Allegiant Travel Reaches Agreement with Flight Attendants Union

June 12, 2023

☀️Trending News

Allegiant Travel ($NASDAQ:ALGT) has reached a tentative agreement with its flight attendants union, the International Brotherhood of Teamsters (IBT). Allegiant Travel is an American low-cost airline that focuses on linking smaller cities to tourist destinations. The airline is known for its low fares and quality customer service. The new agreement will provide the airline’s flight attendants with increased pay, improved benefits, and job security. It is expected to be ratified by the union in the coming weeks.

Allegiant is pleased to have reached an agreement with the IBT, noting that it allows for a more secure future for the airline and its employees. The tentative agreement will help Allegiant maintain its competitive edge in the ever-changing airline industry. The airline hopes that the agreement will open the door for a better working relationship with their flight attendants, and continued success in the future.

Stock Price

On Friday, ALLEGIANT TRAVEL announced that it has reached an agreement with the Association of Flight Attendants-CWA (AFA-CWA) that resolves a long-standing dispute between the two parties. The agreement will benefit the airline’s hardworking flight attendants, while also providing long-term stability for ALLEGIANT TRAVEL. The agreement provides wage increases, comprehensive healthcare coverage and job protections, as well as other important benefits for the airline’s flight attendants. The agreement also establishes a pathway for future collective bargaining agreements, including provisions for wages, benefits and work rules. The agreement has been overwhelmingly approved by ALLEGIANT TRAVEL’s flight attendants and ratified by the AFA-CWA.

It will take effect immediately and is expected to provide much-needed stability to ALLEGIANT TRAVEL’s operations and its workforce. Friday’s announcement marks an important milestone for ALLEGIANT TRAVEL, as it has now reached an agreement with its largest employee group. It also reflects the company’s values of respect and appreciation for its employees, as well as its commitment to provide them with the best possible working environment. The news of the agreement was met with enthusiasm in the financial markets, with ALLEGIANT TRAVEL’s stock opening at $109.1 and closing at the same price on Friday. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Allegiant Travel. More…

| Total Revenues | Net Income | Net Margin |

| 2.45k | 65.24 | 3.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Allegiant Travel. More…

| Operations | Investing | Financing |

| 303.05 | -491.42 | 33.12 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Allegiant Travel. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.51k | 2.11k | 68.99 |

Key Ratios Snapshot

Some of the financial key ratios for Allegiant Travel are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.9% | -13.5% | 8.4% |

