Duluth Holdings Intrinsic Value Calculator – DULUTH HOLDINGS Reports Q2 Earnings Results for FY2024, as of July 31 2023

September 3, 2023

🌥️Earnings Overview

On August 31 2023, DULUTH HOLDINGS ($NASDAQ:DLTH) reported their financial results for the second quarter of FY2024, ending July 31 2023. Total revenue for the quarter was USD 139.1 million, a decrease of 1.7% compared to the same period in the previous year. Net income for Q2 of FY2024 came in at USD -2.0 million, compared to USD 2.4 million the year before.

Stock Price

This news sent shockwaves through the stock market as DULUTH HOLDINGS stock opened at $6.9 and closed at $6.4, plunge by 13.5% from its previous closing price of 7.3. This sudden change in price reflects the market’s reaction to the company’s financial performance over the past quarter. This indicates that their ability to generate profits from their sales was not as strong as it was previously and could be an indicator of future issues.

Despite this, DULUTH HOLDINGS still remains a popular choice among investors looking for a steady and reliable stock with good potential for long-term growth. The company’s performance in Q2 does not appear to have affected investor confidence significantly, as the stock continues to trade relatively close to its pre-earnings levels. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Duluth Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 767.04 | -12.56 | -1.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Duluth Holdings. More…

| Operations | Investing | Financing |

| 34.26 | -35.31 | -3.17 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Duluth Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 503.14 | 279.68 | 6.56 |

Key Ratios Snapshot

Some of the financial key ratios for Duluth Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.0% | -39.5% | -1.6% |

