Hallenstein Glasson dividend yield – Hallenstein Glassons Holdings Ltd Declares 0.24 Cash Dividend

April 8, 2023

Dividends Yield

On April 3 2023, Hallenstein Glasson ($NZSE:HLG)s Holdings Ltd declared a 0.24 cash dividend for the 2021 financial year. This dividend is significantly lower than the 0.42 NZD paid for the past three years and marks a substantial decrease in the company’s dividends. Despite this, HALLENSTEIN GLASSON still remains an attractive dividend stock, with an average dividend yield of 8.17% in the 2021 to 2023 financial years. This includes a 7.28%, 6.15%, and 11.08% dividend yield in 2021, 2022, and 2023 respectively.

For those investors looking to invest in a solid dividend stock, HALLENSTEIN GLASSON should definitely be one of the top considerations. The ex-dividend date is April 11 2023, so investors should act quickly to take advantage of the dividend yield that HALLENSTEIN GLASSON has to offer.

Price History

On Monday, the stock opened at NZ$5.8 and closed at the same price, representing a decrease of 0.7% from the prior closing price of NZ$5.8. The company remains committed to providing a return to shareholders through dividends and it is encouraging to see Hallenstein Glassons Holdings Ltd taking steps to reward its investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hallenstein Glasson. More…

| Total Revenues | Net Income | Net Margin |

| 403.88 | 34.52 | 8.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hallenstein Glasson. More…

| Operations | Investing | Financing |

| 66.25 | -12.99 | -49.99 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hallenstein Glasson. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 201.79 | 108.53 | 1.57 |

Key Ratios Snapshot

Some of the financial key ratios for Hallenstein Glasson are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.8% | -8.5% | 3.9% |

