Spirit Airlines Stock Slips Despite Market Gains on Thursday

June 12, 2023

🌧️Trending News

Spirit Airlines ($NYSE:SAVE) Inc. is an American ultra-low-cost carrier headquartered in Miramar, Florida. On Thursday, despite the increased gains of the market, Spirit Airlines Inc. was not able to keep up with its competitors. Their stock dropped 1.02% to $15.55, while the NASDAQ Composite Index increased by 0.98% to 10,902.99. Analysts believe that the drop in share prices could be attributed to the fact that Spirit Airlines Inc. is relatively new to the market and does not have the same level of brand recognition as competitors such as American Airlines or United Airlines.

Additionally, Spirit Airlines Inc.’s business model is focused on ultra-low cost flying, which means that they can be susceptible to market volatility when demand for air travel falls due to external factors such as a global pandemic.

Market Price

Despite the overall market gains on Thursday, Spirit Airlines Inc. stock took a hit on Friday. This could be attributed to the fact that the airline has recently experienced several operational issues, such as delayed flights and cancellations, which could be having a negative impact on investor sentiment. Despite these issues, Spirit Airlines remains one of the largest low-cost carriers in the U.S., and its stock remains a viable option for investors looking to diversify their portfolios. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Spirit Airlines. More…

| Total Revenues | Net Income | Net Margin |

| 5.45k | -463.36 | -2.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Spirit Airlines. More…

| Operations | Investing | Financing |

| 32.21 | -275.39 | 306.98 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Spirit Airlines. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 9.32k | 7.85k | 13.46 |

Key Ratios Snapshot

Some of the financial key ratios for Spirit Airlines are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 13.3% | 2.3% | -8.9% |

