Airports of Thailand Reports Positive Q1 Results for 2022-2023 Fiscal Year

February 16, 2023

Earnings report

Airports ($BER:TX3A) of Thailand (AOT) reported their earnings results for the first quarter ending December 31 2022 on February 10 2023. The results demonstrated a significant increase in revenue and profit from the same period the previous year. The strong quarter can be attributed to numerous factors, such as higher passenger numbers and improved cost control. A further contributing factor to this positive quarter was the government’s latest aviation promotion policy, which has provided regulations and support in order to increase the number of people flying in Thailand. As of writing this report, the outlook for AOT is looking positive for the rest of the year. It is expected that the revenue generated in the second quarter should continue to grow, with continued cost control and improved airline performance.

In addition, AOT is planning to expand its operations with additional routes and airports, which is expected to drive further growth in long-term revenue and profits.

Share Price

Airports of Thailand (AOT) reported strong financial results for the first quarter of the 2022-2023 fiscal year. On Friday, AOT stocks opened at a steady €2.0 and ended the day flat at the same price, down by just 1.2% from the previous closing price. This reflects the company’s solid performance as it continues to strengthen its foothold in the Thai aviation market. The positive Q1 results come on the back of AOT’s successful rebranding campaign, which succeeded in increasing travellers’ confidence in the air travel experience in Thailand. Furthermore, the growth in passenger numbers can be attributed to the surge in international arrivals as a result of the country’s successful containment of the pandemic and the loosening of travel restrictions.

The company is optimistic that the trend will continue in the coming quarters, thanks to its robust measures designed to ensure a safe and secure air travel experience for all passengers. Overall, AOT’s Q1 performance is a strong indicator of its future prospects and a testament to the company’s ability to adapt to rapidly changing market conditions. With the outlook looking strong for Thailand’s aviation industry, there is no doubt that AOT will continue to be a major player in the country’s transport sector. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for TX3A. More…

| Total Revenues | Net Income | Net Margin |

| 23.06k | -6.47k | -27.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for TX3A. More…

| Operations | Investing | Financing |

| 5.92k | -7.51k | -1.23k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for TX3A. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 183.23k | 80.32k | 7.12 |

Key Ratios Snapshot

Some of the financial key ratios for TX3A are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -28.7% | -38.8% | -21.8% |

| FCF Margin | ROE | ROA |

| -15.7% | -3.1% | -1.7% |

Analysis

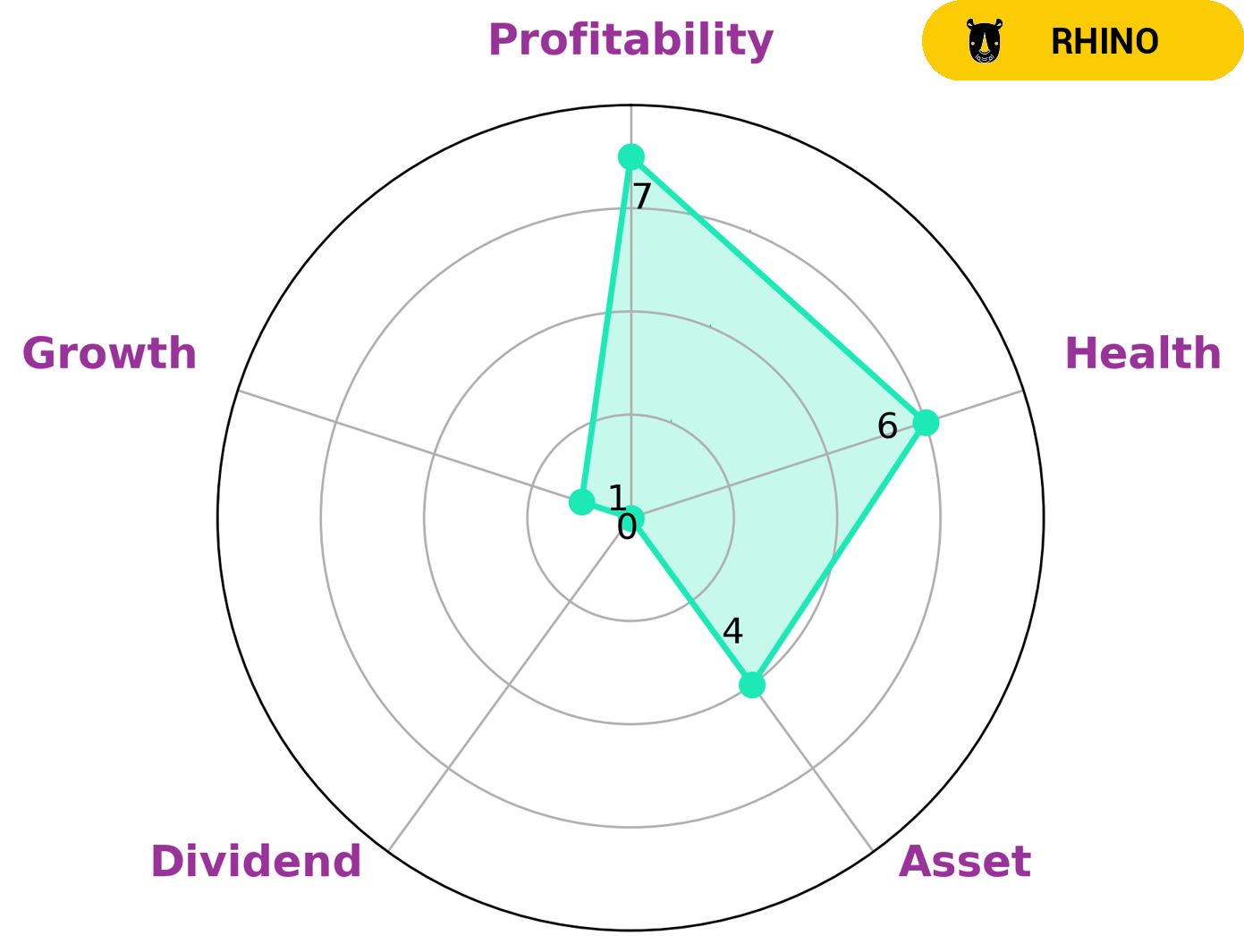

At GoodWhale, we conducted an analysis of AIRPORTS OF THAILAND’s fundamentals. According to our Star Chart, this company is classified as a ‘rhino’, meaning that it has achieved moderate revenue or earnings growth. Investors who may be interested in such a company include value investors who are comfortable with a moderate and stable rate of growth, as well as income seekers who are looking for a steady stream of dividend payments. When it comes to the metrics that make up our Star Chart, AIRPORTS OF THAILAND is strong in profitability and medium in asset, but weak in dividend and growth. Our health score for this company is 6/10, which means that AIRPORTS OF THAILAND has an intermediate health score in terms of its cash flows and debt, and is likely to sustain future operations in times of crisis. More…

Summary

Total revenue for the quarter was THB 342.8 million, up 108.0% from the same period last year, while net income surged 279.1% to THB 8824.0 million. These results demonstrate AOT’s successful implementation of strategies to maximize efficiency and help raise overall returns. As such, AOT is well-positioned for future growth, making it an attractive investment opportunity for those looking for reliable returns in the aviation infrastructure sector.

Recent Posts