Sats Ltd Intrinsic Stock Value – SATS LTD Reports Earnings Results for FY2024 Q2, As of September 30 2023

November 21, 2023

🌥️Earnings Overview

SATS LTD ($SGX:S58) announced their Q2 FY2024 financial results on November 10 2023, with a total revenue of SGD 1282.0 million for the period ending September 30 2023 – a year-over-year growth of 198.8%. Net income for the quarter was reported at SGD -37.7 million, compared to a loss of SGD -10.0 million in the same quarter the year before.

Market Price

SATS LTD reported their financial results for the second quarter of fiscal year 2024, ending on September 30, 2023. On Friday, the stock opened at SG$2.6 and closed at the same price. The company attributed the increase to higher costs associated with marketing and customer support activities.

The company is confident that its cost-saving initiatives will help improve profitability in upcoming quarters. Going forward, the company plans to focus on further increasing profits and expanding its business. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Sats Ltd. More…

| Total Revenues | Net Income | Net Margin |

| 3.43k | -1.81 | 0.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Sats Ltd. More…

| Operations | Investing | Financing |

| 181.75 | -1.74k | 1.39k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Sats Ltd. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 8.46k | 5.94k | 1.56 |

Key Ratios Snapshot

Some of the financial key ratios for Sats Ltd are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 34.3% | 0.7% | 4.1% |

