FRONTIER GROUP Reports Q4 FY2022 Earnings Results on February 8 2023.

March 4, 2023

Earnings report

FRONTIER GROUP ($NASDAQ:ULCC) recently reported its earnings results for the fourth quarter of FY2022, ending on December 31 2022, on February 8 2023. The results show that the company achieved total revenue of USD 40.0 million, a whopping 175.5% increase year-over-year. Net income was reported at USD 906.0 million, up 48.8% from the same period a year prior. It is clear that the company is continuing to show signs of improvement, with strong profits and steady growth in revenue.

These reports are excellent news for investors, as FRONTIER GROUP is continuing to show promising indications of health. This performance could be a sign of more positive developments to come for the company in the future.

Stock Price

On Wednesday, February 8th 2023, FRONTIER GROUP reported its earnings results for the fourth quarter of Fiscal Year 2022. The company’s stock opened at $13.5 and closed at $13.6, down by 0.2% from its prior closing price of 13.6. This is the latest report in a series of quarterly reports that show FRONTIER GROUP’s financial performance since the start of the fiscal year. Overall, FRONTIER GROUP reported a modest earnings decline this quarter compared to the same period last year, though the company was able to meet or beat Wall Street estimates.

The company will now continue to assess current market conditions and make any necessary adjustments in order to remain competitive moving forward. Investors will be watching FRONTIER GROUP’s earnings reports closely over the coming quarters to see if the company is able to rebound from its modestly lower earnings this quarter. Until then, investors will need to keep a close eye on the stock as it’s price is likely to remain volatile in the near term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Frontier Group. More…

| Total Revenues | Net Income | Net Margin |

| 3.33k | -37 | -0.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Frontier Group. More…

| Operations | Investing | Financing |

| -52 | -67 | 391 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Frontier Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.25k | 3.78k | 2.15 |

Key Ratios Snapshot

Some of the financial key ratios for Frontier Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.9% | -0.8% | -1.1% |

