Quadrature Capital Ltd. Invests Big in Howmet Aerospace in 2023

March 16, 2023

Trending News 🌥️

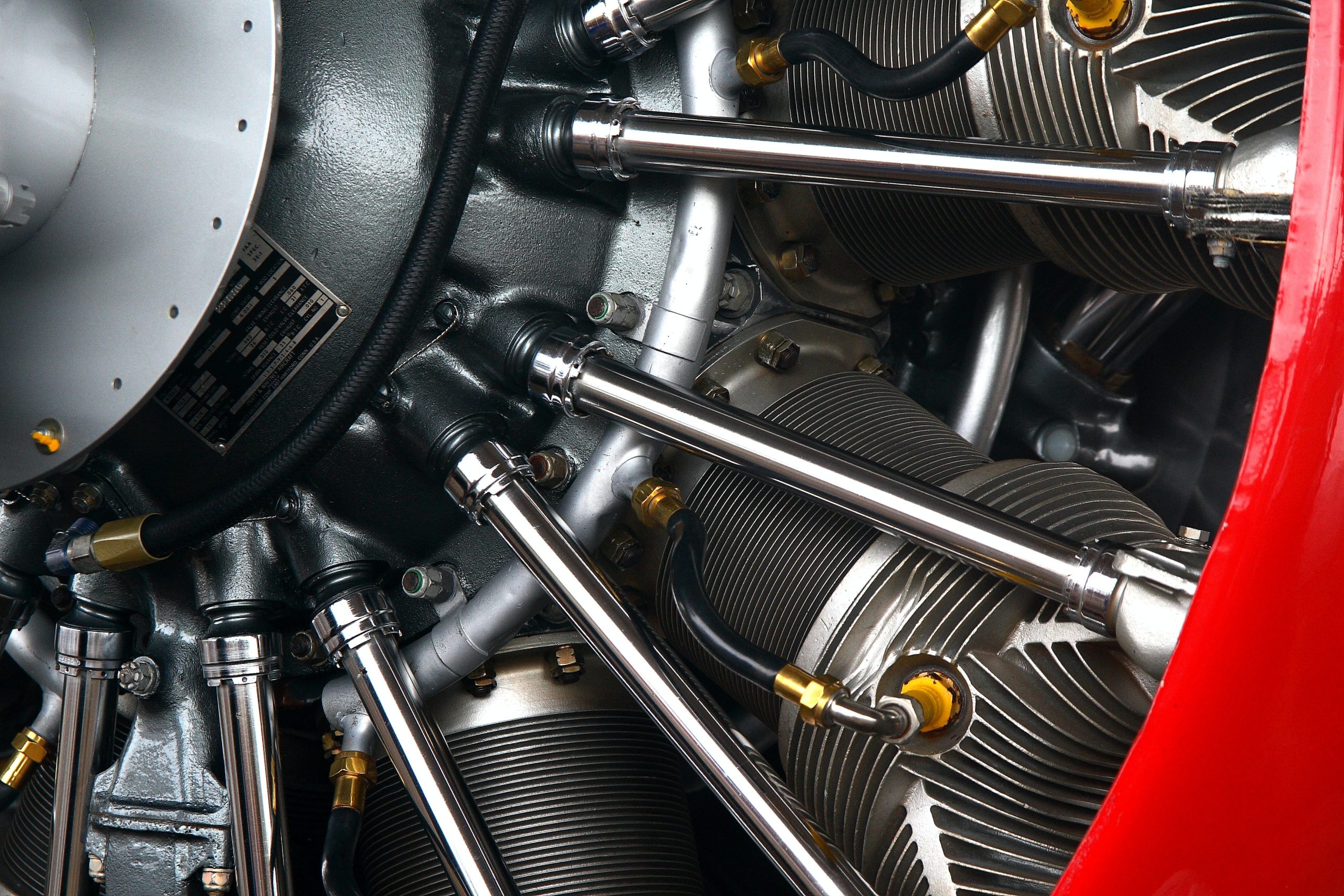

In 2023, Quadrature Capital Ltd. made a sizable investment of $895,000 in Howmet Aerospace ($NYSE:HWM) Inc. Howmet Aerospace Inc. is a global leader in the design, manufacture, and service of technologically advanced products and components for the aerospace industry. Their products are used in a wide range of applications, from the engines of commercial aircrafts to the landing gears of military fighter jets.

