ANF Stock Fair Value Calculation – Argus Cautions Investors on Abercrombie & Fitch Margin Squeeze

April 13, 2023

Trending News 🌥️

Argus Research has downgraded its rating of Abercrombie & Fitch ($NYSE:ANF) (ANF) from Buy to Hold due to concerns about the company’s narrowing margins. This comes as a shock to investors, as ANF has gained considerable momentum in recent years and the stock was trading at record highs. Abercrombie & Fitch is an American retailer that specializes in apparel and accessories for young adults. The company operates retail stores in the U.S., Canada, and Europe, but also has an online presence with a website and digital app. In recent years, they have enjoyed robust growth and a surge in share prices.

However, Argus is now cautioning investors on ANF’s increasingly squeezed margins. While ANF’s sales have grown, their operating expenses have grown at a faster rate. This has led to a narrowing of the company’s margins and a more conservative stance from the research firm. It remains to be seen how this news will affect ANF’s stock price, but Argus’ decision to downgrade their rating is certainly cause for concern among investors. It remains to be seen if Abercrombie & Fitch can successfully manage their cost structure and regain their momentum in the market.

Stock Price

On Wednesday, Argus Research issued a caution to investors that Abercrombie & Fitch (ANF) may be facing a margin squeeze. The warning was sparked by the stock’s drop of 6.7% from its previous closing price of 27.4, opening at $26.8 and closing at $25.6. Argus noted that while ANF has successfully reversed its plunge in sales and profitability, leading to higher share prices, the company’s margins are now under pressure. They also highlighted concerns over the company’s ability to continue to leverage its costs and reposition itself as a premium fashion retailer.

In addition, they noted that the company faces further competition in the retail sector and may struggle to maintain market share. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for ANF. More…

| Total Revenues | Net Income | Net Margin |

| 3.7k | 2.82 | 0.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for ANF. More…

| Operations | Investing | Financing |

| -2.34 | -140.68 | -155.33 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for ANF. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.71k | 2.01k | 14.18 |

Key Ratios Snapshot

Some of the financial key ratios for ANF are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 0.7% | 6.1% | 2.5% |

