Hibbett Intrinsic Stock Value – HIBBETT Reports Second Quarter Earnings Results for FY2024

September 6, 2023

🌥️Earnings Overview

For the quarter ending July 31st, 2023, HIBBETT ($NASDAQ:HIBB) reported total revenue of USD 374.9 million, a decrease of 4.6% year-on-year. Net income for the second quarter of Fiscal Year 2024 was USD 10.9 million, a drop of 55.9% compared to the same period in the previous year.

Share Price

On Friday, HIBBETT reported their second quarter earnings results for Fiscal Year 2024. The company’s stock opened at $43.6 and closed at $45.0, soaring by an impressive 22.2% from its last closing price of $36.9. The strong quarterly results can be attributed to a combination of strong online sales, increased customer visits, and increased demand from new customers, especially in its athletic gear and lifestyle apparel categories. HIBBETT expects to maintain similar trends in the upcoming quarters, with a focus on further increasing overall customer satisfaction and enhancing its e-commerce capabilities.

The company has also been investing in expanding its product portfolio in order to capture more market share. Overall, HIBBETT’s impressive second quarter earnings results suggest that the company is well-positioned to continue its positive momentum going forward. Furthermore, with its strong financial performance, HIBBETT has once again proven that it is a force to be reckoned with in the retail industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hibbett. HIBBETT_Reports_Second_Quarter_Earnings_Results_for_FY2024″>More…

| Total Revenues | Net Income | Net Margin |

| 1.72k | 110.77 | 6.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hibbett. HIBBETT_Reports_Second_Quarter_Earnings_Results_for_FY2024″>More…

| Operations | Investing | Financing |

| 21.42 | -63.17 | -14.91 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hibbett. HIBBETT_Reports_Second_Quarter_Earnings_Results_for_FY2024″>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 976.87 | 579.56 | 31.3 |

Key Ratios Snapshot

Some of the financial key ratios for Hibbett are shown below. HIBBETT_Reports_Second_Quarter_Earnings_Results_for_FY2024″>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.8% | 31.7% | 8.5% |