In addition, Quadrature’s expertise in the aerospace industry will help Howmet Aerospace Inc. to identify new opportunities for growth and to increase its competitive advantage. With the help of this investment from Quadrature Capital Ltd., Howmet Aerospace Inc. will be able to further its mission of developing innovative solutions for the aerospace industry that are cost-effective and reliable. This investment will undoubtedly help them to become a major player in the industry and to continue to maximize value for their customers.

Price History

On Monday, Quadrature Capital Ltd. made a big investment in Howmet Aerospace Inc. This caused the stock of the aerospace components and technology provider to open at $40.3 and close at $40.0, down 2.0% from its prior closing price of $40.8. The investment has been seen as a major vote of confidence for Howmet Aerospace, and a sign of their potential for continued growth in the future. Howmet Aerospace Inc. is a leading manufacturer and supplier of advanced aerospace components and systems, providing integrated solutions to customers worldwide. They supply components and technology to some of the world’s leading aerospace organizations and their products are used in both commercial and military aircraft applications.

Quadrature Capital Ltd is a global investment firm that specializes in investing in promising companies. This latest investment in Howmet Aerospace is seen as a major vote of confidence in the company and their potential for continued growth. With Quadrature Capital Ltd.’s backing, Howmet Aerospace is likely to continue their development of advanced aerospace components and systems and to remain a leader in the aerospace industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Howmet Aerospace. More…

| Total Revenues | Net Income | Net Margin |

| 5.66k | 467 | 10.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Howmet Aerospace. More…

| Operations | Investing | Financing |

| 733 | -135 | -526 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Howmet Aerospace. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.26k | 6.65k | 8.74 |

Key Ratios Snapshot

Some of the financial key ratios for Howmet Aerospace are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -26.4% | -15.9% | 14.7% |

| FCF Margin | ROE | ROA |

| 9.5% | 15.2% | 5.1% |

Analysis

At GoodWhale, we recently conducted an analysis of HOWMET AEROSPACE’s wellbeing. After examining the company’s financial and business aspects, we determined that the company is a high risk investment according to our Risk Rating. Upon further investigation, we discovered three risk warnings in the income sheet, balance sheet, and cashflow statement. If you are interested in learning more about these findings, please consider becoming a registered user of our services to check it out. More…

Peers

Its main competitors are Rolls-Royce Holdings PLC, General Dynamics Corp, and Raytheon Technologies Corp.

– Rolls-Royce Holdings PLC ($LSE:RR.)

Rolls-Royce Holdings PLC is a British multinational engineering company incorporated in February 2011 that owns Rolls-Royce, a business founded in 1904 which today designs, manufactures and distributes power systems for aviation and other industries.

The company has a market cap of 7.25B as of 2022 and a Return on Equity of 21.06%. Rolls-Royce is a global leader in the design, manufacture and distribution of power systems for aviation and other industries. The company’s products and services power more than 35,000 aircraft and over 10,000 ships worldwide.

– General Dynamics Corp ($NYSE:GD)

General Dynamics Corporation is an American aerospace and defense conglomerate company formed by mergers and divestitures, and as of 2012, it is the fifth largest defense contractor in the world. It is headquartered in West Falls Church, The company has a market cap of 68.15B as of 2022 and a Return on Equity of 15.38%. The company is involved in the design, development, and manufacture of products and services for the aerospace and defense industries.

– Raytheon Technologies Corp ($NYSE:RTX)

Raytheon Technologies Corporation is an aerospace and defense company that provides products and services for the commercial, military, and government markets. The company has a market cap of 140.18B as of 2022 and a Return on Equity of 5.82%. Raytheon Technologies is a technology leader in defense, security, and commercial aerospace. The company’s products and services include aircraft engines, radar, and other electronic systems.

Summary

Quadrature Capital Ltd. recently made a major investment in Howmet Aerospace Inc. in 2023. The investment gives Quadrature a significant stake in the company, indicating their confidence in the company’s future growth prospects. Howmet Aerospace is a leading provider of complex components and systems for aircraft and industrial gas turbine engines, as well as a leading supplier of advanced aerospace systems and components for defense and space applications. The financial details of the investment were not disclosed, but it is expected to be beneficial to both companies.

Quadrature Capital believes that Howmet Aerospace is well-positioned to benefit from the growth of the aerospace and defense sectors over the long term, with the potential to increase shareholder value and outperform peers. Analysts believe the investment is a smart move by Quadrature as it diversifies its portfolio and adds exposure to an industry with potential for growth.

Recent Posts