BUCKLE Reports Second Quarter Earnings for FY2024 Ending August 18, 2023

August 26, 2023

🌥️Earnings Overview

BUCKLE ($NYSE:BKE) reported total revenue of USD 292.4 million and a net income of USD 45.6 million for the second quarter of FY2024, ending August 18 2023. This marked a 3.2% decrease in revenue and a 9.0% decrease in net income compared to the same period in the previous year.

Stock Price

On Friday, BUCKLE reported its second quarter earnings for the fiscal year 2024 ending August 18, 2023. The clothing retailer saw a positive outcome in its performance, with stock opening at $36.1 and closing at an impressive $37.4, up by 2.5% from its last closing price of 36.4. This marks the fourth consecutive quarter of increased stock prices for BUCKLE, further demonstrating its commitment to providing quality products and services to its customers. Overall, these financial results showcase BUCKLE’s commitment to running a successful business.

The company has been able to consistently provide quality products and services to its customers with strong financial results. Investors are sure to be pleased by these results and can expect more positive news from BUCKLE in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Buckle. BUCKLE_Reports_Second_Quarter_Earnings_for_FY2024_Ending_August_18_2023″>More…

| Total Revenues | Net Income | Net Margin |

| 1.31k | 237.8 | 18.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Buckle. BUCKLE_Reports_Second_Quarter_Earnings_for_FY2024_Ending_August_18_2023″>More…

| Operations | Investing | Financing |

| 254.17 | -41.4 | -202.88 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Buckle. BUCKLE_Reports_Second_Quarter_Earnings_for_FY2024_Ending_August_18_2023″>More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 861.55 | 425.01 | 8.65 |

Key Ratios Snapshot

Some of the financial key ratios for Buckle are shown below. BUCKLE_Reports_Second_Quarter_Earnings_for_FY2024_Ending_August_18_2023″>More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 16.6% | 34.8% | 22.9% |

