Huntington Ingalls Industries Reports Robust Fourth Quarter FY2022 Earnings Results

April 1, 2023

Earnings Overview

On February 9, 2023, HUNTINGTON INGALLS INDUSTRIES ($NYSE:HII) reported their financial results for the fourth quarter of FY2022 (ending December 31, 2022). The company saw a 2.5% year-over-year increase in total revenue, totaling USD 123.0 million, and a 5.0% year-over-year increase in net income, reaching USD 2812.0 million.

Transcripts Simplified

Huntington Ingalls Industries reported fourth quarter and full year 2021 results, which included 5% revenue growth in the fourth quarter and a 12.1% increase in full year revenues. Operating income for the quarter decreased by 12.5% while operating margin was 3.7%. Net earnings for the year were $579 million, compared to $544 million in 2021, and diluted earnings per share were $14.44, compared to $13.50 in the previous year.

Ingalls reported $2.6 billion in revenues for 2022, up 1.7% from 2021, and operating income of $292 million with a margin of 11.4%. At Newport News, 2022 revenues of $5.9 billion increased by 3.3%, driven by higher revenues in both aircraft carriers and submarines.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HII. More…

| Total Revenues | Net Income | Net Margin |

| 10.68k | 579 | 5.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HII. More…

| Operations | Investing | Financing |

| 766 | -268 | -658 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HII. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.86k | 7.37k | 87.44 |

Key Ratios Snapshot

Some of the financial key ratios for HII are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 6.3% | -11.4% | 7.7% |

| FCF Margin | ROE | ROA |

| 4.5% | 15.7% | 4.7% |

Share Price

The stock opened at $221.0 and closed at $220.4, down 2.3% from the previous closing price of $225.7. The company also affirmed its outlook for fiscal year 2023 and expects to deliver ongoing double-digit growth in both sales and earnings per share. These results demonstrate HII’s commitment to delivering strong financial performance and rewarding shareholders. The market responded positively to these results, and the stock price is expected to gain momentum if the company’s positive trend continues. Live Quote…

