Century Aluminum Struggles to Adapt in Tough Economic Climate

January 31, 2023

Trending News 🌧️

Century Aluminum ($NASDAQ:CENX) Company is a global leader in the production of aluminum. Unfortunately, Century Aluminum has recently been struggling to adapt to the tough economic climate. High input costs have severely affected the company’s main U.S. facility, leading to a limited production range. This has put a strain on Century Aluminum’s ability to stay competitive in the global market. The fluctuating prices of raw materials, such as aluminum, have also had a negative impact on the company’s bottom line.

In addition, the company’s energy costs have been increasing significantly, due to the need to use more energy-efficient methods of production. These include reducing overhead and labor costs, as well as exploring alternative sources of energy. The company has also invested in new technologies to reduce the amount of energy needed for production. In addition, Century Aluminum has focused on diversifying its customer base, in order to reduce reliance on a single market. The company will need to continue to find ways to reduce costs while also improving efficiency in order to remain competitive. In order to do this, Century Aluminum must remain committed to investing in new technologies and finding innovative solutions that can help it weather the storm and remain profitable in the long term.

Stock Price

On Monday, CENTURY ALUMINUM stock opened at $10.7 and closed at $10.6, down by 0.1% from prior closing price of 10.6. The company has been unable to navigate this difficult economic environment and its stock price has been impacted significantly as a result. The company has implemented several strategies to try and cope with the current market conditions. It has reduced costs by eliminating some jobs and cutting back on production and overhead costs. Additionally, the company has worked to increase efficiency by streamlining processes and investing in new technologies. Moreover, Century Aluminum has sought to diversify its product offerings by introducing new products and services. Its stock price remains volatile and the company has had to make difficult decisions such as reducing staff, cutting production, and diversifying its products and services. As a result, Century Aluminum has had to make adjustments to its business model in order to remain competitive. Its stock price has been impacted and it has had to make difficult decisions to remain competitive.

However, the company is showing resilience and is continuing to work to remain profitable in this challenging environment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Century Aluminum. More…

| Total Revenues | Net Income | Net Margin |

| 2.91k | 153.8 | 1.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Century Aluminum. More…

| Operations | Investing | Financing |

| 4.6 | -107 | 99.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Century Aluminum. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.58k | 1.07k | 5.66 |

Key Ratios Snapshot

Some of the financial key ratios for Century Aluminum are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.5% | -16.8% | 9.1% |

