ENTRAVISION COMMUNICATIONS Reports Strong Earnings for FY2022 Q4 as of December 31 2022

March 23, 2023

Earnings Overview

On March 9, 2023, ENTRAVISION COMMUNICATIONS ($NYSE:EVC) reported its total revenue for FY2022 Q4 as of December 31, 2022, which amounted to USD -1.6 million, a decrease of 142.1% year over year. Despite this, the company’s net income rose by 26.7%, totaling USD 296.3 million.

Transcripts Simplified

Joining us today from management is Walter Ulloa, Chairman and Chief Executive Officer; and Christopher Young, President and Chief Operating Officer. Walter Ulloa – Chairman & Chief Executive Officer Thank you, Steven, and good morning everyone. Despite these challenges, we remain focused on our core strategies and business optimization initiatives to drive sustainable long-term growth. Overall, third quarter results were in line with our expectations. Our radio and television station groups produced solid year-over-year revenue growth in the quarter, while our digital services business underperformed due to pandemic-related pressures.

We are encouraged by the improved trends we saw in the second half of the quarter as the pandemic continues to ease in certain markets where we operate. On the expense side, we have taken a disciplined approach to cost containment and operating efficiency, which resulted in sequential quarter-over-quarter cost savings. We remain confident that our balance sheet is strong enough to weather the current economic uncertainty. Given these results and the current environment, we believe that our strategy of reinvigorating our core businesses, investing in new opportunities and cost containment will drive sustainable long-term growth.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Entravision Communications. More…

| Total Revenues | Net Income | Net Margin |

| 956.21 | 18.12 | 3.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Entravision Communications. More…

| Operations | Investing | Financing |

| 78.92 | -60.49 | -92.82 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Entravision Communications. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 880.84 | 595.47 | 3.13 |

Key Ratios Snapshot

Some of the financial key ratios for Entravision Communications are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 51.8% | 33.7% | 4.5% |

| FCF Margin | ROE | ROA |

| 7.1% | 9.9% | 3.0% |

Price History

On Thursday, ENTRAVISION COMMUNICATIONS released its financial results for the fourth quarter of FY2022 ending December 31, 2022. Despite the strong financial performance, stock prices for ENTRAVISION COMMUNICATIONS opened at $6.6 and closed at $6.4, down by 3.2% from its prior closing price of 6.6. ENTRAVISION COMMUNICATIONS CEO Mark S. Hall commented on the strong fourth quarter performance, stating “We are delighted that our strong financial performance continues to exceed expectations. Our focus remains on creating value for our shareholders by delivering quality content and innovative technology solutions to our clients and customers. As we look ahead to the new year, we remain committed to driving long-term shareholder value through strategic partnerships and investments that will further strengthen our position in the marketplace.” The company’s strong financial performance was mainly driven by increased advertising and viewership across all of its media platforms.

In addition, the company also benefited from cost-cutting initiatives and operational efficiencies. With these efforts, ENTRAVISION COMMUNICATIONS looks to continue its strong financial performance in the upcoming year. Live Quote…