| FCF Margin | ROE | ROA |

| 13.2% | 10.7% | 4.9% |

Analysis

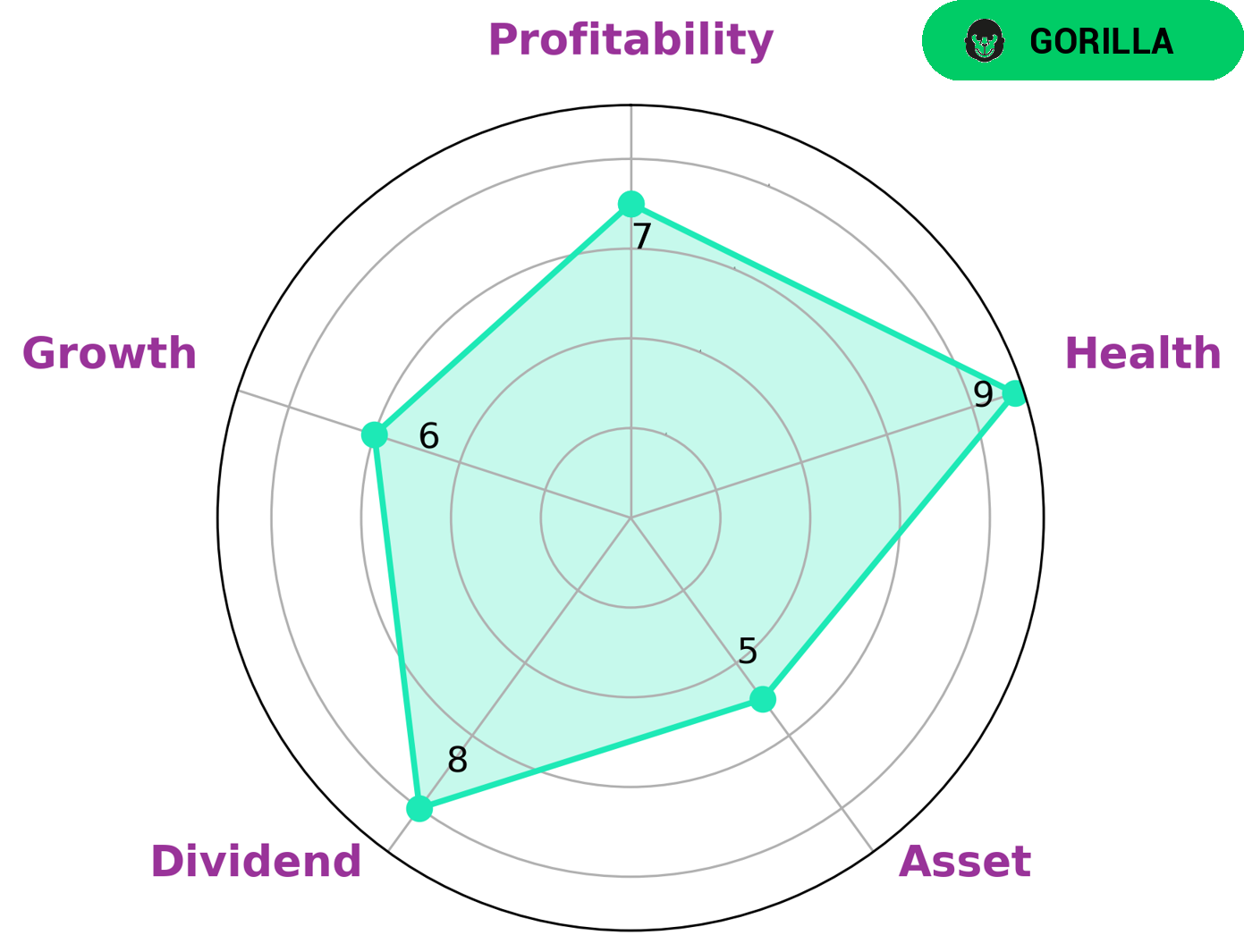

GoodWhale recently analyzed the financials of Hallenstein Glasson and our Star Chart showed that the company is strong in dividend, profitability and medium in asset and growth. We classified it as a ‘gorilla’ – a type of business that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors looking for a company with consistent and steady revenue growth may find this company to be an attractive investment opportunity. Furthermore, Hallenstein Glasson has a high health score of 9/10 with regard to its cashflows and debt, indicating that it is capable of sustaining future operations even in times of crisis. Investors seeking established and resilient companies may want to consider investing in Hallenstein Glasson. More…

Peers

It operates a range of brands covering a wide range of fashion styles and designs, offering high-quality clothing and accessories for men and women. Hallenstein Glassons Holdings Ltd is a leader in the industry, facing intense competition from a number of other companies, such as Mosaic Brands Ltd, Best & Less Group Holdings Ltd, and Lovisa Holdings Ltd. These companies are also major players in the fashion retail industry, offering a range of clothing and accessories for their customers.

– Mosaic Brands Ltd ($ASX:MOZ)

Mosaic Brands Limited is an Australian apparel and retail business that sources, designs, markets and sells products through its retail stores and online presence. The company has a market capitalization of 40.74M as of 2023, which indicates the total value of the company’s shares on the stock market. Furthermore, Mosaic Brands Limited has a Return on Equity of 16.63%, meaning that for every dollar of shareholder’s equity, the company earns 16.63 cents in profit. This impressive ROE indicates that the company’s management is using the shareholders’ capital efficiently and effectively to generate returns.

– Best & Less Group holdings Ltd ($ASX:BST)

Best & Less Group Holdings Ltd is an Australian-based retail company operating over 200 stores across Australia and New Zealand. The company’s main products include clothing, manchester, and accessories for men, women, and children. Best & Less has a market capitalization of 263.27 million as of 2023, indicating the company’s size and value. The company has also achieved a Return on Equity (ROE) of 49.85%, which is a measure of how efficiently the firm is generating profits from its shareholders’ investments. This strong return suggests that Best & Less is successful in its operations and is using its investments wisely.

– Lovisa Holdings Ltd ($ASX:LOV)

Lovisa Holdings Ltd is a retail jewellery company that has been in operation since 2010. As of 2023, the company has a market capitalization of 2.69 billion, which represents its total value. Additionally, the company’s ROE, which measures its profitability relative to the amount of equity investors have in the business, stands at 83.94%. This indicates that the company has had strong profits over the years and is generating substantial returns for its shareholders.

Summary

HALLENSTEIN GLASSON is an attractive option for dividend investors. Over the past three years, they have consistently issued a dividend of 0.42, 0.42, and 0.62 NZD per share. For 2021 to 2023, the dividend yield stands at 7.28%, 6.15%, and 11.08%.

On average, dividend yield is estimated at 8.17%. HALLENSTEIN GLASSON is a strong dividend play for investors looking for steady and reliable income.

Recent Posts