net

May 2, 2023

Trending News 🌥️

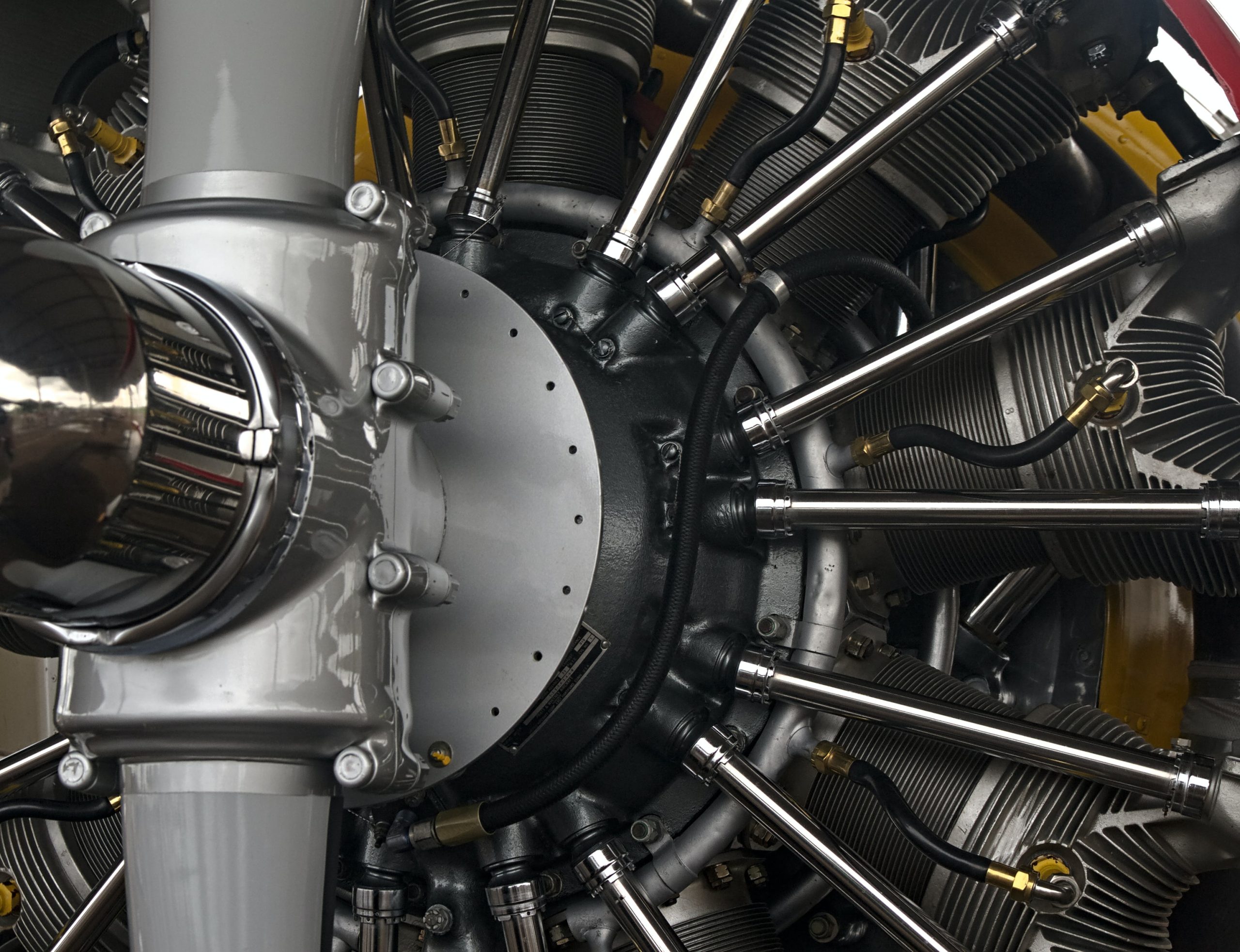

Janney Montgomery Scott LLC recently reduced its stake in Howmet Aerospace ($NYSE:HWM) Inc. by disposing of 1260 shares at Defense World. The firm has now divested its remaining stake in the company. Howmet Aerospace Inc. is a leading global manufacturer and supplier of engineered components and sub-systems for the aerospace and industrial gas turbine industries. The company provides technologically advanced solutions that enable their customers to operate more efficiently and profitably. They are committed to providing innovative solutions to their customers and have a long history of successful collaborations with some of the world’s leading companies.

