HII Unit Wins Contract to Supply U.S. Air Force with Training Systems

June 14, 2023

☀️Trending News

Huntington Ingalls Industries ($NYSE:HII) (HII) is an American shipbuilding company with a long history of providing services to the US Navy. Recently, HII has been awarded a contract to supply training systems to the U.S. Air Force. This contract is a testament to the excellent work HII provides as a leader in shipbuilding and defense services. The new contract will see HII provide the U.S. Air Force with special training systems that are designed to simulate a variety of scenarios in order to prepare airmen for a wide range of operations. This includes high-tech mission rehearsal equipment as well as interactive simulations.

Such systems require an extensive amount of engineering knowledge and technological sophistication which HII is well-positioned to provide. As the Navy and Air Force continue to invest in new technologies and training methods, HII will remain at the forefront of military procurement. Their commitment to excellence and expertise in defense-related services has enabled them to win major contracts like this one which will no doubt benefit the U.S. military for years to come.

Market Price

On Tuesday, HUNTINGTON INGALLS INDUSTRIES (HII) saw its stock rise to open at $213.2 and close at $216.6, a 1.1% increase from the prior closing price of 214.2. This is not only advantageous for the USAF, but also for HII, as the contract will help to further solidify HII’s position in the global defense market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for HII. More…

| Total Revenues | Net Income | Net Margin |

| 10.77k | 568 | 4.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for HII. More…

| Operations | Investing | Financing |

| 840 | -285 | -567 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for HII. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.85k | 7.29k | 89.24 |

Key Ratios Snapshot

Some of the financial key ratios for HII are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.9% | -13.5% | 7.5% |