| FCF Margin | ROE | ROA |

| -3.5% | 33.3% | 10.5% |

VI Analysis

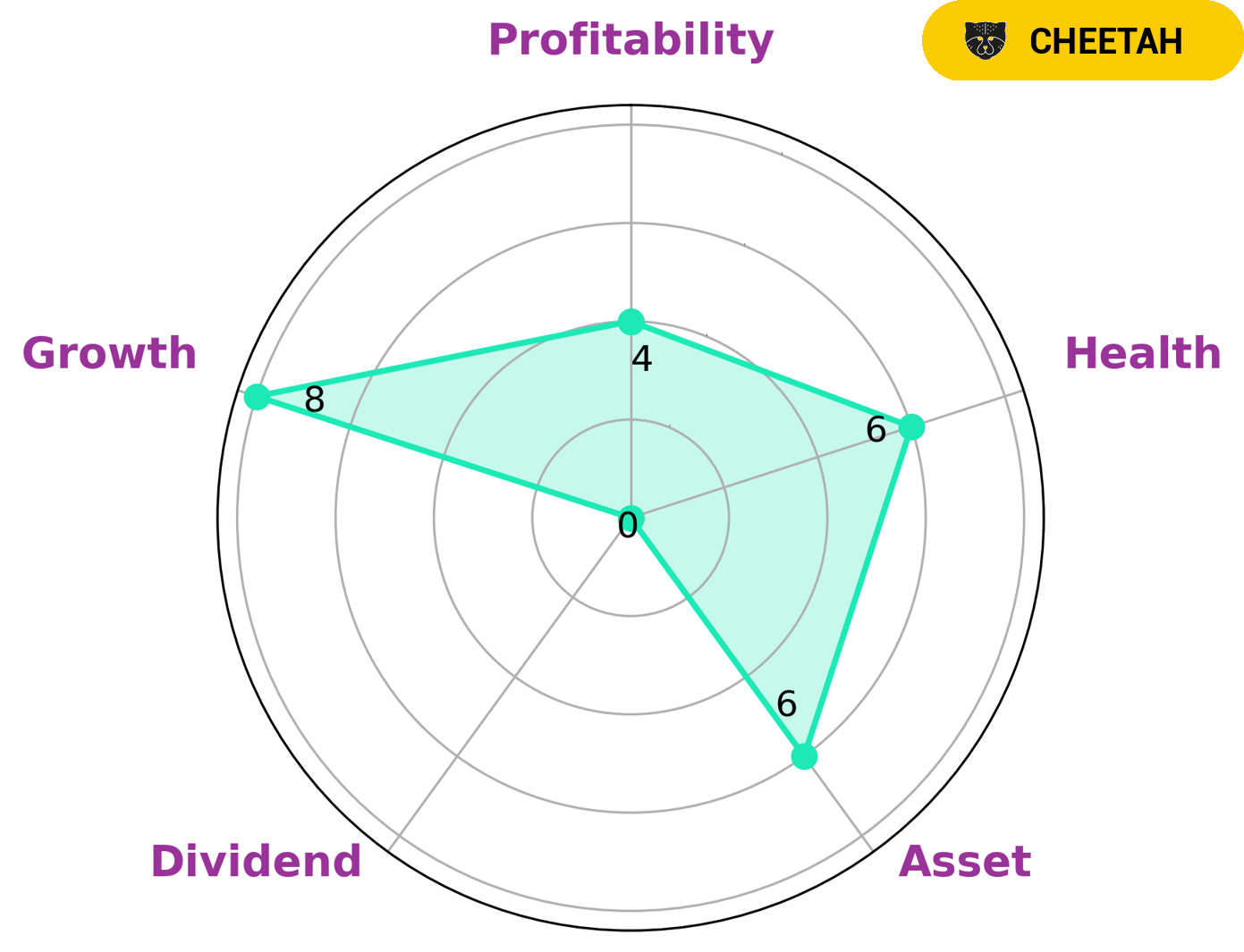

Century Aluminum is a company that has potential to generate long-term value, as reflected in its fundamentals. The VI Star Chart assigns it an intermediate health score of 6/10, indicating that it may be able to pay off debt and fund future operations. Century Aluminum is classified as a “cheetah” company, which means it has achieved high revenue or earnings growth, but is less stable due to lower profitability. Investors that may be interested in Century Aluminum are those that value growth over stability. It has strong growth potential, but its asset, profitability and dividend scores are only medium. This means investors should be aware of the risks associated with investing in such a company. Overall, Century Aluminum is a company that could offer long-term value, but investors should be aware of its lower profitability and the associated risks. As long as investors perform their due diligence and understand the risks involved, they may find this company a worthwhile investment. More…

VI Peers

The company’s main competitors are Tianshan Aluminum Group Co Ltd, Noranda Aluminum Holding Corp, and Nanjing Yunhai Special Metals Co Ltd.

– Tianshan Aluminum Group Co Ltd ($SZSE:002532)

Tianshan Aluminum Group Co Ltd is a Chinese aluminum producer. The company has a market cap of 30.98B as of 2022 and a Return on Equity of 16.7%. Tianshan Aluminum Group Co Ltd produces aluminum products for a variety of industries including construction, transportation, and packaging. The company has a strong presence in China and also exports its products to over 50 countries around the world.

– Noranda Aluminum Holding Corp ($OTCPK:NORNQ)

Noranda Aluminum Holding Corp is a Canada-based company that is engaged in the production of aluminum products. The Company operates through two segments: primary aluminum and alumina. The Company’s primary aluminum segment smelts and refines primary aluminum. The Company’s alumina segment mines, refines and markets alumina. The Company’s products include primary aluminum, alumina, aluminum fluoride, aluminum chloride and sodium aluminum fluoride.

– Nanjing Yunhai Special Metals Co Ltd ($SZSE:002182)

Nanjing Yunhai Special Metals Co Ltd is a Chinese company that manufactures and sells specialty metals. It has a market capitalization of 14.83 billion as of 2022 and a return on equity of 18.83%. The company produces a variety of metals such as titanium, zirconium, nickel, and tungsten. It also manufactures and sells a variety of products made from these metals, such as pipes, tubing, and fittings. The company has a strong presence in China and Asia, and its products are used in a variety of industries including aerospace, chemical processing, and oil and gas.

Summary

Century Aluminum is a major aluminum producer that has been struggling to adapt to the current economic climate. The company’s stock price has dropped significantly in recent months due to the global pandemic and its impact on the economy. Investors have been cautious in their approach to Century Aluminum, citing its high levels of debt and declining margins. Furthermore, aluminum prices have been falling, which has put further pressure on the company’s profitability.

Century Aluminum has implemented a number of cost-cutting measures in an effort to stay competitive, but these efforts appear to be insufficient to offset the ongoing economic downturn. Given the uncertainty of the economic climate, investors are advised to proceed with caution when considering investing in Century Aluminum.

Recent Posts