| FCF Margin | ROE | ROA |

| -4.5% | 8.6% | 2.1% |

Analysis – ANF Stock Fair Value Calculation

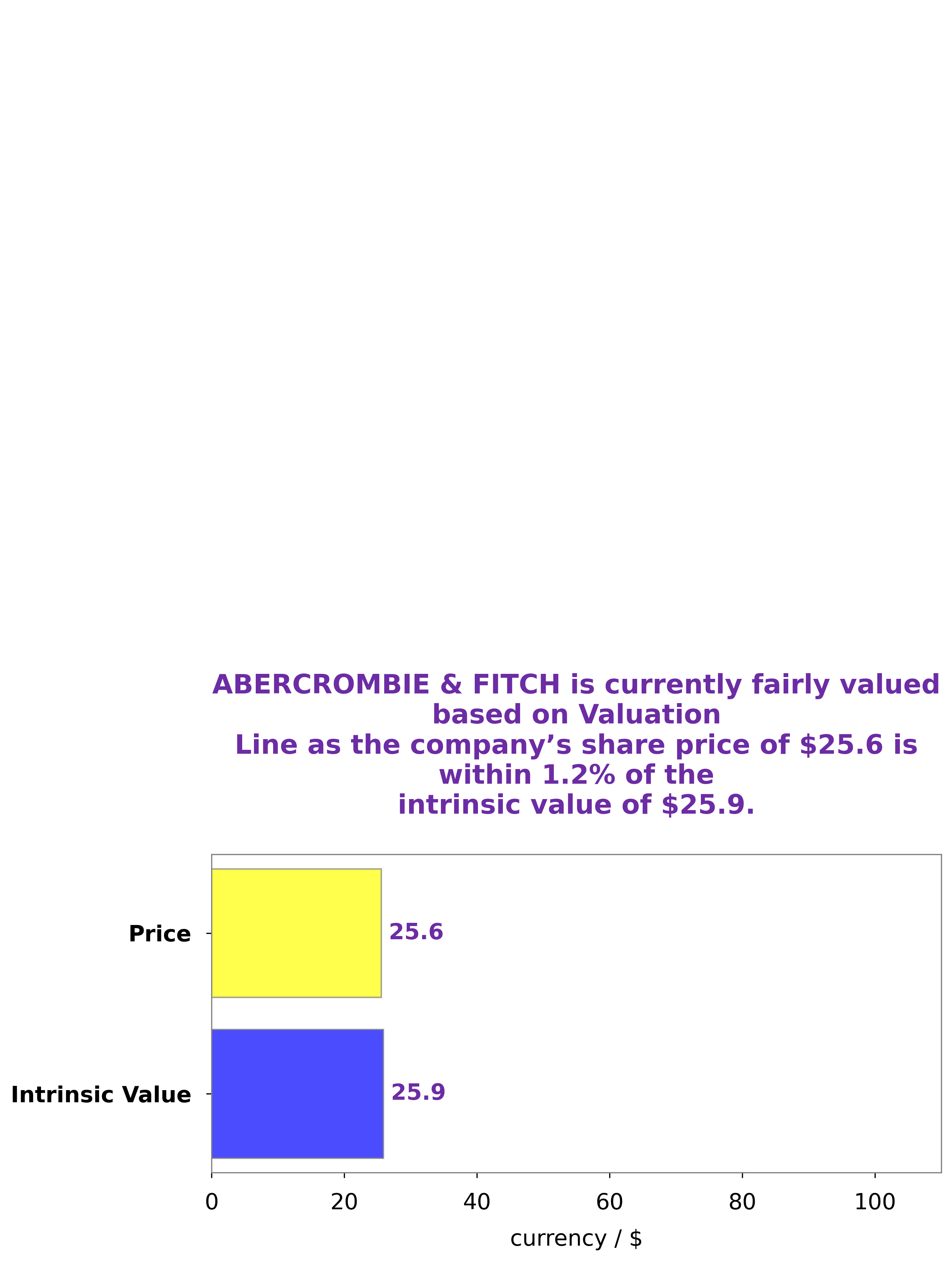

At GoodWhale, we have conducted a comprehensive analysis of ABERCROMBIE & FITCH’s financials and have calculated its intrinsic value to be around $25.9. This figure was determined using our proprietary Valuation Line. More…

Peers

Competition between Abercrombie & Fitch Co and its competitors, Gap Inc, Children’s Place Inc, and Ross Stores Inc, is fierce. All four companies specialize in retail apparel and strive to offer their customers the best products and services. As a result, each company constantly works to outpace the others in terms of product offerings, store locations, and customer service.

– Gap Inc ($NYSE:GPS)

Gap Inc is a leading apparel retail company based in San Francisco, California. The company offers apparel, accessories, and personal care products for men, women, and children through its brands, which include Gap, Old Navy, Banana Republic, Athleta, and Intermix. As of 2022, Gap Inc. has a market capitalization of 4.4 billion dollars and a return on equity of -0.62%. This is lower than the industry average for apparel retail companies, indicating that the company has not been able to generate a satisfactory return on its equity investments. However, the company’s market capitalization of 4.4 billion dollars suggests that investors are still confident in the company’s future prospects.

– Children’s Place Inc ($NASDAQ:PLCE)

Children’s Place Inc is a popular children’s apparel retailer with a market cap of 461.48M as of 2022. The company offers a variety of clothing, accessories, and footwear for kids ranging from newborn to age 14. They have an impressive Return on Equity of 41.18%, which is a measure of the company’s ability to generate income from shareholders’ investments. This is a strong indicator of the company’s financial health and its ability to make efficient use of capital. The Children’s Place Inc is well-positioned to continue to provide great products and services to its customers in the years to come.

– Ross Stores Inc ($NASDAQ:ROST)

Ross Stores Inc is a leading off-price retailer in the United States. It operates 1,400 stores in 39 states, the District of Columbia, and Guam. The company offers apparel, accessories, footwear, and home fashions at discounts of 20% to 60% below department and specialty store regular prices. As of 2022, Ross Stores Inc has a market capitalization of 39.77B and a Return on Equity (ROE) of 29.12%. This reflects the company’s strong financial performance and ability to generate significant returns for its shareholders. Ross Stores has consistently recorded positive earnings growth for over 10 years and is well positioned for future growth.

Summary

Abercrombie & Fitch has been under the microscope from investors recently due to concerns over the company’s margins. Argus Research responded to the concerns by downgrading the stock from a “buy” recommendation to a “hold” recommendation. This downgrade caused the stock to fall on the same day, indicating that investors were taking the downgrade seriously. Investors should continue to monitor Abercrombie & Fitch’s financials to ensure that their margins remain healthy and that they are able to execute their turnaround plans.

It is also important to assess their competitive positioning in the retail sector and to consider the implications of macroeconomic conditions such as consumer spending trends. In general, investors should exercise caution when investing in Abercrombie & Fitch given the company’s recent struggles and the uncertain outlook for the retail sector.

Recent Posts