Triumph Group Stock Fair Value Calculation – TRIUMPH GROUP Reports Second Quarter Earnings Results for FY2024

November 27, 2023

☀️Earnings Overview

On November 7 2023, TRIUMPH GROUP ($NYSE:TGI) released its earnings results for the second quarter of FY2024 (ending September 30 2023). Compared to the same period of the previous year, total revenue was up 15.1% at USD 354.1 million. Unfortunately, net income was down -USD 1.3 million from the same quarter in the prior year, which reported a net income of USD 106.5 million.

Market Price

The news was met with positive reception as the stock opened at $8.9 and closed at $8.9, a 12.0% increase from their prior closing price of $7.9. This marks an impressive gain for TRIUMPH GROUP who have been striving to remain competitive in their sector. The gains were largely attributed to the success of TRIUMPH GROUP’s latest initiative, the “Innovative For Tomorrow” program. This program focuses on developing new products and services to meet changing customer needs, as well as increasing profitability through cost-cutting measures.

TRIUMPH GROUP’s CEO, Franklin Smith, commented on the success of this program stating, “It has been a successful initiative and has allowed us to remain at the forefront of our industry.” This is an encouraging sign for investors as TRIUMPH GROUP continues to grow and expand their operations. Investors can look forward to continued growth and expansion for TRIUMPH GROUP as they strive to remain competitive in their sector. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Triumph Group. More…

| Total Revenues | Net Income | Net Margin |

| 1.4k | -26.05 | -0.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Triumph Group. More…

| Operations | Investing | Financing |

| -35.82 | -33.18 | 130.32 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Triumph Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.67k | 2.34k | -8.7 |

Key Ratios Snapshot

Some of the financial key ratios for Triumph Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -16.1% | 3.8% | 9.1% |

| FCF Margin | ROE | ROA |

| -4.3% | -11.3% | 4.8% |

Analysis – Triumph Group Stock Fair Value Calculation

At GoodWhale, we have conducted a thorough analysis of TRIUMPH GROUP‘s financials and have come to the conclusion that the fair value of a share in the company is around $14.2. This has been calculated through our proprietary valuation line. Currently, TRIUMPH GROUP stock is being traded at $8.9, undervaluing the company by 37.2%. This offers an excellent opportunity for investors to acquire it at a low price and benefit from the long term upside potential the company holds. More…

Peers

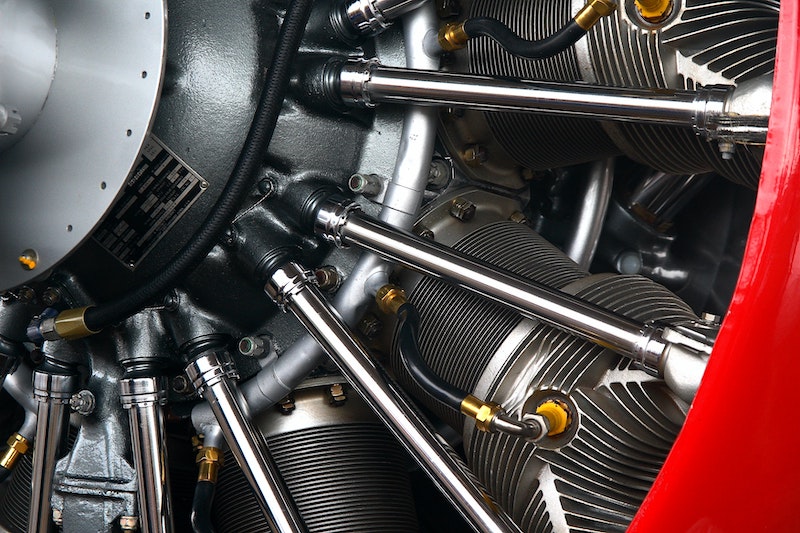

Their primary competitors include TAT Technologies Ltd, Montana Aerospace AG, and Curtiss-Wright Corp. All four of these companies specialize in providing innovative solutions to the aerospace and defense industries.

– TAT Technologies Ltd ($NASDAQ:TATT)

TAT Technologies Ltd is a leading global provider of services and products to the commercial and military aerospace and ground defense industries. The company has a market capitalization of 49.96M as of 2022. This market cap is a measure of the company’s total value and is calculated by multiplying its share price by the number of its outstanding shares. The company’s return on equity (ROE) for 2022 was -3.59%. This shows that the company’s management has been unsuccessful in generating profits from its investors’ capital. TAT Technologies Ltd focuses on providing solutions for aircraft maintenance, repair and overhaul (MRO), as well as production of heat transfer solutions and other related products.

– Montana Aerospace AG ($LTS:0AAI)

Montana Aerospace AG is a technology company based in Switzerland that specializes in aerospace components and systems. The company has a market cap of 882.67M as of 2022, which is a testament to its success, as it ranks among the top aerospace companies in the world. Montana Aerospace AG has also been able to maintain a negative Return on Equity (ROE) of -2.36%, indicating that the company is not utilizing its assets and equity efficiently. This is a sign of potential financial distress, as the company may not be able to generate enough returns to cover its costs and make profits. However, the company remains well-positioned to benefit from the growing aerospace industry.

– Curtiss-Wright Corp ($NYSE:CW)

Curtiss-Wright Corp is a US-based aerospace and defense company that provides highly engineered products and services to the global aerospace, defense, power generation and general industrial markets. As of 2022, the company has a market cap of 6.35B and a return on equity of 12.86%. The company has a strong track record of delivering superior returns for shareholders, and its success is reflected in its market capitalization. Curtiss-Wright is well positioned to continue to capitalize on the opportunities presented by the global aerospace and defense industry, as well as the broader industrial markets.

Summary

Investing in TRIUMPH GROUP has been a major focus for many investors, and recent financial results highlight the success of the company. For the second quarter of FY2024, TRIUMPH GROUP reported total revenues of $354.1 million, a 15.1% increase from the previous year. Net income was reported at $-1.3 million, compared to $106.5 million the same quarter in the prior year.

This resulted in a positive reaction from the stock market, with the share price increasing the same day. Looking forward, potential investors should bear in mind TRIUMPH GROUP’s financial performance as they consider whether investing is right for them.

Recent Posts