MOSAIC COMPANY Reports FY2023 Q2 Earnings Results on August 1 2023

August 26, 2023

🌥️Earnings Overview

On August 1 2023, MOSAIC COMPANY ($NYSE:MOS) released their earnings results for the second quarter of FY2023 (ending June 30 2023). The total revenue had dropped by 36.9% compared to the same period in the prior fiscal year, amounting to USD 3.4 billion. Likewise, net income had decreased by 64.4%, amounting to USD 0.37 billion.

Share Price

On Tuesday, August 1 2023, MOSAIC COMPANY released its financial results for the second quarter of FY2023. The company opened at $40.8 per share, but ended the day trading at $40.2, resulting in a 1.3% decrease in the stock price from the prior closing of $40.8. The company attributed the increase to its new product releases and new customer acquisitions. MOSAIC COMPANY has also made significant investments in its core technology infrastructure, allowing it to remain competitive in the market and maintain its industry-leading solutions.

The company is confident that these investments will pay dividends in the coming quarters and beyond. Overall, MOSAIC COMPANY is pleased with its performance this quarter and is optimistic about its future growth potential. Going forward, the company remains committed to driving innovation and delivering exceptional customer experience. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Mosaic Company. More…

| Total Revenues | Net Income | Net Margin |

| 16.83k | 2.17k | 11.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Mosaic Company. More…

| Operations | Investing | Financing |

| 3.07k | -1.23k | -2.04k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Mosaic Company. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 23.14k | 10.58k | 37.35 |

Key Ratios Snapshot

Some of the financial key ratios for Mosaic Company are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 24.7% | 264.5% | 17.3% |