| FCF Margin | ROE | ROA |

| -0.2% | -3.4% | -1.5% |

Analysis – Duluth Holdings Intrinsic Value Calculator

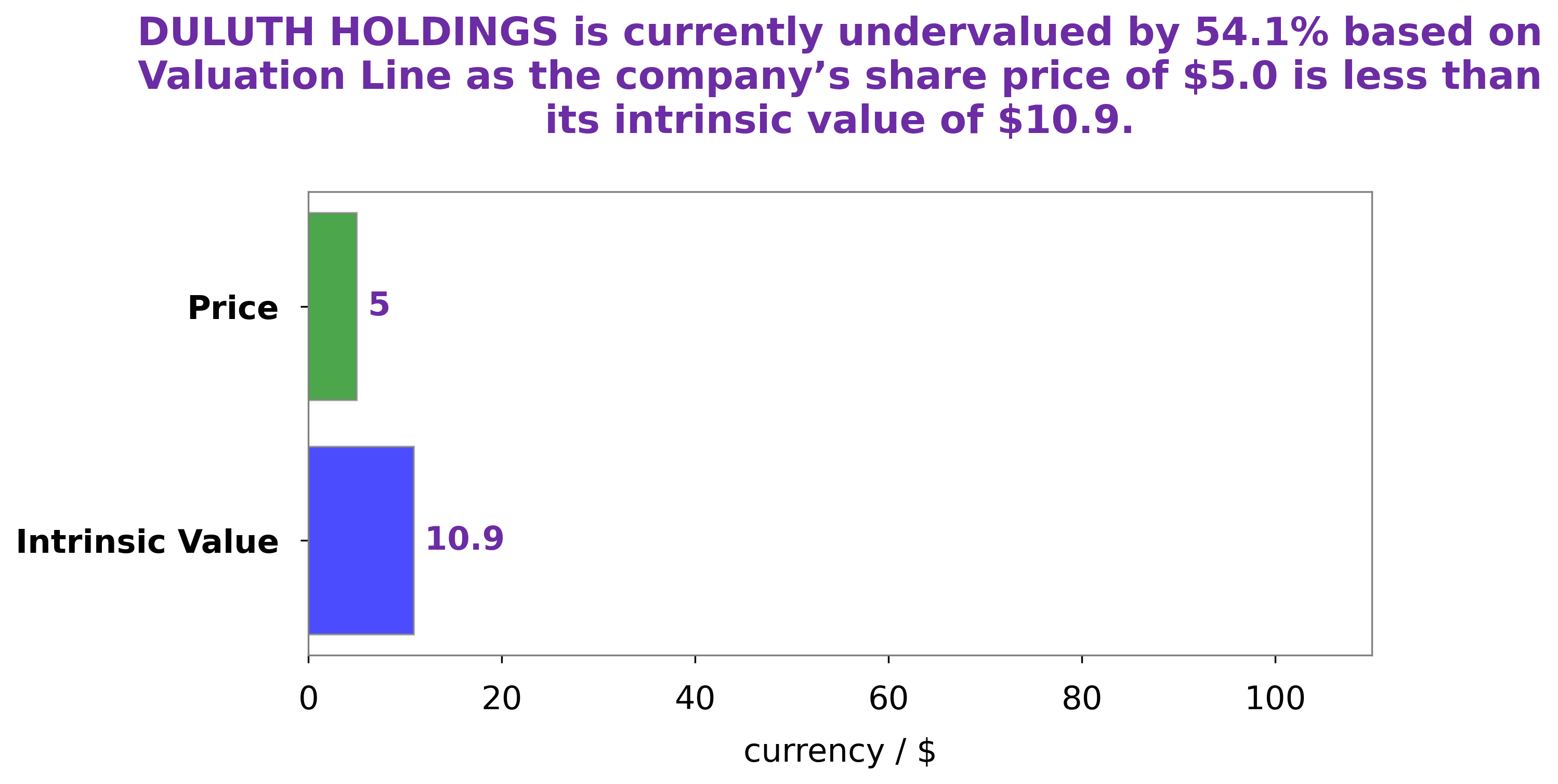

GoodWhale has conducted an analysis of DULUTH HOLDINGS‘s wellbeing in order to provide investors an insight into the company’s current position. Our proprietary Valuation Line has concluded that the fair value of the DULUTH HOLDINGS share is around $11.9. However, the stock is currently trading at $6.4, representing a significant discount of 46.2% to our calculated fair value. As such, we believe that DULUTH HOLDINGS stock is currently undervalued and could provide a good investment opportunity. More…

Peers

Duluth Holdings Inc is an online retailer that specializes in providing casual wear, workwear, and outerwear for men and women. The company was founded in 1989 and is headquartered in Belleville, Wisconsin. Duluth Holdings Inc operates under the name Duluth Trading Company. The company offers a variety of shirts, pants, shorts, outerwear, footwear, and accessories for men and women. Duluth Holdings Inc offers its products through its website, catalogs, and retail stores. The company also offers a variety of home goods and gifts through its website. Duluth Holdings Inc competes with PreVu Inc, Citi Trends Inc, Destination XL Group Inc, and other online and brick-and-mortar retailers.

– PreVu Inc ($OTCPK:PRVU)

PreVu Inc is a company that provides market research and analysis services. It has a market cap of 159.57k as of 2022 and a return on equity of 20.12%. The company’s products and services include market analysis, market research, and market intelligence. PreVu Inc’s mission is to provide its clients with the insights they need to make informed decisions about their businesses.

– Citi Trends Inc ($NASDAQ:CTRN)

Citi Trends Inc is a company that focuses on selling affordable fashion apparel and accessories for women, men, and children. As of 2022, the company has a market cap of 175.05 million and a return on equity of 27.52%. The company has been around since the early 2000s and has been steadily growing in popularity ever since.

– Destination XL Group Inc ($NASDAQ:DXLG)

Destination XL Group is a specialty retailer of men’s apparel with over 600 stores across the United States. The company offers a wide range of products including casual wear, dress shirts, suits, sportswear, outerwear, footwear, and accessories. Destination XL Group has a market cap of 428.59M as of 2022 and a Return on Equity of 41.63%. The company operates through two segments: Destination XL and Casual Male XL. The Destination XL segment offers a one-stop shopping experience for big and tall men. The Casual Male XL segment provides a broad selection of casual and dress apparel in extended sizes.

Summary

Investors in DULUTH HOLDINGS have been disappointed with the company’s financial results for FY2024 Q2 as reported on August 31 2023. Total revenue decreased by 1.7% year-on-year to USD 139.1 million, and net income reported a decline of -2.0 million, compared to 2.4 million in the same period of the previous year. As a result, stock price moved down significantly on the same day. Investors should take into account the company’s recent performance when considering investing in DULUTH HOLDINGS in the future.

Recent Posts