| FCF Margin | ROE | ROA |

| -4.9% | -20.0% | -3.3% |

Analysis

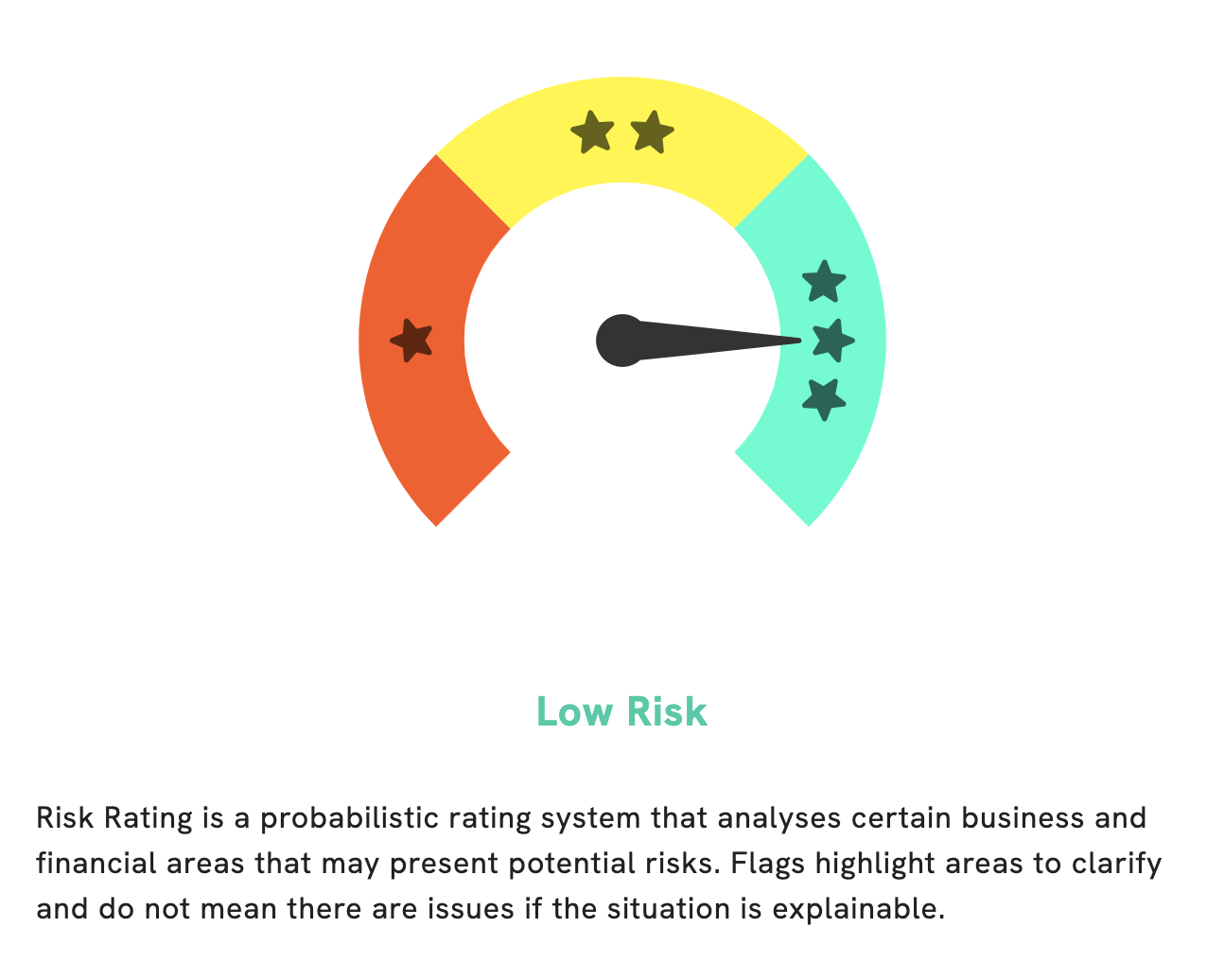

At GoodWhale, we recently performed an analysis to evaluate the wellbeing of SPIRIT AIRLINES. After evaluating the financial and business aspects, we gave SPIRIT AIRLINES a low risk rating. We detected two risk warnings in the income sheet and cashflow statement but, to view our detailed findings, you must be a registered user. Our findings provide you with an up-to-date look at how SPIRIT AIRLINES is performing and can help you make better decisions about investing in the company. More…

Peers

Spirit Airlines Inc competes with Frontier Group Holdings Inc, JetBlue Airways Corp, and Southwest Airlines Co in the airline industry. Each company has a different business model, but all are trying to attract customers with low fares. Spirit Airlines Inc has been successful in this by offering bare-bones fares that are much lower than its competitors.

– Frontier Group Holdings Inc ($NASDAQ:ULCC)

Frontier Group Holdings Inc is a provider of communication services in the United States. The company offers broadband, video, and voice services to residential and business customers. It also provides data and Internet services. The company was founded in 1935 and is headquartered in Stamford, Connecticut.

– JetBlue Airways Corp ($NASDAQ:JBLU)

JetBlue Airways Corporation is an American airline company. It is the 6th-largest airline in the United States. The company was founded in 1998 and is headquartered in New York City. JetBlue Airways operates flights to more than 100 destinations in the United States, Caribbean, and Latin America. The company has a market capitalization of $2.46 billion as of 2022 and a return on equity of -8.81%. JetBlue Airways is a publicly traded company listed on the Nasdaq Stock Exchange.

– Southwest Airlines Co ($NYSE:LUV)

Southwest Airlines Co is a major U.S. airline, headquartered in Dallas, Texas. The company operates a fleet of 737 aircraft and serves destinations across the United States and several international destinations. Southwest is one of the largest airlines in the world, with a market capitalization of over $22 billion as of 2022. The company has a strong financial position, with a return on equity of over 8%. Southwest is a well-known brand and is a preferred choice for many travelers.

Summary

Thursday proved to be a difficult day for Spirit Airlines Inc. as its stock underperformed that of its competitors. The stock closed 1.02%, or $15.55, lower. Despite the NASDAQ having a great trading session, Spirit Airlines failed to keep up with the trend and dropped relative to other stocks.

Investors may want to consider other options if they are looking for short-term returns. It is important to look at the company’s fundamentals and recent performance before making an investing decision.

Recent Posts