| FCF Margin | ROE | ROA |

| 0.8% | 3.8% | 1.0% |

Analysis – Sats Ltd Intrinsic Stock Value

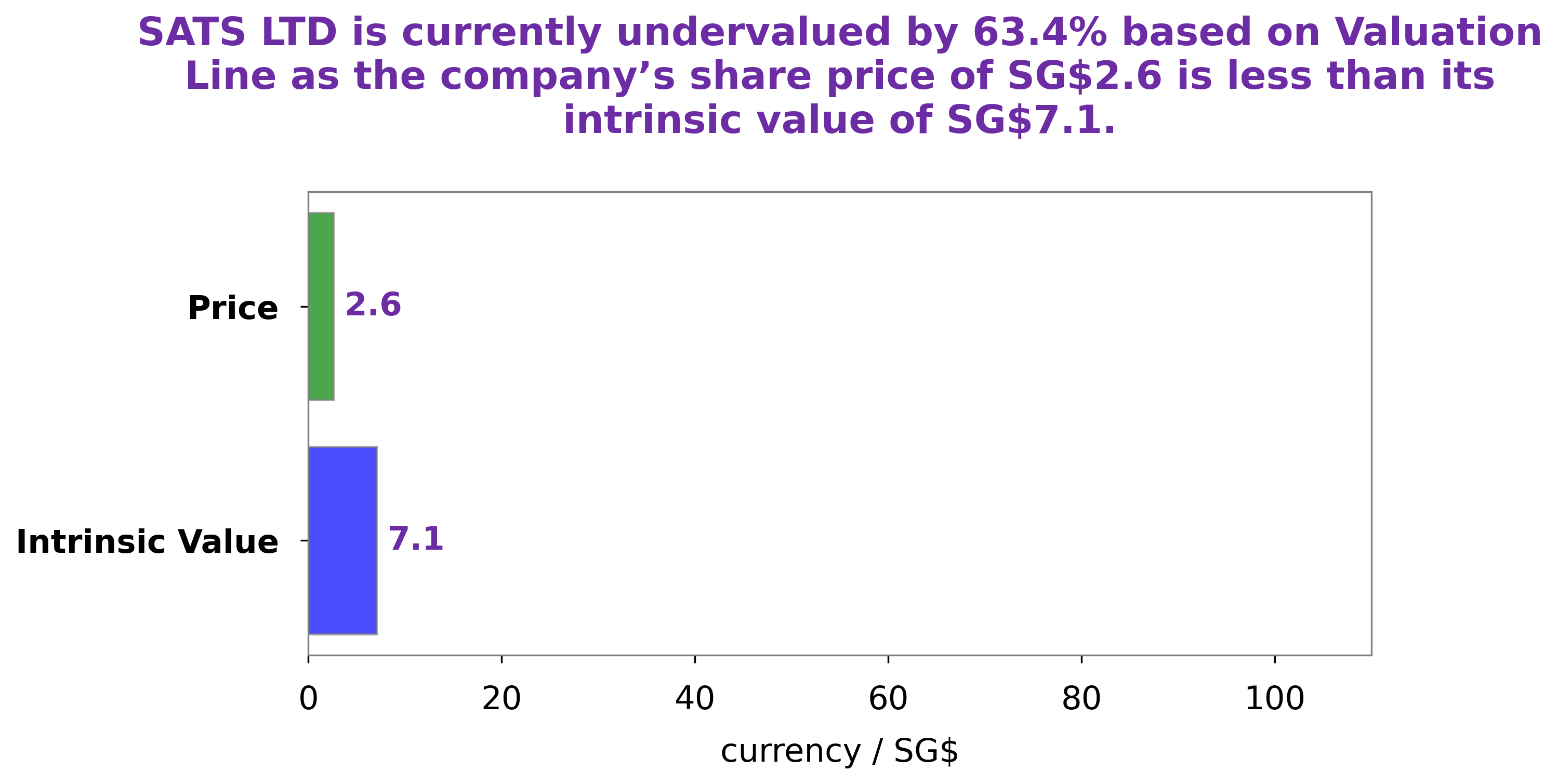

At GoodWhale, we have conducted an analysis of SATS LTD‘s financials and created a proprietary Valuation Line to come up with the fair value of SATS LTD’s shares. Our calculations show that the fair value of SATS LTD shares is around SG$7.1. Interestingly, the stock is currently traded on the market at SG$2.6, which is an undervaluation of 63.3%. This presents an opportunity for investors to purchase these shares at a discount and potentially gain from future appreciation in the share price. More…

Peers

It offers comprehensive services to the aviation industry, ranging from ground handling, catering, and airline operations to aviation engineering and cargo services. SATS Ltd faces competition from Cebu Air Inc, PT Jaya Trishindo Tbk, and Atlas Air Worldwide Holdings Inc, all of which provide similar services in the aviation industry.

– Cebu Air Inc ($PSE:CEB)

Cebu Air Inc is a Philippine-based airline operating flights to several international and domestic destinations. As of 2023, the company has achieved a market capitalization of 24.53 billion USD and a Return on Equity (ROE) of -3124.29%. Cebu Air Inc’s market cap demonstrates its size and financial strength within the industry, while its negative ROE indicates that the company is not generating profits from its shareholders’ investments. Cebu Air Inc’s efforts to increase its profitability are ongoing, through the introduction of new services and the expansion of existing ones.

– PT Jaya Trishindo Tbk ($IDX:HELI)

PT Jaya Trishindo Tbk is an Indonesia-based company that specializes in the production of paper, pulp and packaging products. As of 2023, the company has a market capitalization of 231.54 billion, making it one of the largest publicly traded companies in Indonesia. Its return on equity (ROE) of 5.55% indicates that the company is generating a healthy rate of return for its shareholders. The company’s strong financials and solid market capitalization demonstrate that it is well-positioned to continue to grow and develop in the future.

– Atlas Air Worldwide Holdings Inc ($NASDAQ:AAWW)

Atlas Air Worldwide Holdings Inc is a leading global provider of outsourced aircraft and aviation operating services. It is a publicly traded company with a market capitalization of 2.87 billion as of 2023. The company has maintained a healthy Return on Equity of 13.2%, indicating that it is an efficient and profitable business. Atlas Air Worldwide Holdings Inc provides air cargo charters and related services to customers around the world, and is a leader in providing safe and reliable air cargo services. The company also provides passenger charters and aircraft leasing services, enabling customers to access the most cost-effective solutions for their requirements.

Summary

SATS LTD reported strong Q2 FY2024 financial results with total revenue of SGD 1282 million, a 198.8% year-over-year increase. The company reported a net loss of SGD 37.7 million, however this was an improvement from Q2 FY2023 when they reported a loss of SGD 10 million. Investors should note that with such strong revenue growth, the future outlook for the company is promising and could make for an interesting investment opportunity. For more detailed analysis, investors should look at the company’s balance sheet and liquidity position to get a better understanding of their financial health.

Recent Posts