Deluxe Corporation dividend – Deluxe Corp Declares 0.3 Cash Dividend

June 2, 2023

🌥️Dividends Yield

On May 26, 2023, Deluxe ($NYSE:DLX) Corp declared a 0.3 cash dividend, continuing their steady annual dividend per share of 1.2 USD they have been issuing for the past three years. These dividends have yielded 5.28%, 4.72%, and 2.98% in 2021, 2022, and 2023 respectively with an average of 4.33%. If dividends are a factor in your stock portfolio, then Deluxe Corp may be one to consider. The ex-dividend date for the 2023 dividend is May 19th so investors must purchase shares prior to this date in order for the dividend to be credited to their account.

Overall, Deluxe Corp’s long-term commitment to issuing dividends provides investors with a steady income stream and the potential to generate returns over the long term. Investors who are looking for a steady stream of income should consider adding Deluxe Corp to their portfolio.

Share Price

This announcement caused the company’s stock price to increase by 1.3%, from the previous closing price of $15.0 to today’s closing price of $15.2. Many investors have expressed enthusiasm about DELUXE CORPORATION’s dividend policy and are confident in the company’s future growth prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Deluxe Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2.23k | 58.51 | 4.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Deluxe Corporation. More…

| Operations | Investing | Financing |

| 150.57 | -85.5 | -60.93 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Deluxe Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.94k | 2.35k | 13.98 |

Key Ratios Snapshot

Some of the financial key ratios for Deluxe Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.7% | -9.0% | 8.2% |

| FCF Margin | ROE | ROA |

| 1.7% | 18.9% | 3.9% |

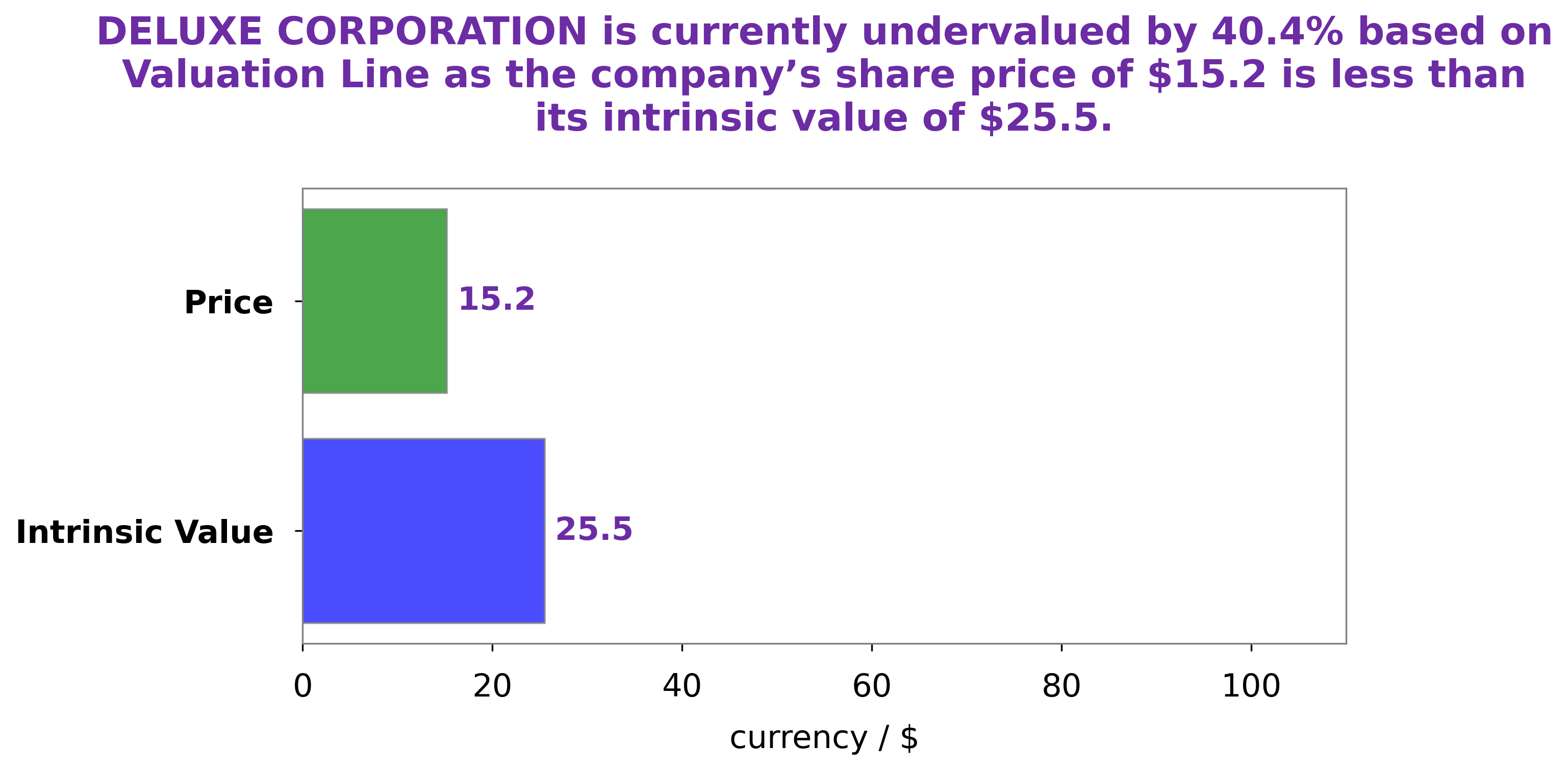

Analysis – Deluxe Corporation Stock Fair Value

At GoodWhale, we analyzed DELUXE CORPORATION‘s financials with our advanced tools. As a result, we believe the fair value of DELUXE CORPORATION share is around $25.5, calculated by our proprietary Valuation Line. Currently, the stock is traded at $15.2, which is 40.3% lower than its fair value. This suggests DELUXE CORPORATION is currently undervalued and could be a good buy for long-term investors. More…

Peers

Deluxe Corp is in the business of providing software solutions. Its competitors are Ilkka Oyj, Specificity Inc, and DM Solutions Co Ltd.

– Ilkka Oyj ($LTS:0IGW)

Ilkka Oyj is a Finnish company that produces and supplies wood products. It has a market cap of 110.82M as of 2022 and a Return on Equity of 2.9%. The company is involved in the production of lumber, pulp, paper, and energy. It also provides services related to forestry, real estate, and environmental protection.

– Specificity Inc ($OTCPK:SPTY)

Based in New York, Specificity Inc is a biotechnology company that focuses on the development of cancer treatments. The company has a market capitalization of 11.71 million as of 2022 and a return on equity of 189.94%. Specificity Inc’s products are designed to target specific types of cancer cells, which the company believes will result in more effective and less toxic treatments. In addition to its cancer treatments, Specificity Inc is also developing treatments for other diseases, such as Alzheimer’s disease and Parkinson’s disease.

– DM Solutions Co Ltd ($TSE:6549)

The company’s market cap as of 2022 is 2.39B, and its ROE is 5.37%. The company provides software development services and solutions.

Summary

The DELUXE CORPORATION has been consistently issuing annual dividends per share of 1.2 USD over the past three years. These dividends have generated returns of 5.28%, 4.72%, and 2.98% over 2021-2023, giving an average yield of 4.33%. This makes DELUXE CORPORATION a viable option for investors looking to maximize their portfolio’s returns from dividends. It is important to research the company and its fundamentals further to make an informed investing decision.

Recent Posts