Howmet Aerospace Inc.’s stock is traded publicly on the New York Stock Exchange under the ticker symbol HWM. The company’s strong balance sheet has allowed them to consistently pay dividends to shareholders and invest in research and development to ensure they stay ahead of their competition. Investors interested in Howmet Aerospace Inc. should do research on the company’s financials and recent developments in order to make an informed decision about investing in the stock.

Stock Price

On Monday, Janney Montgomery Scott LLC announced that it had reduced its stake in Howmet Aerospace Inc., sending the stock price of the company’s stock down. At market open, the stock opened at $44.3 and closed at the same price. With the reduced stake, Howmet Aerospace Inc. has lost a major investor in its company. This could have a significant impact on the performance of the company going forward, as Janney Montgomery Scott LLC held a large portion of Howmet Aerospace Inc.’s stock before the decision was made.

Howmet Aerospace Inc. must now find new investors to make up for the loss of this major stakeholder. It remains to be seen how this decision will affect Howmet Aerospace Inc. in the long run, but investors are clearly cautious when it comes to this news. It is important for Howmet Aerospace Inc. to find new investors quickly if it wants to maintain its current stock price and ensure its future success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Howmet Aerospace. More…

| Total Revenues | Net Income | Net Margin |

| 5.66k | 467 | 10.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Howmet Aerospace. More…

| Operations | Investing | Financing |

| 733 | -135 | -526 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Howmet Aerospace. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.26k | 6.65k | 8.74 |

Key Ratios Snapshot

Some of the financial key ratios for Howmet Aerospace are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -26.4% | -15.9% | 14.7% |