| FCF Margin | ROE | ROA |

| 10.3% | 15.0% | 7.9% |

Analysis

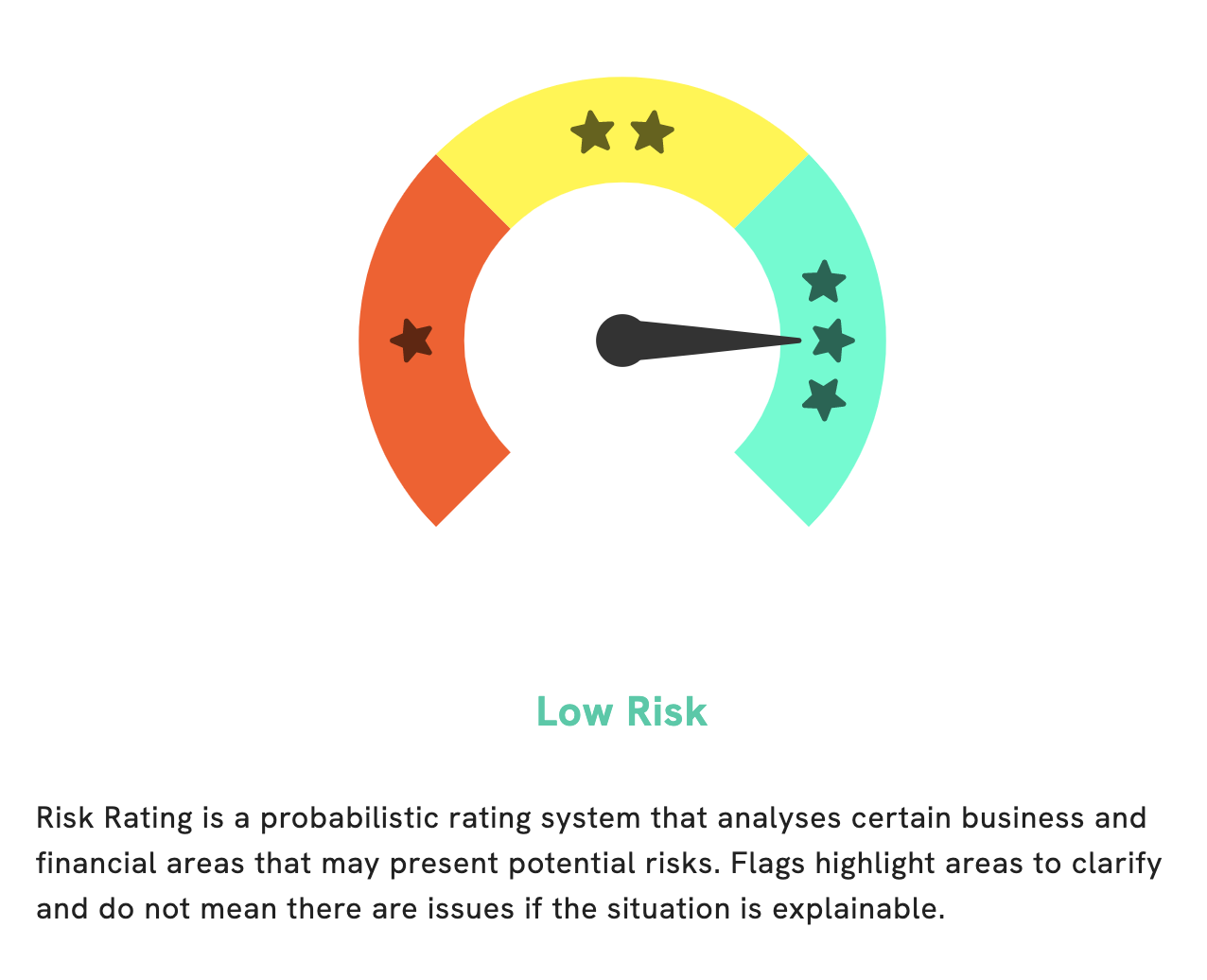

At GoodWhale, we have conducted a detailed analysis of MOSAIC COMPANY‘s fundamentals. Our findings have revealed that MOSAIC COMPANY is a low risk investment in terms of financial and business aspects. We have detected one risk warning in the income sheet. If you’d like to gain more insight into this, please register with us. We can provide you with a further breakdown of the warning and what it means for the company’s performance. Overall, MOSAIC COMPANY is a relatively low risk investment with positive prospects. We urge potential investors to sign up with us to gain more information about the company’s performance and future potential. More…

Peers

The company operates mines, production facilities, and distribution centers in the United States, Canada, and South America. The Mosaic Co’s competitors include CF Industries Holdings Inc, Nutrien Ltd, Corteva Inc.

– CF Industries Holdings Inc ($NYSE:CF)

CF Industries Holdings, Inc. is a holding company. The Company, through its subsidiaries, is engaged in the manufacture and distribution of nitrogen fertilizers. It operates through two segments: Nitrogen Fertilizers and Nitrogen Fertilizer Intermediates. The Company’s nitrogen fertilizers include ammonia, granular urea, urea ammonium nitrate and ammonium nitrate. The Company produces nitrogen fertilizer intermediates, including nitric acid and soda ash. It also owns and operates a natural gas liquids (NGL) business, which consists of its equity investment in Grande Prairie Pipelines Limited Partnership (GPP), which owns and operates a 1,912-mile pipeline system that transports NGLs from western Canada to the United States Gulf Coast.

– Nutrien Ltd ($TSX:NTR)

Nutrien Ltd is a Canadian agricultural company that produces and distributes crop nutrients. It is the largest fertilizer company in the world with a market cap of 60.94B as of 2022. The company has a strong focus on sustainable agriculture and has a return on equity of 23.76%.

– Corteva Inc ($NYSE:CTVA)

Corteva Inc is a publicly traded company with a market capitalization of $45.19 billion as of 2022. The company has a return on equity of 5.63%. Corteva Inc is a leading provider of crop protection and seed products. The company’s products are used by farmers to improve crop yields and protect against pests and diseases. Corteva’s products are sold in more than 130 countries around the world.

Summary

Mosaic Company reported its second quarter earnings results for the fiscal year ending June 30, 2023. Revenue decreased by 36.9%, to a total of $3.4 billion. Net income also decreased significantly, by 64.4% to $0.37 billion. Analysts consider these figures a cause for concern as they indicate Mosaic’s financial health is declining.

Investors should carefully consider the risks and rewards of investing in this company. Short-term price volatility could be expected, though long-term prospects could be promising if Mosaic can navigate its current difficulties.

Recent Posts