TransDigm Group Shares Dip 0.16% to $795.59 on Dismal Trading Session

May 16, 2023

Trending News 🌧️

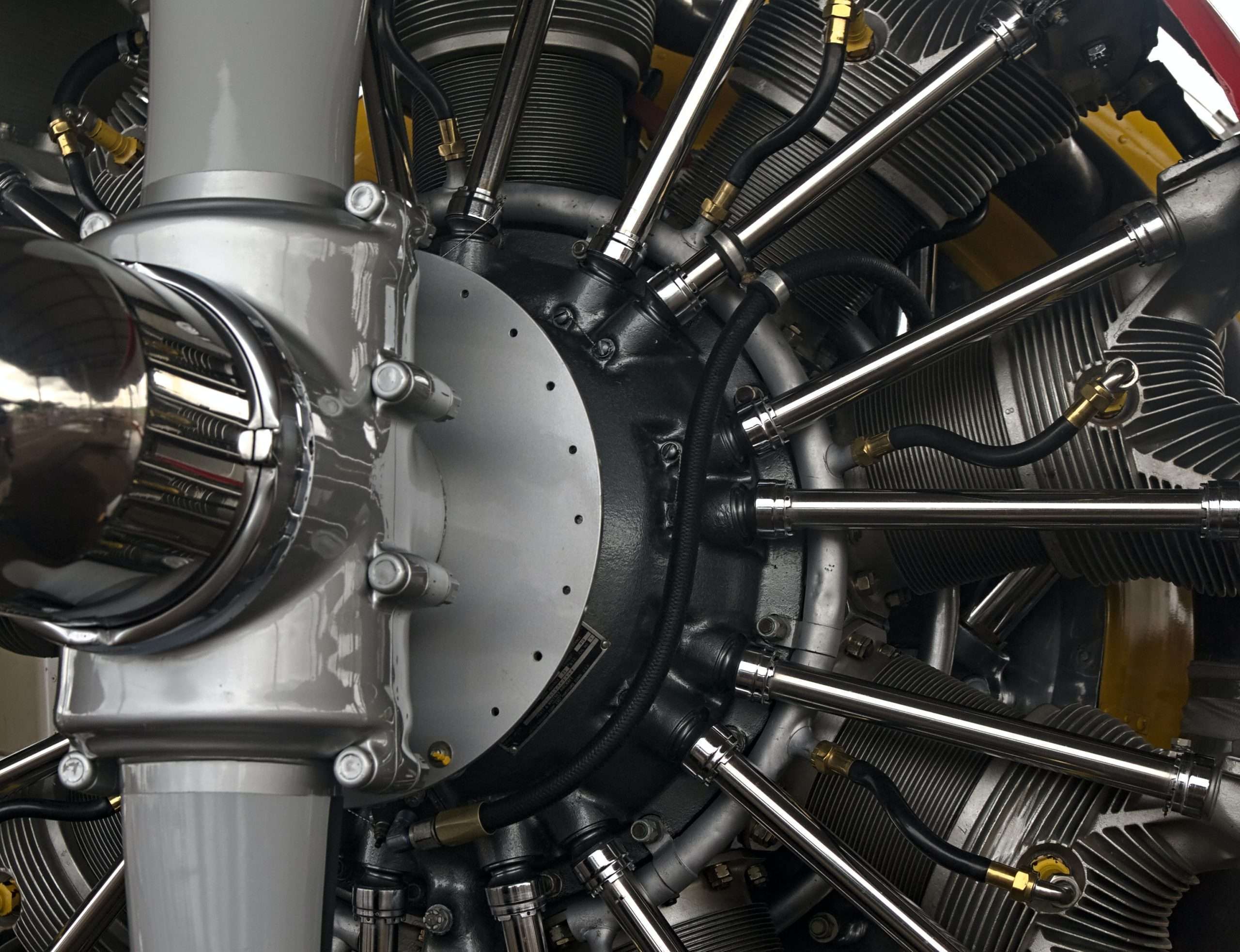

TRANSDIGM ($NYSE:TDG): On a day of dismal trading, TransDigm Group Inc. saw its shares dip by 0.16% to close at $795.59. TransDigm Group Inc. is a global leader in the aerospace and defense industry, supplying proprietary and technologically advanced components, subassemblies and systems to commercial, regional, business, and military aircraft manufacturers worldwide. The company is the world’s largest non-OEM supplier of commercial and military aircraft spare parts, and is the leading provider of highly engineered components used on virtually all commercial and military aircraft in service today.