| FCF Margin | ROE | ROA |

| -5.4% | 10.3% | 2.8% |

Analysis

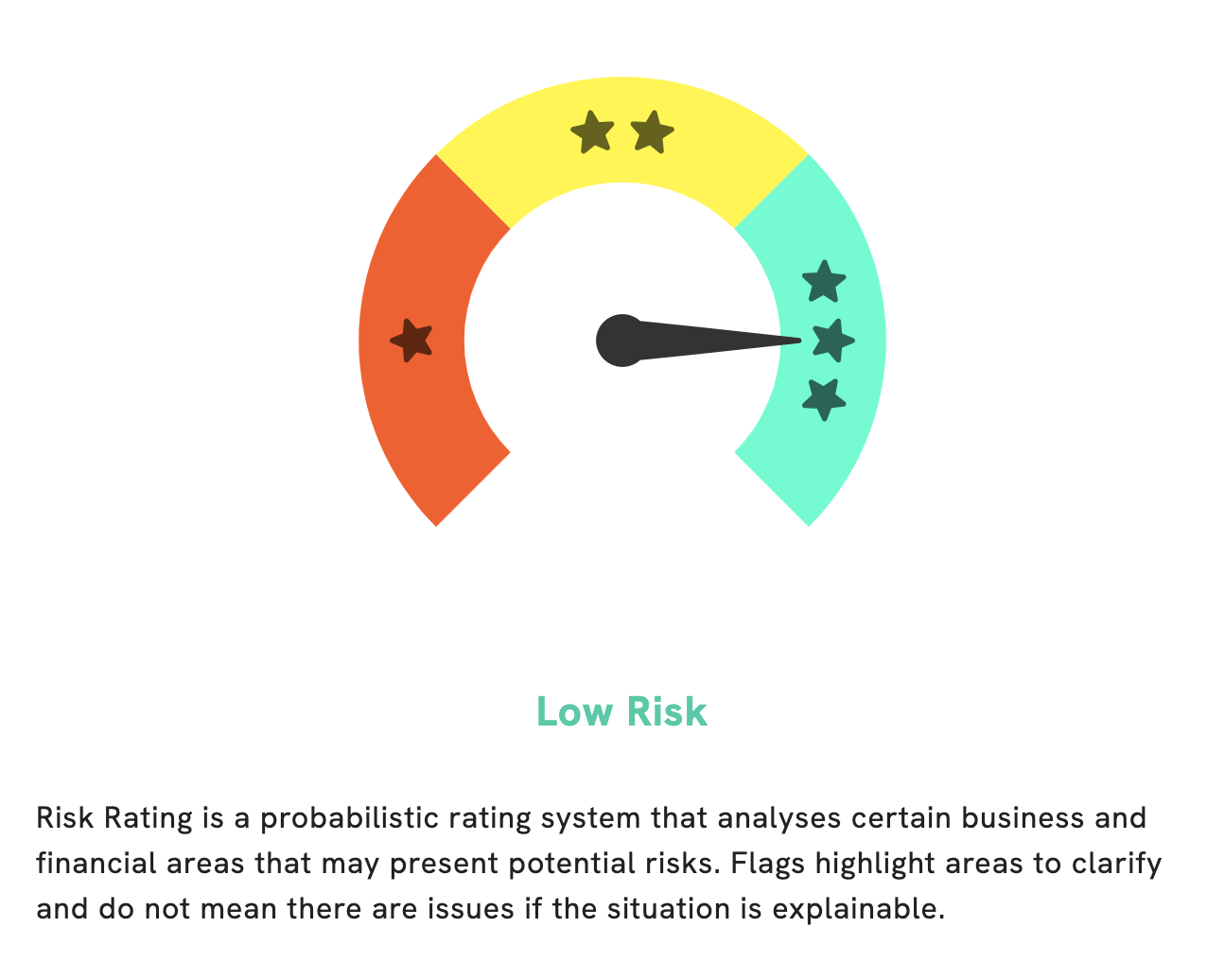

At GoodWhale, we recently conducted an analysis of ALLEGIANT TRAVEL‘s wellbeing. The results indicate that ALLEGIANT TRAVEL is a low risk investment in terms of financial and business aspects, according to our Risk Rating. However, our analysis also uncovered two risk warnings in both their income sheet and balance sheet. For a comprehensive assessment of ALLEGIANT TRAVEL’s wellbeing, you can register on GoodWhale.com to see our full findings. More…

Peers

The competition among Allegiant Travel Co, Korean Air Lines Co Ltd, Cebu Air Inc, and InterGlobe Aviation Ltd is fierce. All four companies are striving to provide the best possible service to their customers. Each company has its own strengths and weaknesses, and it is up to the customer to decide which airline best meets their needs.

– Korean Air Lines Co Ltd ($KOSE:003490)

Korean Air Lines Co Ltd is a major airline company headquartered in Seoul, South Korea. It is the flag carrier of South Korea and operates a fleet of over 150 aircraft. The company has a market cap of 7.89T as of 2022 and a Return on Equity of 20.57%. Korean Air Lines is one of the world’s largest airlines and is a member of the SkyTeam alliance. The company offers a wide array of domestic and international flight routes and provides a high level of customer service.

– Cebu Air Inc ($PSE:CEB)

Cebu Air Inc is a leading low-cost carrier in the Philippines. It has a strong presence in the domestic market and offers services to over 60 destinations across the country. The company has a market cap of 22.34B as of 2022 and a Return on Equity of -580.13%. Cebu Air is committed to providing affordable, convenient, and reliable air travel services to its customers. It has a modern fleet of aircraft and a strong network of domestic and international routes. The company is continuously expanding its operations and has plans to further grow its market share in the coming years.

– InterGlobe Aviation Ltd ($BSE:539448)

InterGlobe Aviation Ltd, the owner of India’s largest airline by market share, IndiGo, has a market cap of 672.27B as of 2022. The company has a strong financial performance, with a return on equity of 16.73%. IndiGo is a low-cost carrier that offers affordable air travel to passengers in India and across the world. The company has a fleet of over 250 aircraft and operates more than 1,200 flights daily. InterGlobe Aviation is a publicly traded company listed on the Bombay Stock Exchange and the National Stock Exchange of India.

Summary

Allegiant Travel (ALGT) has recently reached a tentative agreement with its flight attendants union, which could signal a positive outlook for the company. Analysts suggest that the agreement may result in increased cost savings and improved working conditions for employees, which could lead to better overall efficiency and higher customer satisfaction.

Additionally, Allegiant has made strategic investments in its fleet and route expansions that should help the company remain competitive and capture new market opportunities. Furthermore, ALGT’s financials have been consistently improving, with strong cash flows and returns on equity. Investors should consider this new development as a potential opportunity to gain exposure to a solid business with strong prospects.

Recent Posts