Analysis

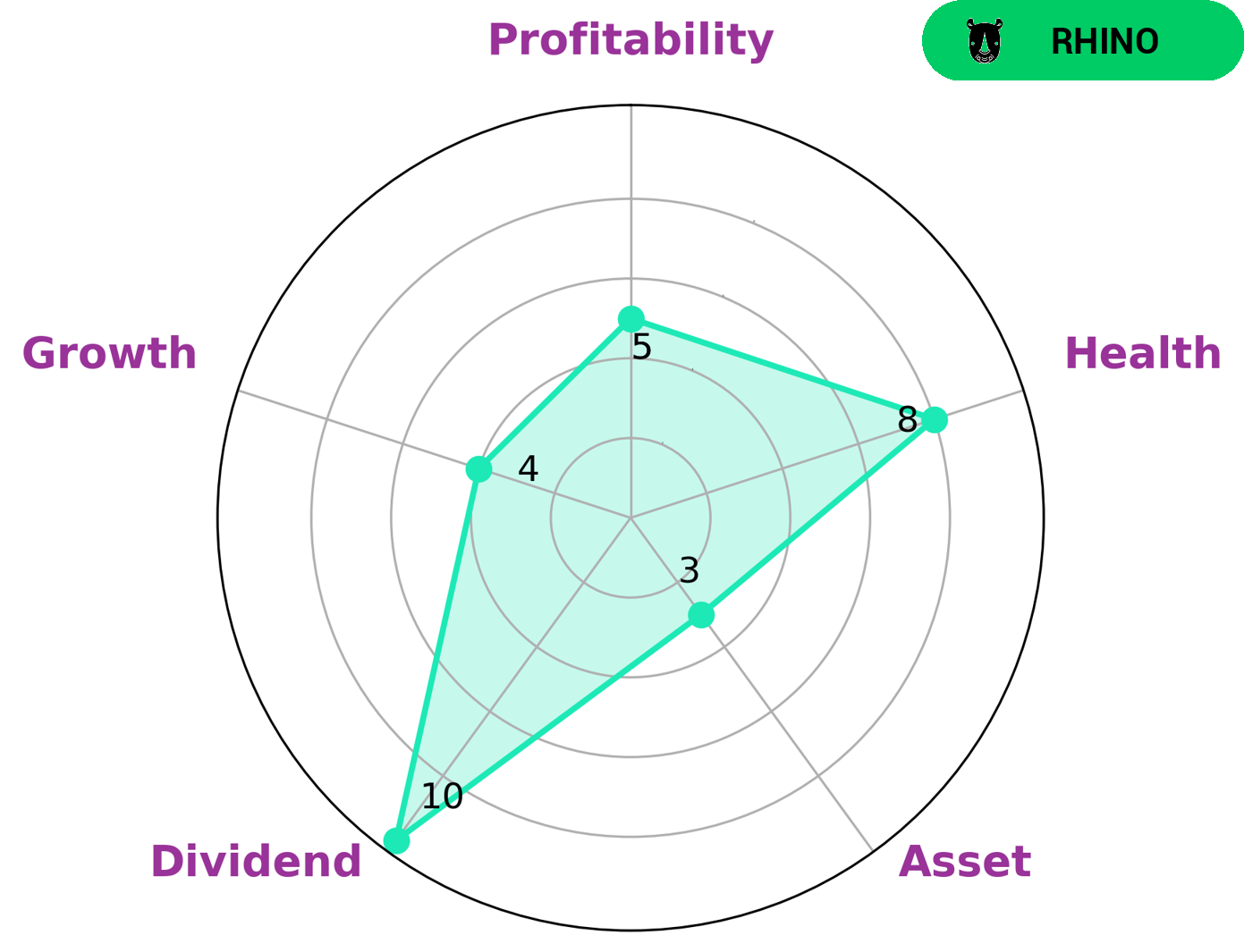

At GoodWhale, we analyze the financials of HUNTINGTON INGALLS INDUSTRIES every day. According to our Star Chart, HUNTINGTON INGALLS INDUSTRIES is classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. This means that the company is strong in dividend and medium in growth, profitability and asset. HUNTINGTON INGALLS INDUSTRIES also has a high health score of 8/10 with regard to its cashflows and debt. This means that HUNTINGTON INGALLS INDUSTRIES is capable of sustaining its future operations even in times of crisis. Given these strengths, investors who are looking for steady returns or stability may be interested in investing in HUNTINGTON INGALLS INDUSTRIES. The company provides a good balance between risk and reward. The company is also a good option for long-term investors who are looking for steady returns over time. More…

Peers

The competition between Huntington Ingalls Industries Inc and its competitors is fierce. Each company is trying to gain market share and increase profits. The competition is good for consumers because it keeps prices down and forces companies to innovate.

– Textron Inc ($NYSE:TXT)

Textron Inc is a publicly traded company with a market cap of 12.89B as of 2022. The company has a return on equity of 9.94%. Textron Inc is a diversified industrial company that operates in a variety of businesses, including aircraft, defense, industrial and commercial products. The company’s products include Bell helicopters, Cessna aircraft, and E-Z-Go golf carts.

– Penguin International Ltd ($SGX:BTM)

Penguin International Ltd is a Singapore-based company that is engaged in the design, manufacture, and marketing of a range of inflatable products, including inflatable boats, marine products, and industrial products. The company has a market capitalization of 160.72 million as of 2022 and a return on equity of 7.36%. Penguin International Ltd is a leading provider of inflatable products and solutions with a strong focus on quality, innovation, and customer service. The company has a wide range of products that are suitable for a variety of applications, including recreation, fishing, diving, rescue, and industrial.

– Airbus SE ($OTCPK:EADSF)

Airbus SE is a leading aircraft manufacturer with a market cap of 78.35B as of 2022. The company has a strong Return on Equity of 34.09%. Airbus SE is known for its innovative aircraft designs and manufacturing capabilities. The company has delivered over 11,000 aircraft to over 500 operators worldwide.

Summary

Investors in Huntington Ingalls Industries should be pleased with the company’s financial performance in the fourth quarter of FY2022, as total revenue was up 2.5% year-over-year and net income increased by 5.0%. This demonstrates that the company is continuing to improve its financial standing and is well-positioned to continue delivering solid results moving forward. With the positive momentum from this quarter, investors may consider investing in Huntington Ingalls Industries for the potential of strong returns over the long term.

Recent Posts