| FCF Margin | ROE | ROA |

| 9.5% | 15.2% | 5.1% |

Analysis

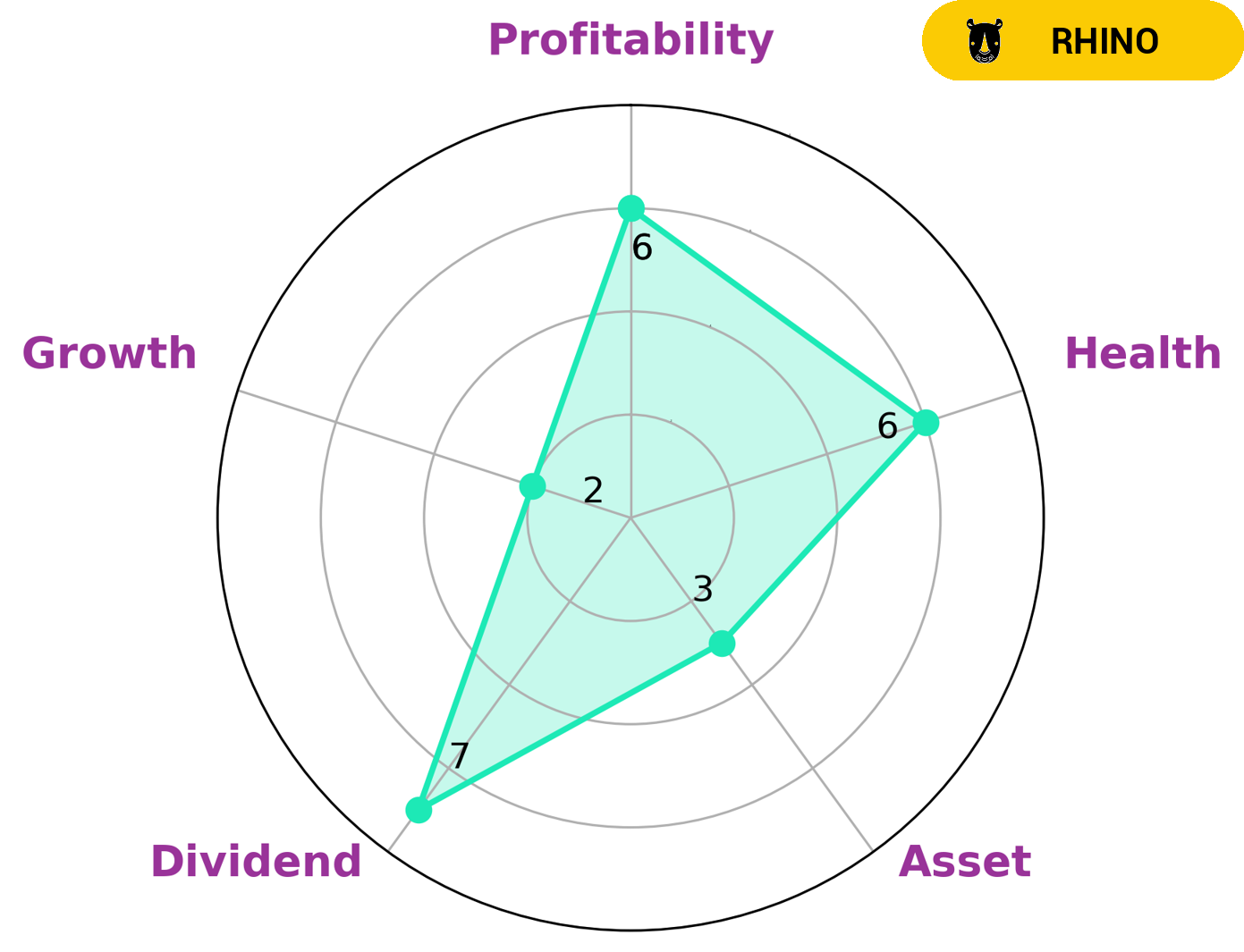

At GoodWhale, our analysis of HOWMET AEROSPACE‘s financials has given us an intermediate health score of 6/10 with regard to its cashflows and debt, suggesting that it might be able to safely ride out any crisis without the risk of bankruptcy. We have also classified HOWMET AEROSPACE as ‘rhino’, a type of company we conclude has achieved moderate revenue or earnings growth. This indicates that HOWMET AEROSPACE is strong in dividend, medium in profitability and weak in asset, growth. This makes the company an attractive investment opportunity to a variety of investors. For example, those with a focus on income and stability may be drawn to the strong dividend, while value investors may be keen to take advantage of the relatively low asset growth and purchase the stock at a bargain price. More…

Peers

Its main competitors are Rolls-Royce Holdings PLC, General Dynamics Corp, and Raytheon Technologies Corp.

– Rolls-Royce Holdings PLC ($LSE:RR.)

Rolls-Royce Holdings PLC is a British multinational engineering company incorporated in February 2011 that owns Rolls-Royce, a business founded in 1904 which today designs, manufactures and distributes power systems for aviation and other industries.

The company has a market cap of 7.25B as of 2022 and a Return on Equity of 21.06%. Rolls-Royce is a global leader in the design, manufacture and distribution of power systems for aviation and other industries. The company’s products and services power more than 35,000 aircraft and over 10,000 ships worldwide.

– General Dynamics Corp ($NYSE:GD)

General Dynamics Corporation is an American aerospace and defense conglomerate company formed by mergers and divestitures, and as of 2012, it is the fifth largest defense contractor in the world. It is headquartered in West Falls Church, The company has a market cap of 68.15B as of 2022 and a Return on Equity of 15.38%. The company is involved in the design, development, and manufacture of products and services for the aerospace and defense industries.

– Raytheon Technologies Corp ($NYSE:RTX)

Raytheon Technologies Corporation is an aerospace and defense company that provides products and services for the commercial, military, and government markets. The company has a market cap of 140.18B as of 2022 and a Return on Equity of 5.82%. Raytheon Technologies is a technology leader in defense, security, and commercial aerospace. The company’s products and services include aircraft engines, radar, and other electronic systems.

Summary

Janney Montgomery Scott LLC recently sold 1260 shares of Howmet Aerospace Inc. This news reflects a bearish sentiment in the stock. Analysts are concerned about the company’s current financials and expect that profits will remain flat for the foreseeable future. Currently, the stock has failed to make any significant gains in the past several weeks and appears to be in a downward trend.

Analysts suggest investors wait for signs of improvement before investing in Howmet Aerospace Inc. They warn that the stock may not perform well in the near term and suggest that investors consider other alternatives before investing. In conclusion, Howmet Aerospace Inc. is a risky investment and should be approached with caution.

Recent Posts