| FCF Margin | ROE | ROA |

| 16.9% | 44.5% | 21.8% |

Analysis

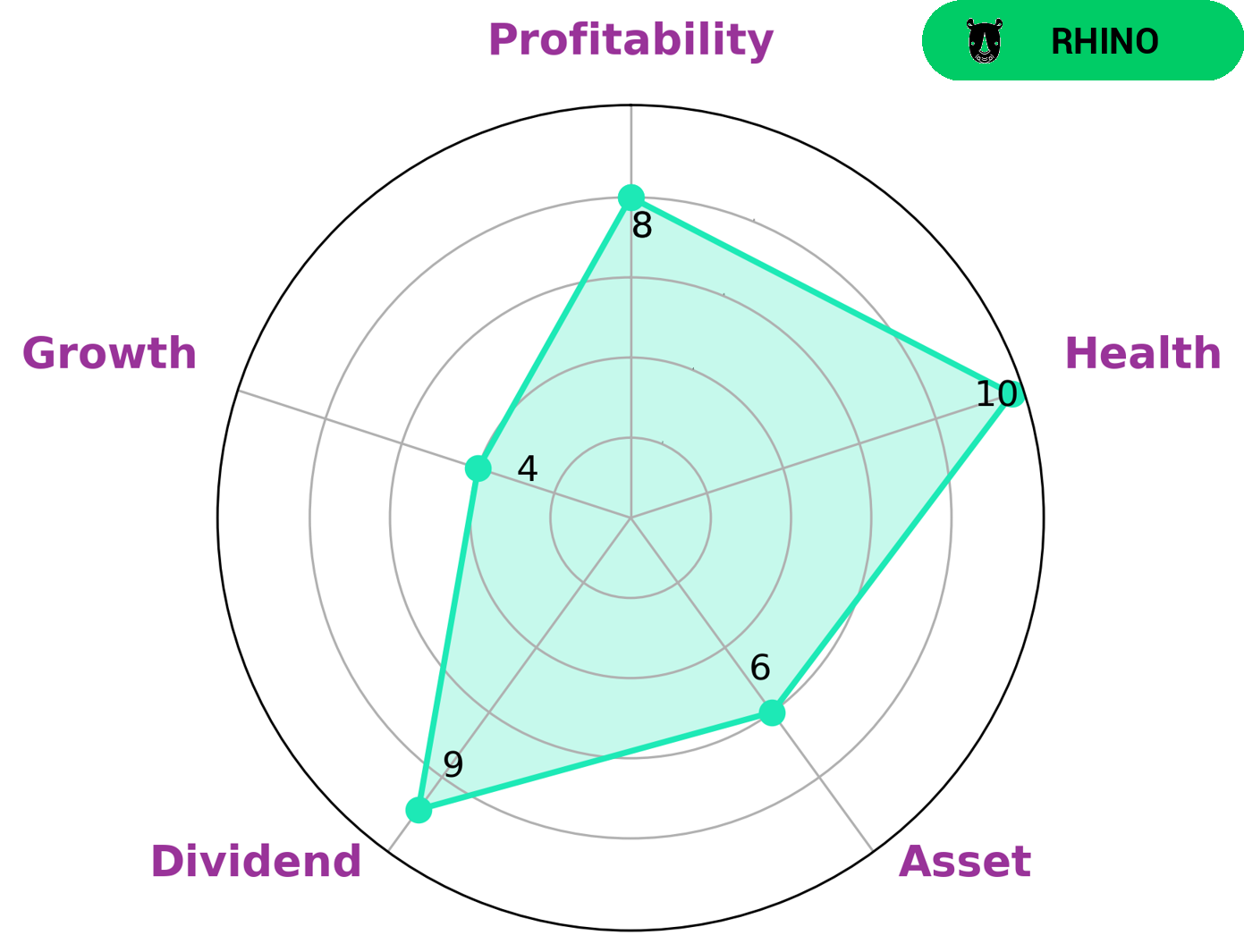

GoodWhale recently performed an analysis of BUCKLE‘s wellbeing and the results are positive. According to our Star Chart, BUCKLE has a high health score of 10/10 with regard to cashflows and debt, which means that the company is capable of sustaining future operations in times of crisis. BUCKLE is particularly strong in dividend and profitability, and medium in asset and growth. Based on our analysis, we classify BUCKLE as a ‘rhino’ – a type of company that has achieved moderate revenue or earnings growth. Given the nature of BUCKLE’s performance, we believe that value investors may be interested in this company. Since BUCKLE is well-positioned to sustain operations during difficult times, investors who prioritize stability and security might also find BUCKLE to be a good investment opportunity. More…

Peers

Buckle Inc. is an American fashion retailer that specializes in selling apparel, footwear, and accessories for men and women. The company operates through two segments: Retail and Direct. The Retail segment consists of the company’s stores, e-commerce, and catalog businesses. The Direct segment includes the company’s credit card business. Buckle Inc. competes with Citi Trends Inc, Vedant Fashions Ltd, Gfoot Co Ltd, and other retailers who sell similar products.

– Citi Trends Inc ($NASDAQ:CTRN)

Citi Trends Inc is a specialty retailer of urban lifestyle apparel and accessories for men, women, and children. The company has a market cap of 183.43M and a ROE of 27.52%. Citi Trends operates over 700 stores in 33 states, primarily in the southeastern United States. The company offers a variety of apparel, including t-shirts, hoodies, jeans, and dresses, as well as accessories such as jewelry, belts, and handbags. Citi Trends’ mission is to provide affordable, trendy apparel and accessories for its customers.

– Vedant Fashions Ltd ($BSE:543463)

Vedant Fashions Ltd is an Indian clothing company with a market cap of 347.93B as of 2022. The company has a Return on Equity of 38.43%. Vedant Fashions Ltd is a leading manufacturer and retailer of clothing in India. The company designs, manufactures, and markets a wide range of clothing products for men, women, and children. Vedant Fashions Ltd has a wide network of retail outlets across India. The company also has an online presence through its website and mobile app.

– Gfoot Co Ltd ($TSE:2686)

Gfoot Co Ltd is a company that manufactures and sells footwear. It has a market cap of 12.42B as of 2022 and a Return on Equity of -375.46%. The company’s products are sold in over 100 countries and it has over 30,000 employees.

Summary

BUCKLE recently reported their earnings results for the second quarter of FY2024, ending August 18 2023. Total revenue decreased by 3.2% to USD 292.4 million and net income decreased by 9.0% to USD 45.6 million, compared to the same period the previous year. This may be an indication that investors should proceed with caution when making investments in this company.

Factors such as the current macroeconomic environment, rising costs and competition should be taken into consideration when evaluating BUCKLE’s long-term growth potential. Investors should also be aware of any changes in the company’s financial position that could impact its future performance.

Recent Posts