| FCF Margin | ROE | ROA |

| -6.4% | -4.7% | -0.5% |

Analysis

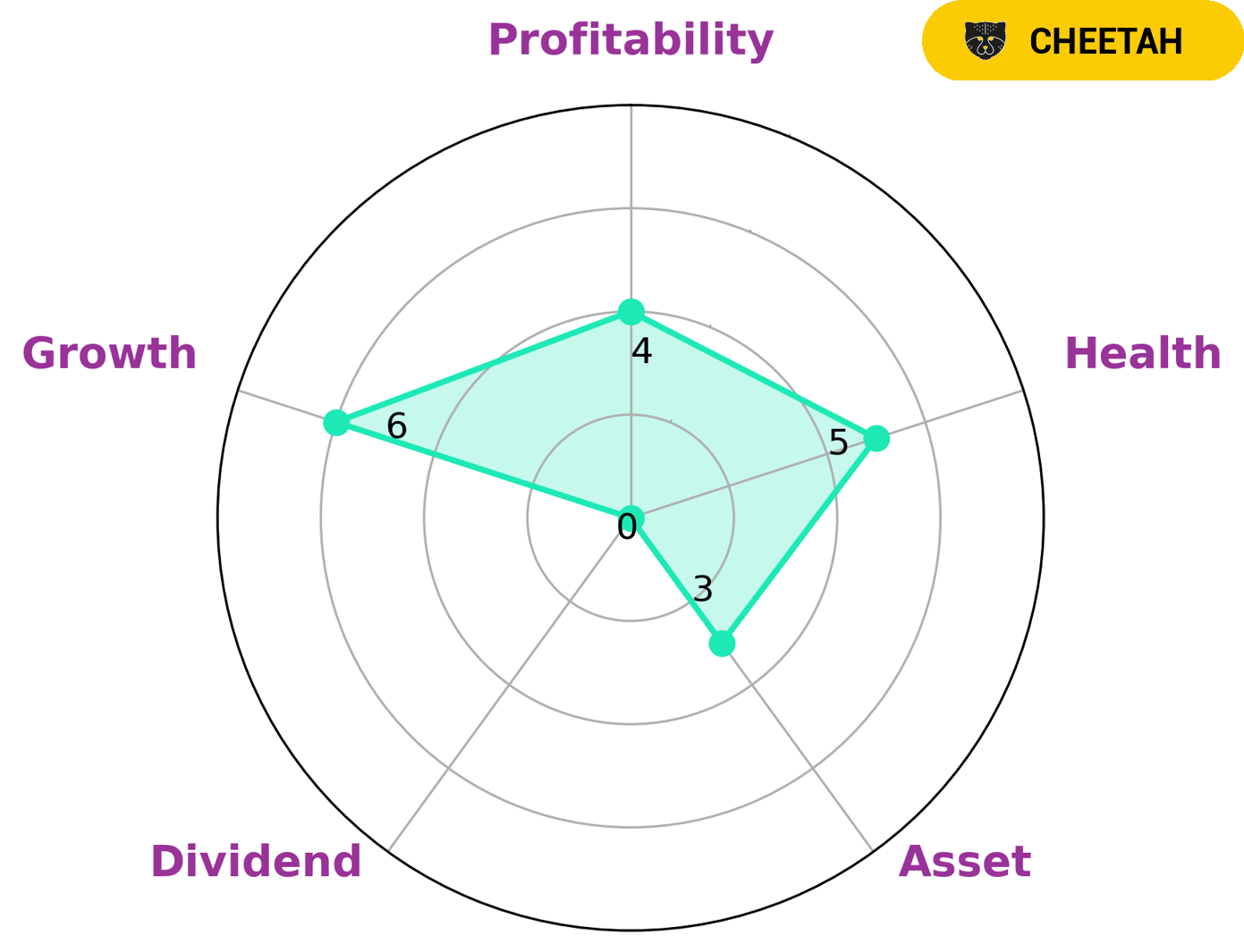

As part of GoodWhale’s analysis of FRONTIER GROUP‘s financials, we’ve determined that the company is strong in some areas and weak in others. According to our Star Chart, FRONTIER GROUP is strong in growth, medium in profitability, and weak in asset and dividend. Moreover, we gave FRONTIER GROUP an intermediate health score of 5/10 with regard to its cashflows and debt, suggesting that it may be able to sustain future operations in times of crisis. Based on our analysis, FRONTIER GROUP is classified as a ‘cheetah’, a type of company that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors that may be interested in FRONTIER GROUP as a potential investment may include those with a higher risk tolerance, as well as those with an affinity for rapid growth. More…

Peers

Frontier Group Holdings Inc is an airline holding company that owns and operates Frontier Airlines. The company was founded in 1994 and is headquartered in Denver, Colorado. Frontier Group Holdings Inc’s competitors include Spirit Airlines Inc, JetBlue Airways Corp, and Southwest Airlines Co.

– Spirit Airlines Inc ($NYSE:SAVE)

In 2022, Spirit Airlines had a market cap of 2.38 billion and a return on equity of -10.47%. The company is an American ultra-low-cost carrier, headquartered in Miramar, Florida. Spirit operates scheduled flights throughout the United States and in the Caribbean, Mexico, Latin America, and South America.

– JetBlue Airways Corp ($NASDAQ:JBLU)

As of 2022, JetBlue Airways Corp has a market cap of 2.42B and a Return on Equity of -8.81%. JetBlue Airways Corp is an airline company that operates in the United States. The company was founded in 1999 and is headquartered in New York, New York. JetBlue Airways Corp offers scheduled air service in the United States and the Caribbean. The company also provides cargo transportation services.

– Southwest Airlines Co ($NYSE:LUV)

Southwest Airlines Co is a publicly traded company with a market capitalization of $20.39 billion as of 2022. The company has a return on equity of 10.01%. Southwest Airlines Co is a low-cost carrier that operates in the United States. The company was founded in 1967 and is headquartered in Dallas, Texas.

Summary

Frontier Group is a company that has seen significant growth this past year. Total revenue increased by 175.5%, rising to 40.0 million USD. Net income also saw a major increase, rising 48.8% to 906.0 million USD.

Recent Posts