| FCF Margin | ROE | ROA |

| 5.2% | 14.3% | 4.6% |

Analysis

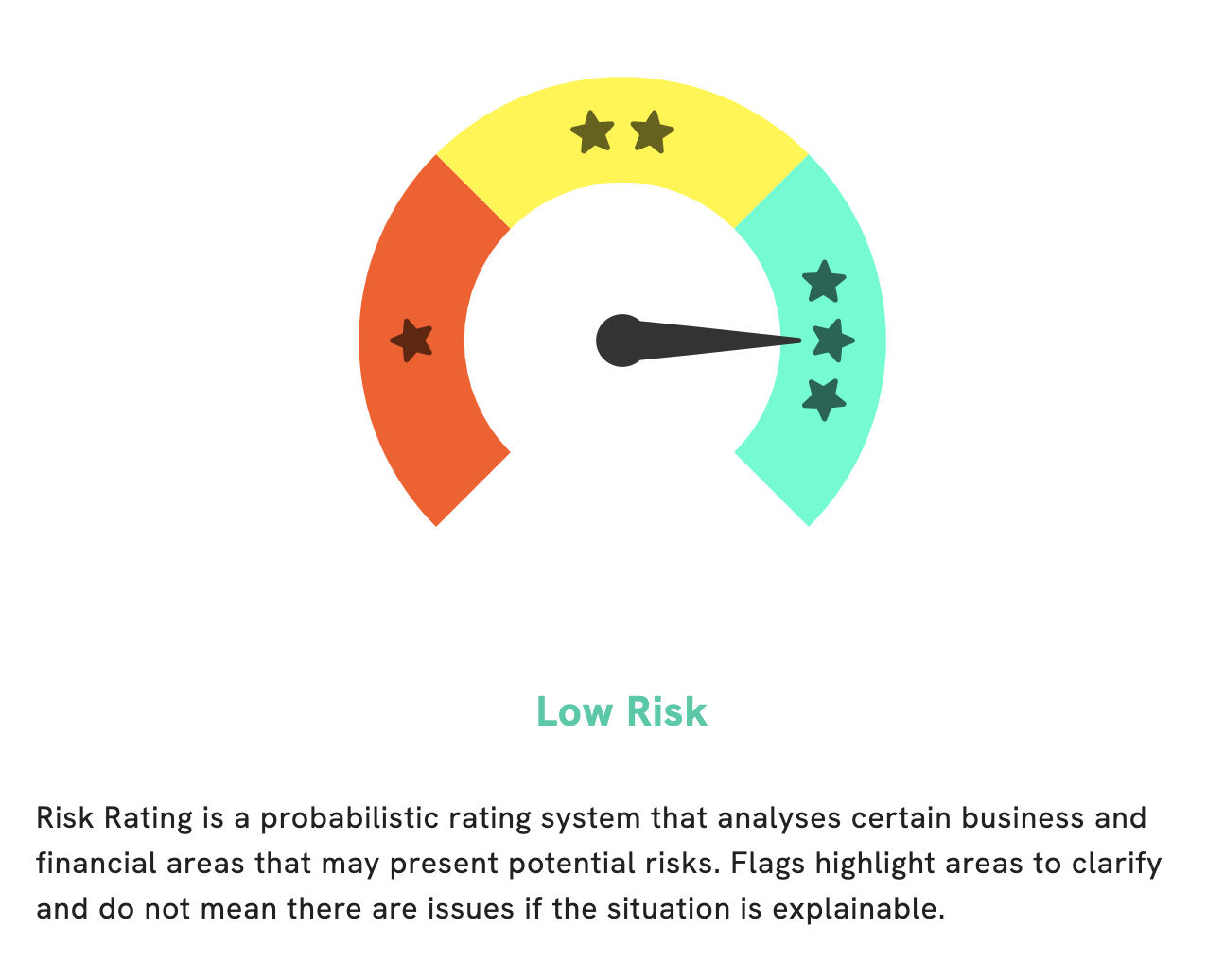

At GoodWhale, we conduct analysis of HUNTINGTON INGALLS INDUSTRIES’ fundamentals to help our users make informed decisions when investing. Based on our Risk Rating, HUNTINGTON INGALLS INDUSTRIES is a low risk investment in terms of its financial and business aspects. However, we have detected one risk warning in the company’s balance sheet. To find out more, our users can register on goodwhale.com to review the details. More…

Peers

The competition between Huntington Ingalls Industries Inc and its competitors is fierce. Each company is trying to gain market share and increase profits. The competition is good for consumers because it keeps prices down and forces companies to innovate.

– Textron Inc ($NYSE:TXT)

Textron Inc is a publicly traded company with a market cap of 12.89B as of 2022. The company has a return on equity of 9.94%. Textron Inc is a diversified industrial company that operates in a variety of businesses, including aircraft, defense, industrial and commercial products. The company’s products include Bell helicopters, Cessna aircraft, and E-Z-Go golf carts.

– Penguin International Ltd ($SGX:BTM)

Penguin International Ltd is a Singapore-based company that is engaged in the design, manufacture, and marketing of a range of inflatable products, including inflatable boats, marine products, and industrial products. The company has a market capitalization of 160.72 million as of 2022 and a return on equity of 7.36%. Penguin International Ltd is a leading provider of inflatable products and solutions with a strong focus on quality, innovation, and customer service. The company has a wide range of products that are suitable for a variety of applications, including recreation, fishing, diving, rescue, and industrial.

– Airbus SE ($OTCPK:EADSF)

Airbus SE is a leading aircraft manufacturer with a market cap of 78.35B as of 2022. The company has a strong Return on Equity of 34.09%. Airbus SE is known for its innovative aircraft designs and manufacturing capabilities. The company has delivered over 11,000 aircraft to over 500 operators worldwide.

Summary

Huntington Ingalls Industries (HII) recently secured a contract to provide training systems to the United States Air Force. This is good news for potential investors in the company as it implies that HII is well-positioned to benefit from increased spending in military training systems, which is likely to remain strong in a time of ongoing international insecurity.

Additionally, the contracting provides HII with access to the resources of the U.S. Air Force, which may provide further opportunities for growth for the company. The contracting also gives HII a foothold in the military training market, which may lead to more contracts both with the U.S. Air Force and other branches of the U.S military. Overall, investing in HII looks like a solid long-term proposition.

Recent Posts