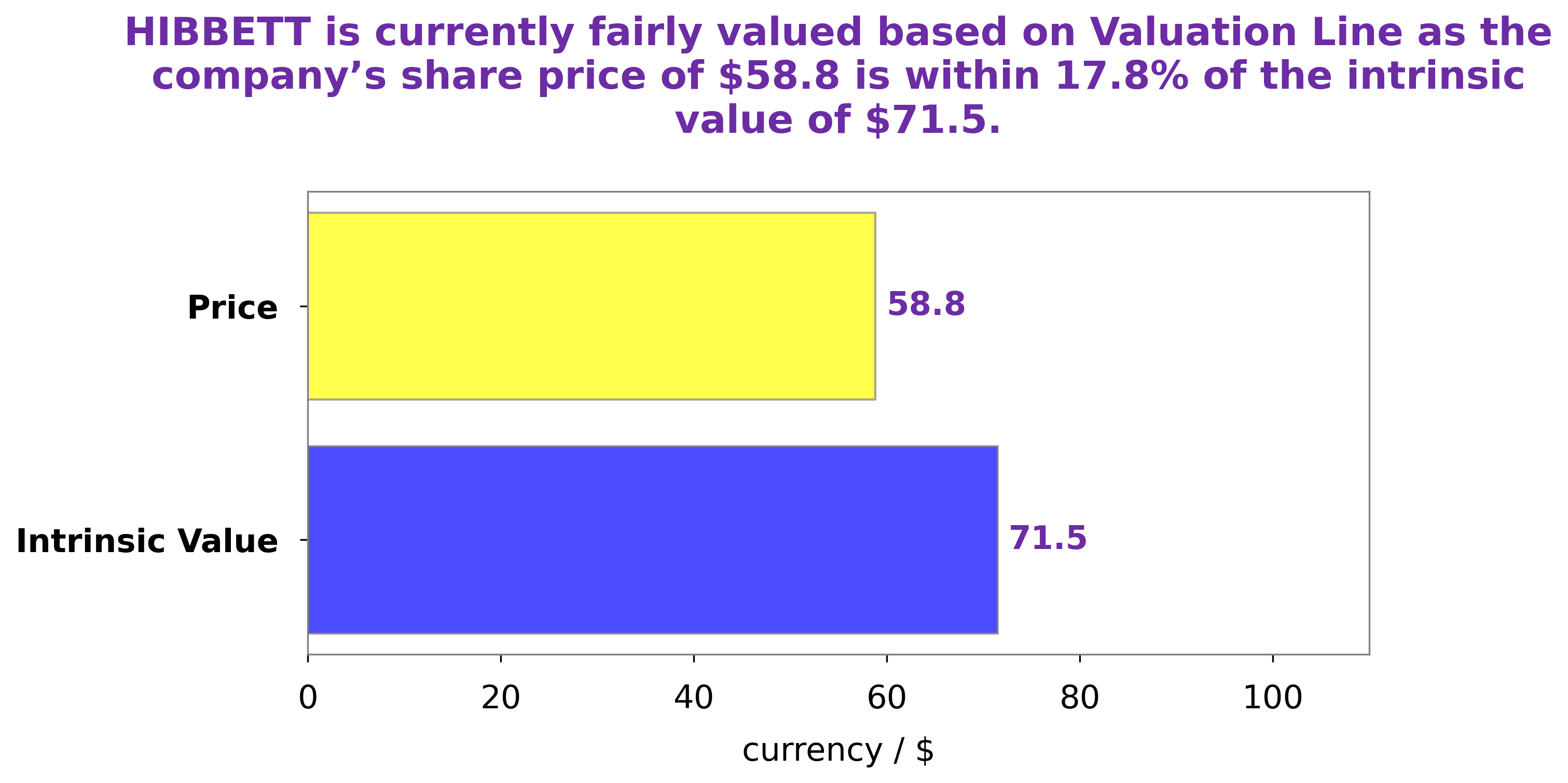

GoodWhale has conducted an analysis of the financials of HIBBETT and completed a proprietary Valuation Line for the company. Our analysis and calculations reveal that HIBBETT’s intrinsic value per share is roughly $72.1. However, at present, HIBBETT’s stock is traded at just $45.0, which means it is undervalued by 37.6%. This presents an interesting opportunity for investors who are confident in the potential of HIBBETT. More…

Peers

The company’s main competitors are C’sMEN Co Ltd, Shimamura Co Ltd, and Konaka Co Ltd.

– C’sMEN Co Ltd ($TSE:3083)

Singing River Health System is a non-profit, community-owned health system located in Jackson County, Mississippi. The health system includes Singing River Hospital, George E. Weems Memorial Hospital, Ocean Springs Hospital, and a number of other healthcare facilities. The system has a total of 2,000 employees and provides care for patients in Mississippi, Alabama, and Louisiana.

– Shimamura Co Ltd ($TSE:8227)

Shimamura Co Ltd is a Japanese company that operates a chain of discount stores. As of 2022, the company had a market capitalization of 449.84 billion yen and a return on equity of 7.86%. The company was founded in 1954 and is headquartered in Tokyo, Japan.

– Konaka Co Ltd ($TSE:7494)

Konaka Co Ltd is a Japanese electronics company with a market cap of 9.67B as of 2022. The company has a Return on Equity of 0.49%. Konaka is primarily engaged in the manufacture and sale of electronic equipment, including semiconductor production equipment, electronic measuring instruments, and electronic control devices. The company also offers services related to the design, development, and maintenance of electronic equipment.

Summary

Hibbett reported its second quarter FY2024 earnings, ending August 25 2023 on July 31st. Total revenue for the quarter was USD 374.9 million, a 4.6% decrease compared to the same period from the prior year. Net income was reported at USD 10.9 million, a 55.9% decrease from the prior year.

Despite the lower revenue and net income, investors were pleased as it was an improvement from the previous quarter and the stock price moved up the same day. Analysts are generally optimistic about the company’s long-term potential as the retailer is making efforts to attract new customers and expand its online presence.

Recent Posts