Analysis

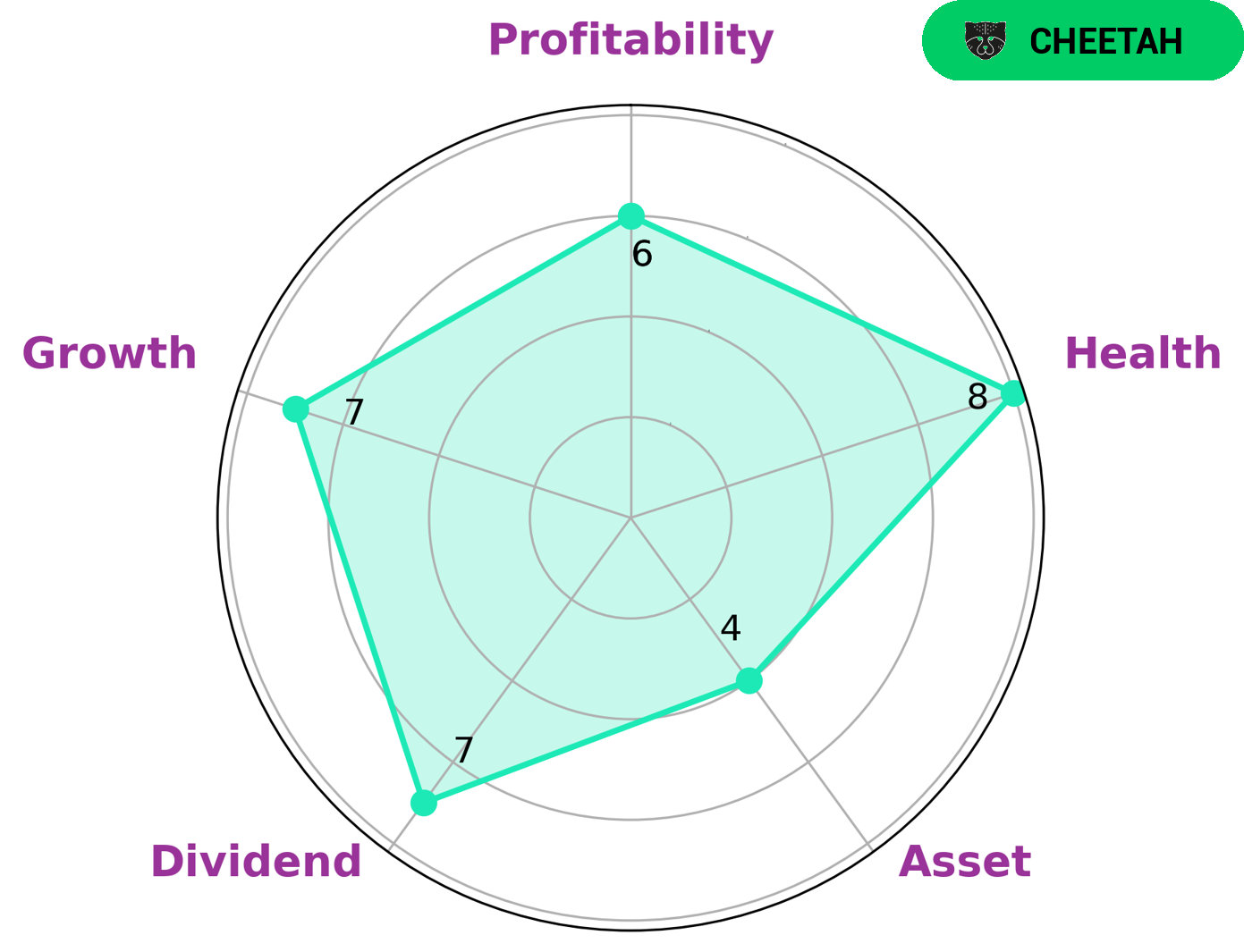

GoodWhale conducted an analysis of ENTRAVISION COMMUNICATIONS‘s financials, and according to our Star Chart system, the company has a high health score of 8/10 with regard to its cashflows and debt. From our analysis, we concluded that ENTRAVISION COMMUNICATIONS is capable to pay off debt and fund future operations. We classified ENTRAVISION COMMUNICATIONS as ‘cheetah’ company, which achieved high revenue or earnings growth but is considered less stable due to lower profitability. Therefore, investors that are interested in such company may be looking for dividend and growth opportunities. We rated ENTRAVISION COMMUNICATIONS as strong in dividend, growth and medium in asset and profitability. More…

Peers

In the world of media and broadcasting, competition is fierce. Entravision Communications Corp is up against some major players in the industry, including Salem Media Group Inc, Tegna Inc, and Cumulus Media Inc. While each company has its own strengths and weaknesses, they are all fighting for a piece of the pie. Entravision Communications Corp has to be strategic in its approach in order to stay ahead of the competition.

– Salem Media Group Inc ($NASDAQ:SALM)

Salem Media Group, Inc. operates as a multi-media company in the United States. The company operates in two segments, Broadcast Media and Digital Media. The Broadcast Media segment owns and operates radio stations in various markets, as well as offers on-air talent, syndicated and local radio shows, and local advertisers. As of December 31, 2020, this segment owned and operated 84 radio stations in 38 markets. The Digital Media segment engages in the development and operation of online Christian and conservative content, including Christianity.com, GodTube.com, OnePlace.com, Crosswalk.com, BibleStudyTools.com, GodVine.com, ChurchLeadership.com, and ChristianJobs.com. This segment also operates SalemSurveys.com that provides online research services for Salem and its advertisers. Salem Media Group, Inc. was founded in 1985 and is headquartered in Camarillo, California.

– Tegna Inc ($NYSE:TGNA)

Tegna Inc is a publicly traded company with a market cap of 4.24B as of 2022. The company’s Return on Equity is 20.09%. Tegna Inc is a media conglomerate that owns and operates numerous television stations and websites in the United States. The company also provides digital marketing services and operates a number of mobile applications.

– Cumulus Media Inc ($NASDAQ:CMLS)

Cumulus Media Inc is a radio broadcasting company that owns and operates radio stations across the United States. The company has a market cap of 138.56M as of 2022 and a Return on Equity of 16.7%. Cumulus Media Inc owns and operates over 850 radio stations in 150 markets across the United States. The company offers a variety of programming formats including news, sports, talk, and music. Cumulus Media Inc is headquartered in Atlanta, Georgia.

Summary

Investors in Entravision Communications may be disappointed by the company’s fourth quarter results for fiscal year 2022, which saw a 142.1% decline in total revenue to -$1.6 million. Nevertheless, net income rose by 26.7%, reaching $296.3 million for the same period compared to the prior year. Despite a decrease in stock price the same day, long-term investors may find value in Entravision Communications given their increase in profitability. Short-term investors should consider the company’s current financials, market dynamics, and other factors before making any decision.

Recent Posts