It operates in four segments including Engine Components, Airframe Components, Electro-Mechanical Components, and Non-Aviation Components. Despite the 0.16% drop on this particular dismal trading day, TransDigm Group Inc. still continues to remain a strong player in the aviation industry through its technological advancements and resilient operations.

Analysis

At GoodWhale, we have conducted an in-depth analysis of TRANSDIGM GROUP‘s fundamentals. Our Risk Rating indicates TRANSDIGM GROUP is a high risk investment in terms of financial and business aspects. In order to give our users an even more comprehensive overview of the company, we have detected 3 risk warnings in the income sheet, balance sheet, and non-financials. To find out more, register as a user with GoodWhale and explore these risk warnings in greater detail. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Transdigm Group. More…

| Total Revenues | Net Income | Net Margin |

| 5.9k | 958 | 17.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Transdigm Group. More…

| Operations | Investing | Financing |

| 1.09k | -575 | -208 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Transdigm Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 20.01k | 22.9k | -52.86 |

Key Ratios Snapshot

Some of the financial key ratios for Transdigm Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -0.4% | 4.0% | 42.4% |

| FCF Margin | ROE | ROA |

| 16.3% | -50.1% | 7.8% |

Peers

TransDigm Group Inc is a leading designer, producer, and supplier of aircraft components. The company’s main competitors are Chemring Group PLC, Triumph Group Inc, and AECC Aero-Engine Controls Co Ltd.

– Chemring Group PLC ($LSE:CHG)

The company’s market cap is 849.54M as of 2022 and has a ROE of 12.84%. The company is a leading international provider of specialist products, services and solutions for military, homeland security and commercial markets.

– Triumph Group Inc ($NYSE:TGI)

Triumph Group Inc is a global aerospace and defense company that designs, manufactures, repairs and overhauls a wide variety of aircraft components, accessories, subsystems and systems. The company serves the commercial, military, business and general aviation markets, as well as the space and defense markets. Triumph Group has a market cap of 582.13M as of 2022 and a Return on Equity of -8.78%. The company has a long history of providing quality products and services to its customers, and is well-positioned to continue doing so in the future.

– AECC Aero-Engine Controls Co Ltd ($SZSE:000738)

AECC Aero-Engine Controls Co Ltd is a leading manufacturer of aircraft engines and engine controls. The company has a market cap of $37.18 billion and a return on equity of 4.22%. AECC Aero-Engine Controls Co Ltd designs, develops, manufactures, and sells aero-engines and engine controls for use in aviation and power generation applications. The company’s products are used in a variety of aircraft, including commercial jets, business jets, and helicopters. AECC Aero-Engine Controls Co Ltd has over 3,000 employees and is headquartered in Shanghai, China.

Summary

TransDigm Group Inc., a publicly traded aerospace and defense company, saw its share price fall 0.16% on Friday to close at $795.59. This decline came as part of an overall downturn in the stock market. Investors should carefully evaluate TransDigm Group Inc’s financials and performance metrics before deciding how to best allocate their money in the stock market. Analyze the company’s revenue growth, profitability, debt levels, cash flow, and other key financial indicators to determine the stock’s short- and long-term prospects.

Assess the company’s competitive advantages and any potential risks, such as changing customer demands or technological disruption, that could affect the stock’s performance. As always, investors should conduct their own due diligence before investing in any security.

Recent Posts