AZ Intrinsic Value Calculator – A2Z Smart Technologies Seeks $200M in Mixed Shelf Offering, Shares Surge 10% After Hours

April 13, 2023

Trending News ☀️

Shares of A2Z ($NASDAQ:AZ) Smart Technologies surged by approximately 10% after the company announced a $200 million mixed shelf offering. This offering will be used to fund the continued growth of the company and its development of innovative products and services in the areas of artificial intelligence and machine learning. A2Z Smart Technologies is a leading provider of artificial intelligence and machine learning solutions. The company develops a wide range of products and services, including predictive analytics, facial recognition technology, autonomous vehicles, robotics, and more. The company has been on the cutting edge of these technologies since its inception, and has been at the forefront of many advances in the industry. The mixed shelf offering will allow A2Z Smart Technologies to continue its investments in these innovative technologies and expand its reach even further.

The proceeds of the offering will also be used to fund acquisitions, partnerships, and other strategic initiatives. The announcement of the offering has been well received by investors, with the stock surging by 10% after hours. With this offering, the company is well positioned to remain a leader in the field of artificial intelligence and machine learning for years to come.

Market Price

Following the announcement, the company’s stock surged 10% after hours trading. During the regular trading session, the stock opened at $1.3 and closed at $1.3, a 3.7% decrease from its prior close. The mixed shelf offering consists of a combination of bonds, notes and common stock, with the purpose of providing funding for the company’s growth plans. The details of the offering, including the type and amount of securities, have yet to be disclosed.

The announcement has generated positive sentiment on Wall Street, with investors showing confidence in the company’s growth prospects. Analysts expect the stock price to maintain its upward trajectory in the coming weeks, as the details of the offering are revealed. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AZ. More…

| Total Revenues | Net Income | Net Margin |

| 9.35 | -18.35 | -189.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AZ. More…

| Operations | Investing | Financing |

| -9.43 | -1.56 | 6.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AZ. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.69 | 9.8 | 0.17 |

Key Ratios Snapshot

Some of the financial key ratios for AZ are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 92.7% | – | -193.7% |

| FCF Margin | ROE | ROA |

| -108.6% | -184.7% | -89.2% |

Analysis – AZ Intrinsic Value Calculator

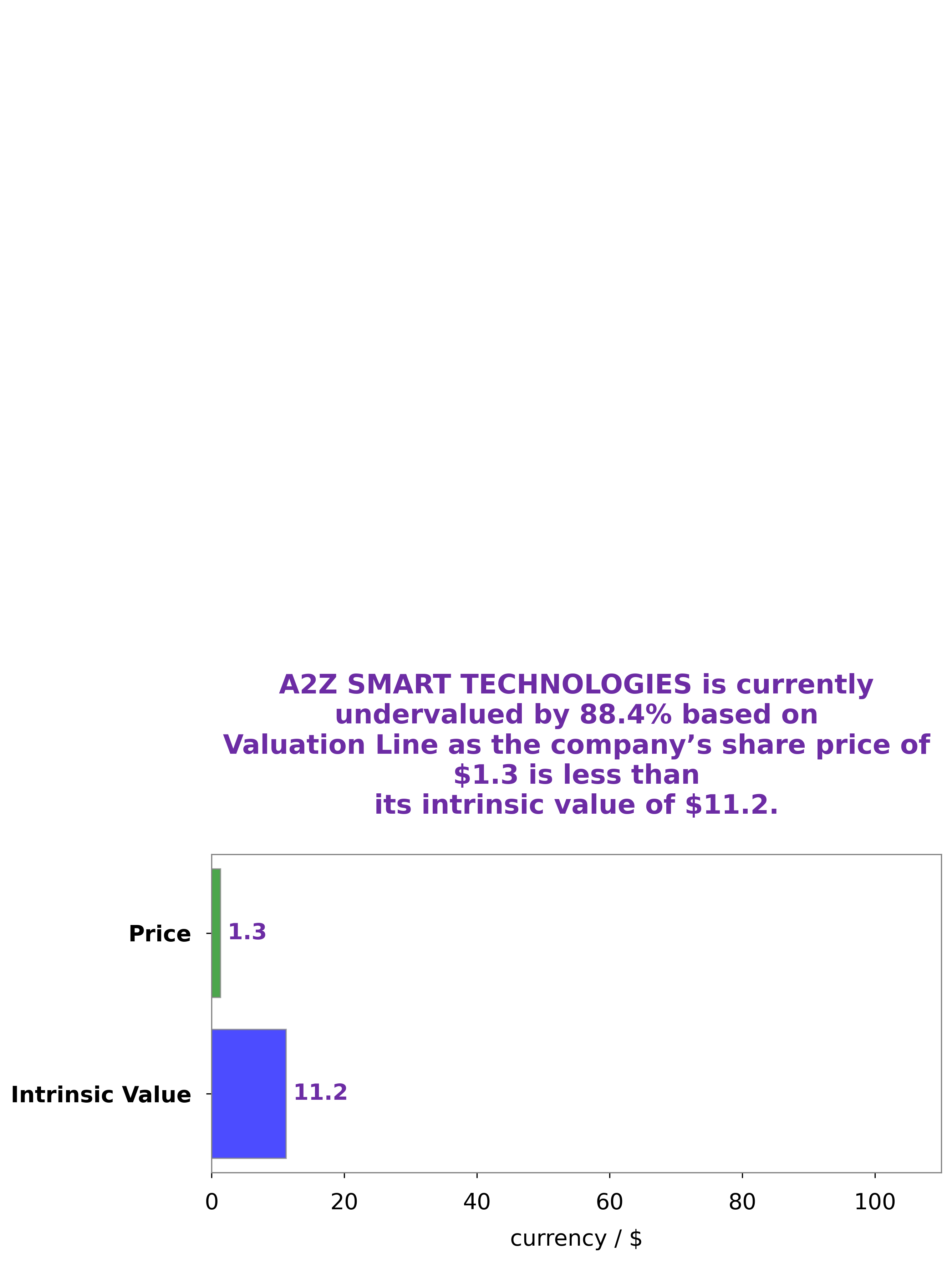

At GoodWhale, we have recently conducted an analysis of A2Z SMART TECHNOLOGIES’s overall wellbeing. Our proprietary Valuation Line has calculated the intrinsic value of A2Z SMART TECHNOLOGIES share to be around $11.2. However, despite this, the stock is currently traded at $1.3, which means it is undervalued by an astonishing 88.4%. This presents a great opportunity for investors to secure great returns as the stock returns to its true value. Therefore, we are confident that investing in A2Z SMART TECHNOLOGIES is a great decision at this point in time. More…

Summary

A2Z Smart Technologies recently filed for a $200 million mixed shelf offering and saw its stock prices surge by around 10% in after-hours trading. Despite the initial positive reaction, the stock price moved down the same day. From an investing standpoint, it is important to analyze the company’s fundamentals before making any decisions. It is necessary to look at A2Z Smart Technologies’ financial performance, debt load, and other factors such as management expertise and corporate culture.

Additionally, investors should compare A2Z Smart Technologies to its competitors and consider its growth potential. Further analysis should consider macroeconomic trends such as the state of the industry and the overall market environment. With proper due diligence, investors can make an informed decision about whether A2Z Smart Technologies is a good investments for their portfolio.

Recent Posts