| FCF Margin | ROE | ROA |

| -2.3% | 23.0% | 9.4% |

Analysis – Hibbett Intrinsic Stock Value

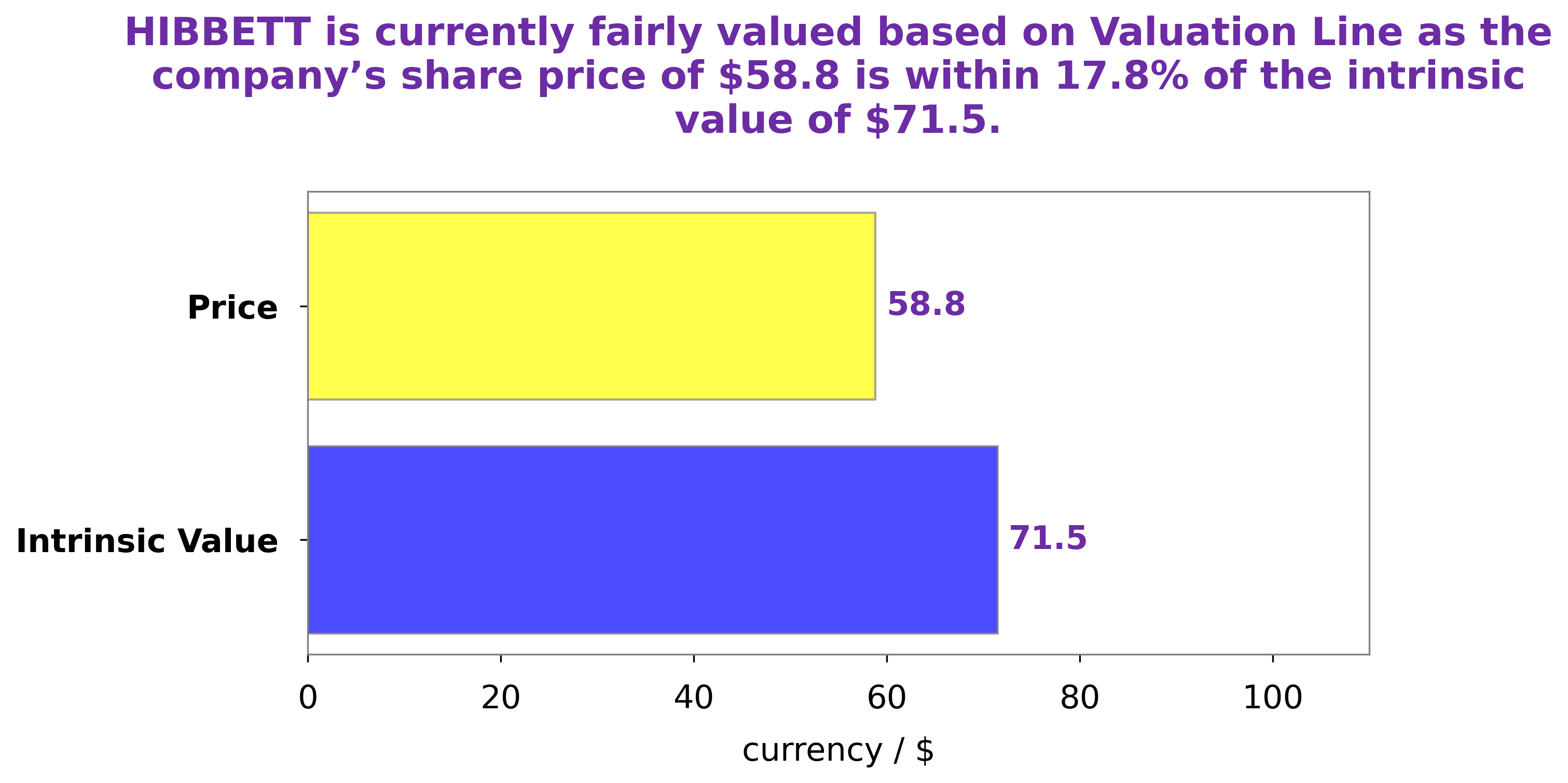

At GoodWhale, we analyze HIBBETT’s fundamentals to bring our users to make intelligent investment decisions. Our proprietary Valuation Line reveals the intrinsic value of HIBBETT share is around $72.2. This means that now HIBBETT stock is traded at $45.0, undervalued by 37.7%. Our analysis aims to bring valuable insights that may help investors make wise decisions. More…

Peers

The company’s main competitors are C’sMEN Co Ltd, Shimamura Co Ltd, and Konaka Co Ltd.

– C’sMEN Co Ltd ($TSE:3083)

Singing River Health System is a non-profit, community-owned health system located in Jackson County, Mississippi. The health system includes Singing River Hospital, George E. Weems Memorial Hospital, Ocean Springs Hospital, and a number of other healthcare facilities. The system has a total of 2,000 employees and provides care for patients in Mississippi, Alabama, and Louisiana.

– Shimamura Co Ltd ($TSE:8227)

Shimamura Co Ltd is a Japanese company that operates a chain of discount stores. As of 2022, the company had a market capitalization of 449.84 billion yen and a return on equity of 7.86%. The company was founded in 1954 and is headquartered in Tokyo, Japan.

– Konaka Co Ltd ($TSE:7494)

Konaka Co Ltd is a Japanese electronics company with a market cap of 9.67B as of 2022. The company has a Return on Equity of 0.49%. Konaka is primarily engaged in the manufacture and sale of electronic equipment, including semiconductor production equipment, electronic measuring instruments, and electronic control devices. The company also offers services related to the design, development, and maintenance of electronic equipment.

Summary

Hibbett reported second quarter earnings for FY 2024 ending July 31st, 2023 with total revenue of USD 374.9 million, a 4.6% decrease from the previous year. Net income for the quarter was USD 10.9 million, a 55.9% decrease year over year. Stock price moved up the same day, indicating investors may be encouraged by the results.

Analysts are likely to take a closer look at the earnings numbers and company outlook to determine whether they should invest in the company. It is important to consider potential risks and rewards of investing in Hibbett, while also paying attention to potential trends in the industry and retail sector.

Recent Posts